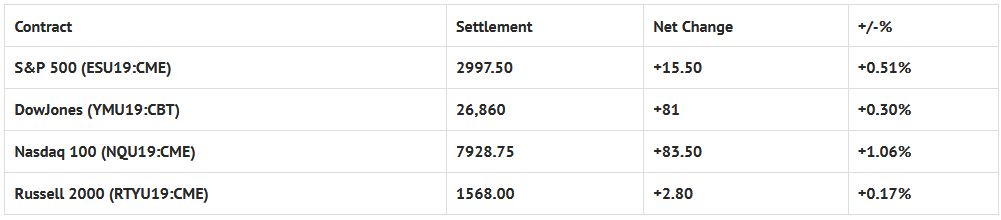

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 10 out of 11 markets closed higher: Shanghai Comp +0.08%, Hang Seng +0.81%, Nikkei +0.51%

- In Europe 7 out of 13 markets are trading higher: CAC +0.11%, DAX -0.21%, FTSE -0.09%

- Fair Value: S&P +3.61, NASDAQ +22.79, Dow -8.31

- Total Volume: 1.4 million ESU & 164 SPU traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes CPI 8:30 AM ET, Jobless Claims 8:30 AM ET, Jerome Powell Speaks 10:00 AM ET, EIA Natural Gas Report 10:30 AM ET, John Williams (NYSE:WMB) Speaks 11:00 AM ET & 1:30 PM ET, Randal Quarles Speaks 1:30 PM ET, Treasury Budget 2:00 PM ET, Fed Balance Sheet & Money Supply 4:30 PM ET, and Neel Kashkari Speaks 5:00 PM ET.

S&P 500 Futures: Rate Cuts On The Horizon

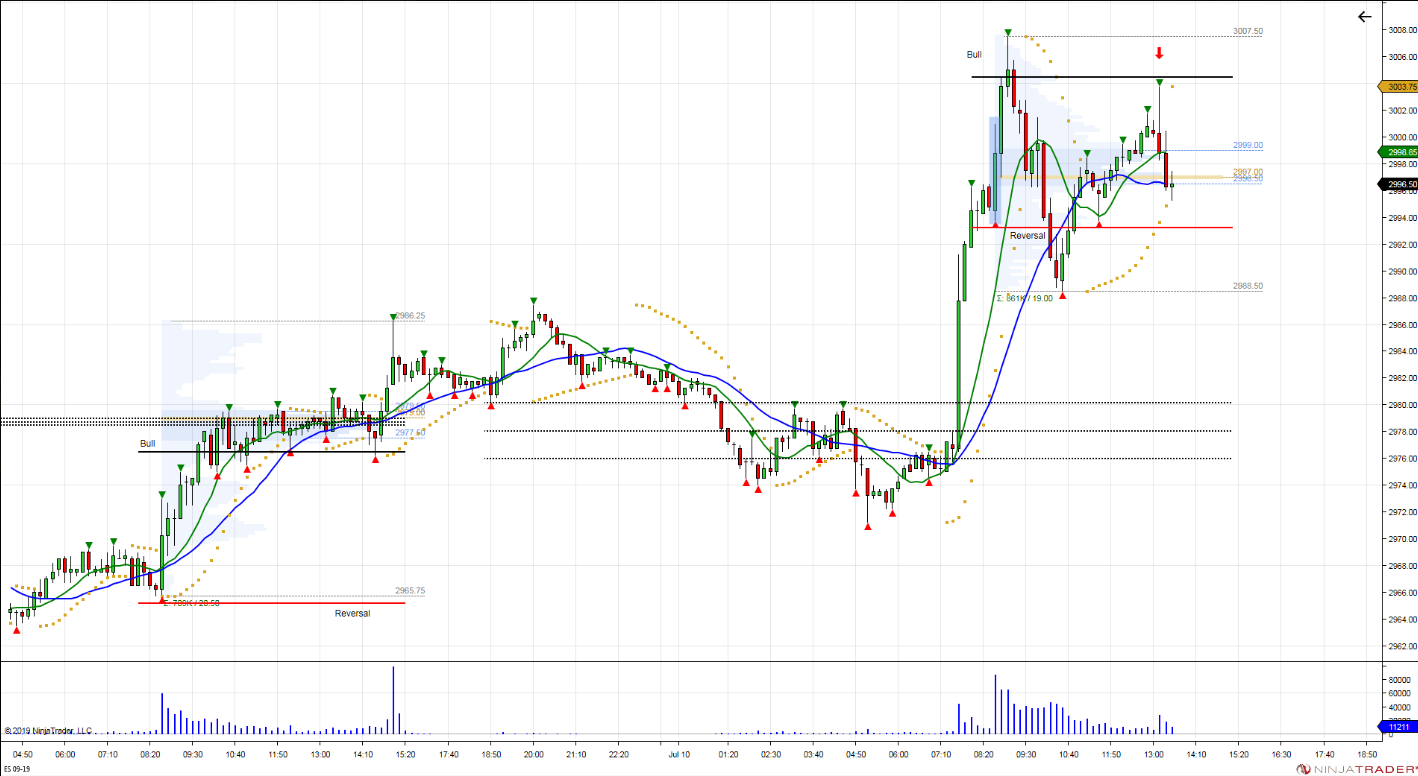

Chart courtesy of Stewart Solaka @Chicagostock – $ES_F Gap up force buyers to chase through upper vol window, setting bull bias that trapped buyers above. Bias reversed with move below opening low. Walked up to retest bull trap per FOMC minutes. Technically should continue lower… Bulls need to hold > prior high 86.

After trading down to 2971.25 during Tuesday nights Globex session, the S&P 500 futures (ESU19:CME) popped up to 2996.25 early Wednesday morning when fed chairman Jerome Powell came out saying that weak inflation will be more persistent than the fed currently anticipates. He also said that U.S. economic growth appears to have moderated in Q2, and that economic momentum has slowed in some major foreign economies in recent months.

Stocks obviously interpreted these statements as a positive, and after the 8:30 CT bell, the ES rallied to a new all time high at 3007.50.

Once the smoke cleared, the futures did a little back-and-fill down to 2988.50, then consolidated in a sideways range for the rest of the day.

Going into the close, when the MiM reveal showed a mere $70 to buy MOC, the ES was trading at 2996.00. It would then go on to print 2996.75 on the 3:00 cash close, and 2997.50 on the 3:15 futures close, up +15.50 handles on the day.