VIX broke out above its Long-term resistance at 13.45 again to create a potential inverted Head & Shoulders formation.Abuy signal has been made above its Intermediate-term resistance at 11.65.Abreakout above the neckline suggests that the Ending Diagonal formation may also be at risk of a breach. An actual change in long-term trend may occur above the top trendline of the 15-month long Ending Diagonal formation at 19.00.

(CNBC) A pattern of huge, near-daily trades on the VIX is turning heads in the options market.

What's most notable is that even after losing some $75 million by betting on a volatility spike, the huge options buyer known as "50 Cent" shows no signs of slowing down.

"I would categorize them as someone who doesn't flinch at losing money," commented PravitChintawongvanich, head of risk strategy at Macro Risk Advisors, who flagged the activity in a series of research notes.

SPX challenges Short-term support.

SPX challenged Short-term support at 2335.80 on Monday before bouncing back above the trendline of the Orthodox Broadening Top. Once beneath the trendline at 2360.00 the SPX is on an aggressive sell signal. A break of Intermediate-term support at 2312.38 may send the SPX to its cycle Bottom at 1882.34, or possibly lower. The Cycles Model forecasts weakness in equities for the entire month of April.

(Bloomberg) Stocks in the U.S. and around the world ended a strong first quarter with a whimper as investors wavered amid political and economic uncertainty. The rand tumbled after South Africa’s finance minister was fired.

The S&P 500 Index ended trading Friday down 0.23 percent to 2362.72, while the Dow Jones Industrial Average fell 0.31 percent to 20,663.22. Small caps fared better, as the Russell 2000 Index rose 0.26 percent. Since the start of the year, the S&P 500 is up 5.7 percent, its best quarterly performance since 2015, and the Dow has gained 4.9 percent.

NDX makes a new all-time high.

NDX declined, but bounced off the upper trendline of a smaller Orthodox Broadening Top at 5325.00. Short-term support is just beneath it at 5306.28. A loss of that support may create a sell signal in the NDX with a subsequent decline testing lower supports. A decline beneath mid-Cycle support at 4604.48 may bring a potential change of trend with it.

In what was the clearest sign to date that the Fed is targeting the stock market bubble with its rate hikes (recall two weeks ago Goldman caused a stir when it suggested that the Fed had made a policy error by being overly dovish with its rate hike, which instead of tightening financial conditions, had the effect of a 25bps rate cut), today not one but two Fed presidents warned that the market is getting "a little rich", that "valuations may be a little frothy", and that the record "wealth to income ratio is a reason to keep raising rates."

First, it was Boston Fed president Eric Rosengren who during an interview with Bloomberg, said some asset markets are "a little rich", with an emphasis on commercial real-estate valuations, which he said are “pretty ebullient." And while the Boston Fed president repeated what Neel Kashkari told Zero Hedge last week, when he said that "stock market values aren’t a driving force for monetary policy", he made it quite clear that one of the reasons why the Fed is pushing with as many as 4 rate hikes in 2017 is precisely to push stocks lower, saying that "rich asset prices are another reason for the central bank to tighten faster."

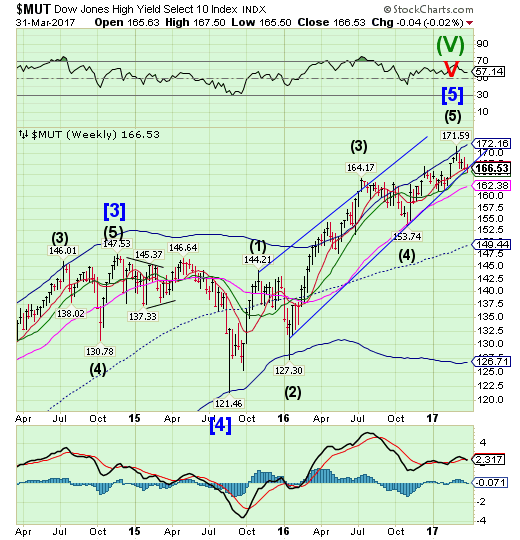

High Yield Bond Index violates Short-term support.

The High Yield Bond Indexdeclined beneath Short-term support at 166.77, closing beneath it and the Ending Diagonal trendline.This created a sell signal in high yield bonds. The Cycles Model suggests weakness ahead that may last the entire month of April.

Alex Bryan: So, high-yield bonds for the most part are fairly illiquid securities. So, they don't trade very often and that can make them expensive to trade when you do want to trade them. So, they tend to have very wide bid-ask spreads and when you want to trade a large amount of fixed-income securities in the high-yield space, oftentimes that moves the market. So, that's a big challenge with an index-based product because indexes demand liquidity. Anytime a security comes in or out of the index, the managers who are trying to track the index have to transact in that security regardless of the price that they get when they execute. So, that illiquidity presents a big challenge.

