By Ambar Warrick

Investing.com-- China’s blue-chip index led gains among Asian stocks on Monday, recovering from its lowest level since mid-June as data showed service sector activity in the country continued to expand despite a slowdown in manufacturing.

The Shanghai Shenzhen CSI 300 blue-chip index was up 0.6% as of 12:54 am ET (0454 GMT), with consumer-oriented service sector stocks gaining the most. Tsingtao Brewery Co Ltd (SS:600600), Anhui Jianghuai Automobile Group Corp Ltd (SS:600418) and Citic Guoan Wine Co Ltd (SS:600084) were among the best performers on the index, rising between 7% and 10%.

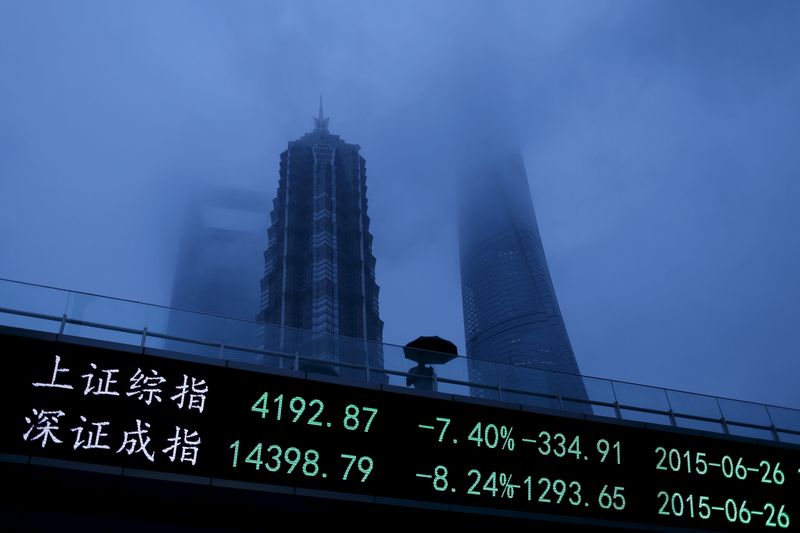

The Shanghai Composite index rose 0.1%,

In the Asia-Pacific region, Australia's S&P/ASX 200 rose nearly 0.7%, while FTSE Malaysia KLCI and Thailand's SET Index added 0.3% and 0.8%, respectively. Japan’s Nikkei 225 rose 0.6%.

Government data on Sunday showed that China’s service sector continued to expand through July, albeit at a slower pace. But this still helped offset an unexpected contraction in manufacturing activity.

China’s non-manufacturing purchasing managers index was 53.8 in July, compared to 54.7 in June. A reading above 50 indicates expansion.

“This shows a continual recovery of services after lockdowns were lifted in early June. Since then, China has adopted a more flexible approach on Covid testing and quarantines, which also helps the recovery of services,” analysts at ING wrote in a note.

“We expect these service industries to keep expanding in August as summer holiday travels within China should boost services activities.”

But China’s key manufacturing sector shrank in July, largely due to disruptions in the property market. New home prices and sales also dropped through the month.

Blue-chip property stocks were the worst performers on Monday, with majors such as Shanghai Construction Group Co Ltd (SS:600170), Poly Real Estate Group Co Ltd (SS:600048) and Gemdale Corp (SS:600383) dropping between 3% and 5%.

The sector was also rattled by China Evergrande saying that one of its units would have to pay 7.2 billion yuan ($1.1 billion) to a guarantor over its debt obligations.

In broader Asian markets, South Korea’s KOSPI Index traded flat after data showed the country’s trade deficit widened substantially in July.

The Taiwan Weighted benchmark dropped 0.4% as sentiment turned sour over U.S. House Speaker Nancy Pelosi’s possible visit to the island. China has strongly opposed the trip.