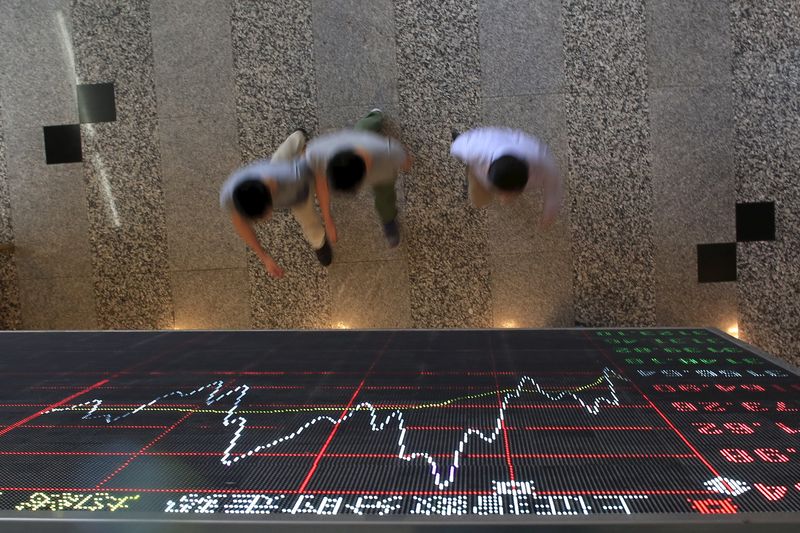

Investing.com-- Most Asian stocks rose slightly on Wednesday ahead of key U.S. consumer inflation data, while Chinese markets lagged their peers after the Biden administration slapped the country with higher tariffs on several key industries.

Wall Street indexes provided some positive cues to Asian markets, as they shrugged off a hotter-than-expected producer price index reading.

But U.S. stock index futures stalled in Asian trade, as the hot PPI reading sparked caution ahead of a reading on U.S. consumer price index inflation, which is more closely tied to interest rates.

Regional trading volumes were also somewhat muted on account of holidays in Hong Kong and South Korea.

Chinese stocks dip as US imposes harsher tariffs

China’s Shanghai Shenzhen CSI 300 and Shanghai Composite indexes fell about 0.5% each on Wednesday, lagging their peers after the Biden administration sharply hiked tariffs on several key imports from the country, including electric vehicle batteries and semiconductors.

The move drew ire from Chinese authorities, and sowed fears of retaliatory measures from the world’s second-largest economy.

The tariffs were somewhat telegraphed by a slew of reports last week, and affect up to $18 billion in goods imported from China.

The increased tariffs further soured sentiment towards Chinese markets, after another major default in the country’s property market pointed to more headwinds from the sector.

But losses in Chinese stocks were limited by the prospect of more fiscal stimulus in the country, after Beijing said it will begin a massive 1 trillion yuan ($138 billion) bond issuance this week.

Focus this week was also on Chinese industrial production and retail sales data, due this Friday.

Japan’s Nikkei 225 buoyed by Sony

Japan’s Nikkei 225 index was among the better performers for the day, rising 0.4% on sharp gains in electronics and entertainment giant Sony Corp (TYO:6758) (NYSE:SONY).

The broader TOPIX index rose 0.3%.

Sony rallied over 10% after it announced a $1.6 billion stock buyback and a five-for-one stock split. The move largely offset a 7% decline in annual profits, and a somewhat middling earnings outlook for fiscal 2025.

Sentiment towards Japan was also on edge ahead of key first-quarter gross domestic product data, which is due on Thursday.

Broader Asian markets drifted higher. Australia’s ASX 200 index rose 0.4%, taking some support from soft wage data that diminished the prospect of a more hawkish Reserve Bank in the coming months.

Futures for India’s Nifty 50 index pointed to a muted open, as the 2024 general elections carried on and kept traders largely cautious towards the country.