Monday May 30: five things the markets are talking about

Despite the holiday shortened trading week for two of the markets biggest financial centers (U.S and U.K closed today), investors are required to be ‘fleet of foot in a week packed with market moving events.

Fed rhetoric has been ‘hawkish’ of late and the market now requires the fundamental evidence that would justify a Fed rate hike sooner rather than later. This week’s data could go a long way in justifying the Fed’s stance.

Friday’s non-farm payroll (NFP) report will be the last one before the June FOMC meeting and is likely to impact the direction of all asset classes. But the NFP report is not the only report that’s expected to move markets; other news items to consider are: U.S. core PCE, ECB rate decision, E.U flash CPI, U.S. manufacturing PMI, China’s manufacturing PMI and then there’s OPEC, who meet in Vienna on Thursday.

1. Market digests Yellen’s comments

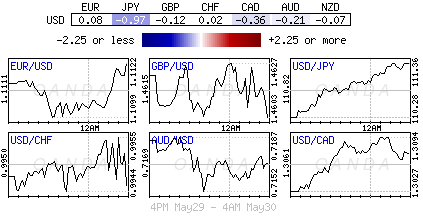

Global indices are edging higher, the dollar sees gains across the board after Fed Chair Yellen said Friday an interest-rate increase would be appropriate “probably in the coming months” if the economy and labor market continue to strengthen.

The timing of the Fed’s next rate increase has been a key consideration for the market. Fed officials scaling back plans to hike rates by a percentage point in 2016 helped support a rally in riskier assets and a decline in the dollar in Q1.

Now, investors are looking to see whether the Fed believes the U.S. economy is strong enough to withstand a rate increase at either its June or July meetings.

On Friday, Yellen noted factors that pushed inflation lower seem to be stabilizing, echoing comments from some of the other Fed officials to state that a tightening would be appropriate in the next few months.

Fed funds futures contract have pushed up toward a +30% probability of a +25bp hike in June, and a near +50% chance of a hike in either June or July.

2. Is Abe to ‘pass the parcel’?

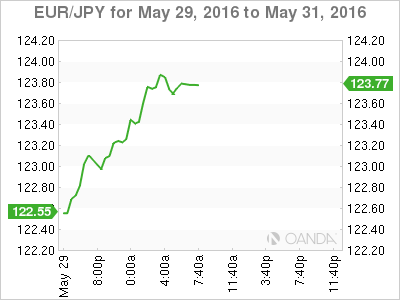

Japan PM Abe is now rumored to be in a position to postpone the sales tax hikes by two and a half years to Oct 2019, leaving the decision to his successor since his term ends in 2018.

His Finance Minister Aso (tax hike proponent) indicated that if the delay is announced, the government should also call “lower house” elections and put the matter to a national vote.

According to one survey, over +70% said delay to Japan’s sales tax hike would not be a policy breach. However, there are a number of analysts who note that credit rating agencies may downgrade Japan if Abe delays the sales tax increase as planned without explaining how his government plans to reduce the country’s deficit.

The LDP policy chief is proposing a compromise, namely a more gradual +1% increase in tax next year.

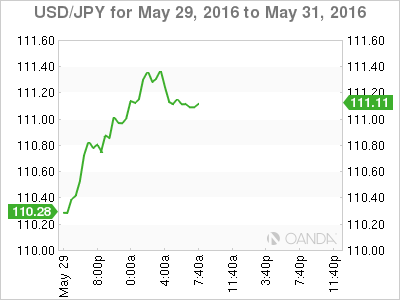

USD/JPY has tested above ¥111.35 for the first time in a month.

3. Gold continues its loosing streak

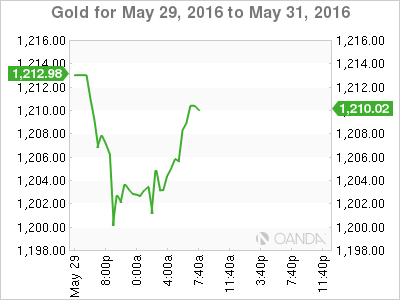

The bullion market cooled down again in the past week as the market continues to expect the Fed to raise rates in the coming months and the ‘big’ dollar keeps recovering.

Bullion broke below $1,200 an ounce earlier this morning after losing more than $100 in less than a month on Fed rhetoric. In overnight trading, gold for immediate delivery lost as much as -1% to print $1,199.80 an ounce, the lowest level since Feb. 17.

With prices that peaked at a 15-month high of $1,303.82 on May 2 are down for the ninth consecutive day, equaling the worst daily losing run on record.

4. Euro inflation data shows signs of improvement

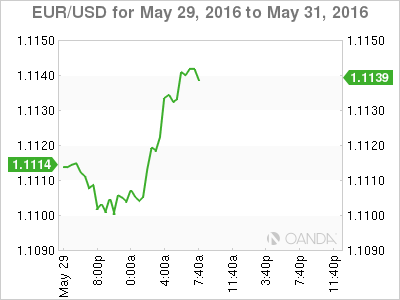

The EUR is trading a tad higher (€1.1135) after a plethora of tier II euro inflation reports were released earlier this morning.

With Draghi and company previously noting that they are highly focused on implementing the set of easing measures already announced. May’s CPI readings are expected to have little or no impact on the ECB’s rate decision come this Thursday.

Due to the lack of market participation, the Stoxx Europe 600 Index is little changed this morning, after a +3.4% rally last week that marked its best performance in three-months.

Indices: Stoxx50 -0.2% at 3,073, FTSE closed for holiday, DAX +0.1% at 10,301, CAC 40 -0.2% at 4,506, IBEX 35 -0.4% at 9,074, FTSE MIB +0.3% at 18,248, SMI -0.1% at 8,282, S&P 500 Futures +0.2% at 2,101

5. U.S Ten-year futures plummet on Yellen comments

In overnight trading, U.S 10-year futures contracts fell by the most in more than one week after Yellen’s Friday comments that said an improvement in the U.S. economy would warrant raising interest rates in the coming months.

The market was not looking for anything from the Fed Chair. Nevertheless, it ended up she said something that was a bit “hawkish” especially for her.

10-year futures contracts for September fell -14 ticks this morning (129 9/32) – the biggest decline in nearly three weeks.

With Ms. Yellen making her comments lunch time Friday, it comes as no surprise that fixed income traders are still reacting to them because the market closed early in NY for the U.S. Memorial Day holiday.