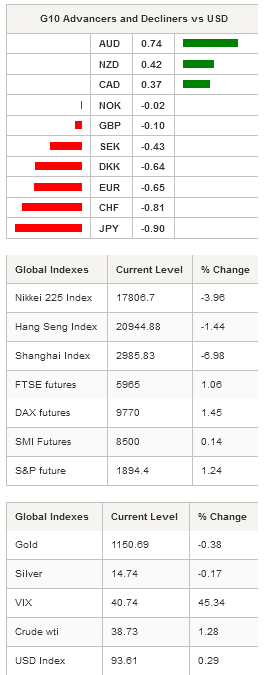

Asian regional equity markets stabilise, to some extent, this morning while the pace of sell-off in mainland Chinese stocks is maintained. World’s stock markets may have not reached the bottom yet but traders took a step back and had a look at the damage. On the bright side, US futures are up 1.24% this morning after having suffered a bear attack on Monday. The S&P 500 lost 3.94%, the Dow Jones 3.57% while the NASDAQ dropped 3.82%. This morning in Asia, the Shanghai Composite fell 6.98% and returned to levels last seen in December 2014 while the SZSE Composite slid 7.13%. In Japan, the Nikkei remains among the loser as it dropped 3.96% while the broader TOPIX index fell 3.26%. In Hong Kong, the Hang Seng fell 1.44% while in South Korea the KOSPI surged 0.92%. Further south, Australian shares are the biggest winners with a gain of 2.72%.

In the FX market, the US dollar gets some respite from sellers and recovers previous losses as the dollar index adds 0.33% over the last 24 hours. USD/JPY broke its 200dma yesterday amid fears spread from the equity market to the FX market. The pair stabilised above the bottom of its February-May range, around 118 and will likely have a hard time breaking the 200dma, standing at 120.72 for the moment, to the upside. AUD/USD was somewhat less sensitive to global fears about China’s economic slowdown as the Aussie is first in line when traders price in the consequences of a weaker growth from the world’s second biggest economy.

In Europe, equity futures are blinking green on the screen, pointing toward a positive opening for regional stock markets. In German, futures on the DAX are up 1.45% while the ones on the CAC 40 jump 1.21%. In Switzerland, futures on SMI edge up 0.14% while ones on the FTSE 100 rise 1.06%.

EUR/USD is having a breather after a mad run of more than 6%, bringing EUR/USD as high as 1.1714. The euro is currently stabilising around 1.1550. When we have a look at the last 4 days, we realise that the pair broke 4 strong resistance: its 50dma standing around 1.1092, the 38.2% Fibonacci level (on December-march debasement) at 1.1265, its 200dma at 1.1328 and finally the 50% Fibonacci level lying at 1.1514. We expect the euro to hold ground against the dollar as the odds a September rate hike have diminished considerably amid Fed Lockhart, Federal Reserve Bank of Atlanta President, said he still expects a lift-off this year but moderated his language by adding that recent developments in China, together with the appreciation of the dollar and further decline of oil prices are clouding the US economic growth outlook. Investors are taking into account the latest available information and it appears that a rate hike in 2015 is not even guaranteed anymore.

Today traders will be watching PPI from Sweden; IFO business climate from Germany; Q2 GDP from South Africa; capacity utilisation from Turkey; FHFA house price index, S&P/CaseShiller HPI, Markit PMIs, consumer confidence index and Richmond Fed manufacturing index from the US.

Currency Tech

EUR/USD

R 2: 1.2252

R 1: 1.1871

CURRENT: 1.1560

S 1: 1.1017

S 2: 1.0809

GBP/USD

R 2: 1.5930

R 1: 1.5803

CURRENT: 1.5773

S 1: 1.5425

S 2: 1.5330

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 119.37

S 1: 115.57

S 2: 113.86

USD/CHF

R 2: 0.9904

R 1: 0.9488

CURRENT: 0.9367

S 1: 0.9151

S 2: 0.9072