Market Brief

The Australian dollar surged against the US dollar in overnight trading in reaction to a pickup in inflation. The consumer price index printed at 1.7%y/y in the fourth quarter, beating estimates of 1.6% and previous reading of 1.5%, while the trimmed mean inflation measure came in line with the median forecast and remained stable at 2.1%y/y. The data showed that the pickup is mostly attributable to the effects of the currency’s depreciation as the price of tradable goods rose 0.8%y/y from -0.3% in the previous quarter. The Australian dollar jumped 0.60% to 0.7040 on the news and stabilised around that level. Overall, we maintain our short-term positive bias on AUD/USD. On the upside, a strong resistance can be found at 0.7382 (high from December 12th), while on the downside, the low from January 15th will act as support (0.6827).

The Federal Open Market Committee will deliver its interest rate decision later today. It is widely accepted that the Fed will stay on hold today. However, the market expects to get some insight regarding the tightening path of the Federal Reserve as well as the effects of the January turmoil on Fed thinking. The US dollar has been losing market interest since the beginning of the year, which is consistent with the downward shift of the entire yield curve. After bouncing back on the 1.08 support, EUR/USD is on its way to the 1.09 level, the closest resistance lies at 1.10.

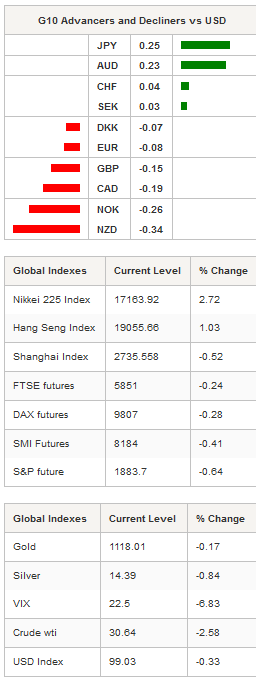

In the equity market, most Asian regional indices were able to stay in positive territory. Japanese stocks rose sharply after Wall Street gains; the Nikkei was up 2.72%, while the broader TOPIX index rose 2.98%. Hong Kong’s Hang Seng increased by 1.03% to 19,055 points. On the other hand, China’s mainland stocks were unable to enjoy the positive lead and ended up wearing red with the Shanghai and Shenzhen Composite down 0.52% and 0.83% respectively. Elsewhere, in Singapore the STI rose 0.37%, the Thaï BGK surged 1.37% and the Indonesian JCI was up 1.24%.

In Europe, futures on major indices are pointing to a lower open as crude oil suffered another blow. WTI is down 2.58%, while its counterpart from the North Sea fell 2.14%. The Euro Stoxx 600 was down 0.44%, the Footsie fell 0.24%, the DAX 0.28% and the SMI -0.41%. In spite of this negative performances, we have the feeling that the worst of the volatility is behind us, returning to lower levels and equities able to move higher in spite of weaker crude oil.

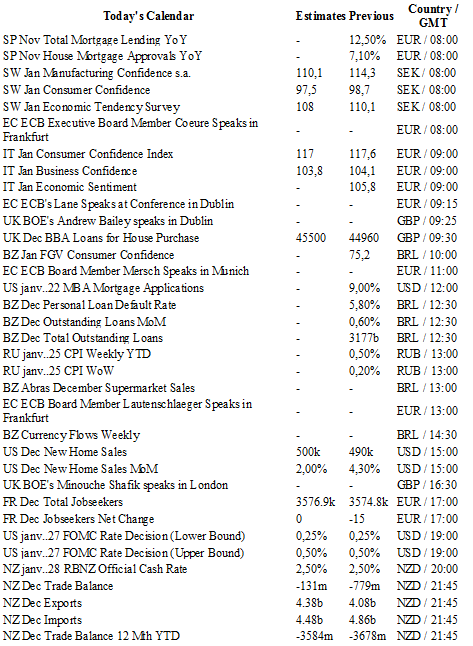

Today traders will be watching consumer and business confidence from Italy; MBA mortgage application, new home sales and FOMC rate decision from the US; trade balance, export, import and interest rate decision from New Zealand.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0857

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5242

R 1: 1.4969

CURRENT: 1.4322

S 1: 1.3657

S 2: 1.3503

USD/JPY

R 2: 125.86

R 1: 123.76

CURRENT: 118.21

S 1: 115.57

S 2: 105.23

USD/CHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 1.0170

S 1: 0.9786

S 2: 0.9476