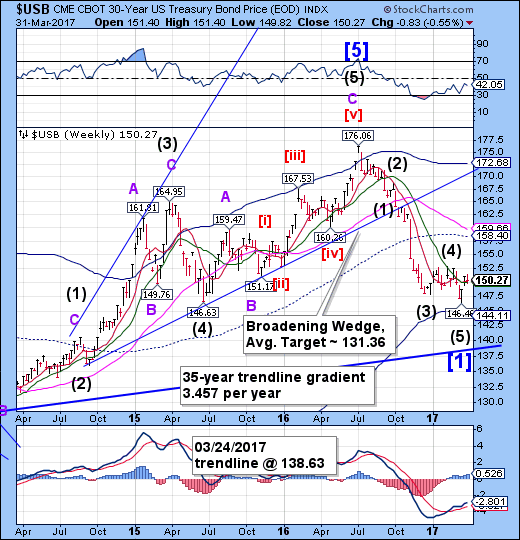

USB consolidates.

The Long Bond consolidated above Intermediate-term support at 149.98.The Cycles Modelnow suggests an extended period of strength may extend through the month of April.The mid-Cycle resistance at 158.40 still appears to be the target.

The bond market may be setting up for a disaster, but not the way that everyone thinks.

After the presidential election in the U.S., speculators piled into the short side of the market, running longer dated yields up as many as 80 basis points on the belief that President Trump's protectionist trade agenda — along with his plans to cut taxes, roll back regulations, and spend $1 trillion on infrastructure — would bring back inflation to the U.S.

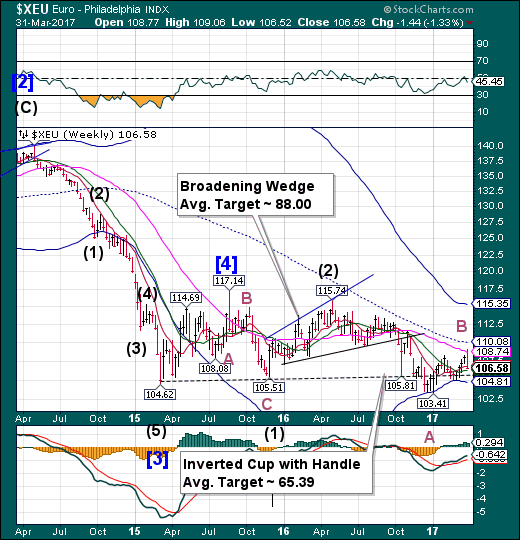

The euro reverses down.

The euro finally achieved Long-term resistance at 108.74 on Monday and reversed down. The Cycles Model suggests a possible panic decline over the next one to two weeks.

Euro exchange rate values could be about to be hit by a massive hammer in the shape of the European Central Bank with analysts at a prominent Scandinavian research house saying another round of quantitative easing is coming.

Recall that the orthodoxy suggests the next move at the ECB will be to start drawing the curtains on the quantitative easing programme?

Many economists think that in coming months the Bank will start indicating this to be the case through verbal warnings.

Euro Stoxx 50 tends its high.

The Euro Stoxx 50 Indexrallied to a new high that achieved a 71% retracement of its 2015 losses and round number resistance at 3500.00, which may deflect further gains. The period of strength may have come to a hard stop.

Investors are showing up in strength to the European equity party, pulling out of the previously popular U.S. market.

Stock funds in Europe saw inflows of $1.5 billion in the past week, the most in more than a year, while investors withdrew $1.9 billion from U.S. ones, according to a note by Bank of America Merrill Lynch (NYSE:BAC) citing EPFR Global. The region’s shares are poised for their best March performance since 2010 amid fading concern that anti-euro candidate Marine Le Pen will prevail in France’s upcoming presidential elections.

Geoffroy Goenen, the Brussels-based head of fundamental Europe equity management at Candriam Investors Group, wrote in a note this week

Europe has never been such good value compared to the U.S. Economic and confidence indicators are extremely positive, while political incertitude will soon be alleviated, providing Europe with fresh momentum.

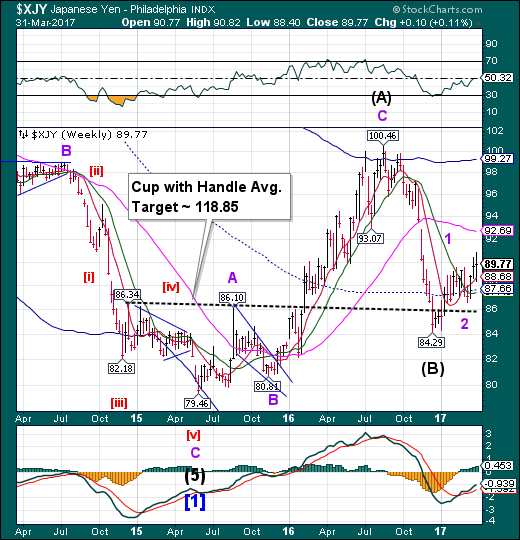

The yen consolidates its gains.

