By Herbert Lash

NEW YORK (Reuters) -World stock markets sputtered on Wednesday and the dollar eased as some investors accepted the notion that interest rates will stay higher for longer even though the Federal Reserve may have halted hiking them.

Yields across the Treasury curve mostly fell as the auction of benchmark 10-year notes fared modestly better than expected, and on the view that the Fed has likely ended its hiking cycle.

The dollar has rebounded from last week's sharp sell-off on rising confidence the Fed has ended raising rates, though there is less agreement on whether a rate cut is on the horizon with inflation still above the U.S. central bank's 2% target.

"The Fed not necessarily hiking anymore might get people a little bit more excited, but does that mean we're going to start cutting aggressively? It's too early to say that," said Marvin Loh, senior global macro strategist at State Street (NYSE:STT) in Boston.

"A lot of the questions that we were asking that drove yields higher we're still asking," he said, referring to the bond rally that raised the 10-year yield above 5% two weeks ago. Bond prices move inversely to their yield.

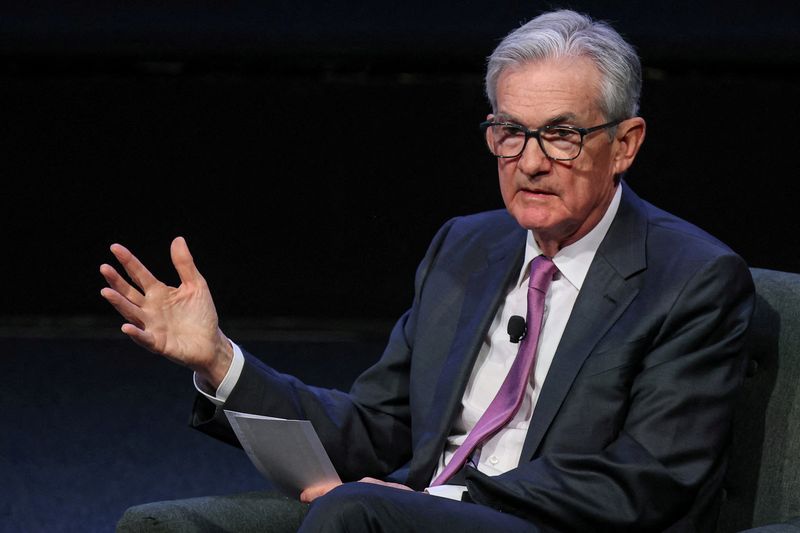

Fed Chair Jerome Powell did not comment on monetary policy or the economic outlook in prepared remarks at a U.S. central bank statistic conference on Wednesday. Investors have ramped up bets for Fed rate cuts next year, though the timing is unclear.

Markets are pricing in an almost 50% chance of a rate cut of at least 25 basis points as soon as May, according to the CME Group's (NASDAQ:CME) FedWatch Tool, up from about 41% a week earlier.

But futures also call for the Fed's overnight lending rate to remain above 5% through next June.

MSCI's all-country world stock index closed flat, rising just 0.01 point, after last week posting its biggest weekly jump in almost a year. Europe's broad STOXX 600 index closed up 0.28%.

On Wall Street, the S&P 500 rose 0.10% and the Nasdaq Composite added 0.08% to extend their winning streaks to eight and nine consecutive sessions, respectfully. The Dow Jones Industrial Average fell 0.12%,

"The market has it right that rates have peaked," said Rhys Williams, chief strategist at Sprouting Rock Asset Management in Bryn Mawr, Pennsylvania, but since the Fed has "been so macho about higher for longer," a rate cut is unlikely to come soon.

European shares rose, supported by gains in healthcare stocks and strong earnings reports, while investors assessed a slew of economic data and comments from central bankers for cues on the European Central Bank's rate hike path.

Data showed euro zone retail sales fell roughly in line with expectations in September, while another survey showed euro zone consumers have raised their inflation expectations over the next 12 months to 4%.

The two-year Treasury yield, which reflects interest rate expectations, rose 2 basis points to 4.938%, while the yield on the benchmark 10-year note slid 6.2 basis points to just above 4.50% - a level some see as a new bottom.

The dollar index fell 0.01% at 105.51, after earlier being on track for a third straight day of gains, while the euro rose 0.07% to $1.0707.

The majority of FX strategists in a Reuters poll expect the dollar to remain weak for the rest of the year, amid a building consensus that the Fed's tightening cycle is done, also signaling a peak in U.S. yields.

MSCI's broadest index of Asia-Pacific shares overnight slipped 0.3% and Japan's Nikkei 225 closed lower after Bank of Japan Governor Kazuo Ueda told parliament the central bank need not wait until real wages turn positive before exiting stimulus.

Hong Kong's Hang Seng fell and an index of mainland blue chips lost 0.24%.

Chinese authorities have asked Ping An Insurance Group to take a controlling stake in embattled Country Garden, the nation's biggest private property developer, four people familiar with the plan said.

A spokesperson for Ping An said the company had not been approached by the government and denied the information reported by Reuters.

Oil prices slid to more than three-month lows on concern over waning U.S. and Chinese demand, while gold prices retreated for a third straight session as yields on the short end of Treasuries rose and on longer-dated notes fell.

Brent crude futures settled down $2.07 at $79.54 a barrel and U.S. crude lost $2.04 to settle at $75.33.

U.S. gold futures settled 0.8% lower at $1,957.80 an ounce.