The yen made a new high on Monday, then a quick bounce off Short-term support at 88.68 on Friday. This action confirms the buy signal in the yen. This runs true to form as the Cycles Model called for a short correction..

The fiscal year ended Friday saw the first volatile yen exchange rate in eight years, thanks to the "Brexit" vote and the U.S. presidential election.

Cumulative daily price movement the sum of the differences between the lowest and highest value each day throughout the fiscal year -- was 310 yen, a 19% increase from fiscal 2015 and the largest figure since the financial crisis in 2008.

Daily fluctuations against the dollar were added up from markets in Tokyo, the U.S. and Europe. The largest fluctuation in the yen-dollar market was 7.87 yen on June 24, when Britain voted to leave the European Union. The yen soared to 99 against the dollar that day.

The Nikkei declines from Intermediate-term support/resistance.

After the Nikkei challenged Intermediate-term support at 19286.94 last week, it fell away on Friday, confirming its sell signal. A loss of that supports suggests a potential decline to the Cycle Bottom at 15187.50 or lower. The Cycles Model suggests a probable three-week decline to a significant low in late April.

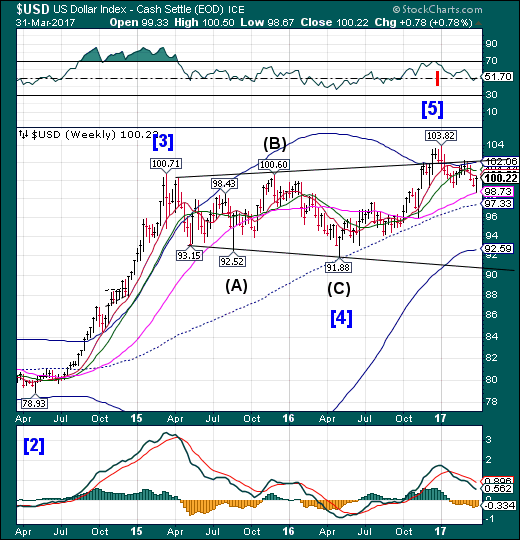

U.S. dollar bounced off long-term support.

USD broke through a trendline at 99.00 but bounced from weekly Long-term support at 98.73 to Short-term resistance, which may have stopped the rally. USD may consolidate between support and resistance over the next two weeks. However, there is much work to be done on the downside, as technical support has been broken.

The dollar's share of currency reserves reported to the International Monetary Fund rose in the fourth quarter, snapping three straight quarterly declines, as the absolute level of reserves held in greenbacks hit a record, data released on Friday showed.

The dollar's share of allocated currency reserves, or those reported to the IMF, rose to a record $5.05 trillion in the October-December period, or nearly 64 percent, according to the data. That was up from the third quarter, when the dollar's share hit its lowest in two years at $4.94 trillion, or 63.3 percent.

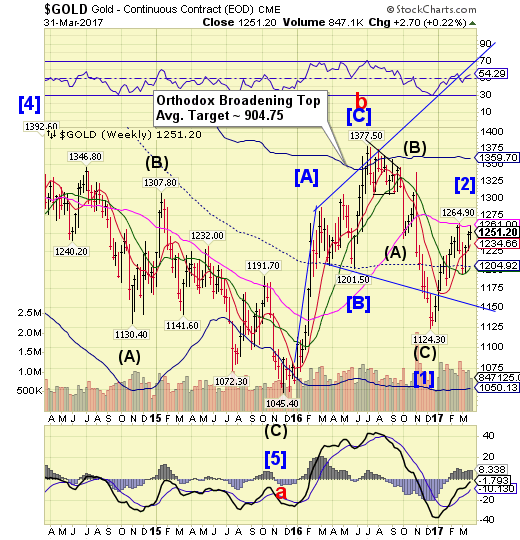

Gold retests Long-term resistance.

Gold retested Long-term resistance at 1261.00 on Tuesday, then eased away. Both the Cycles Model and Orthodox Broadening Top pattern anticipate the decline to resume with only short-term bounces until it reaches its target illustrated on the chart.

Gold has recorded a strong gain in the first quarter of 2017, with prices for the precious metal rising around 8 percent.

This is the biggest quarterly gain since the first quarter of 2016, when the price rose around 16 percent, according to data from ICE Benchmark Administration Limited. In fact, gold prices have made positive gains in 8 of the last 10 first quarters.

Crude bounces from the neckline.

Crude has bounced from the neckline of a Head & Shoulders formation that suggests the decline may continue shortly.It further lends credence to the Orthodox Broadening Top formation which indicates the Cycle Bottom as its target. The Cycles Model suggests the decline may resume for another two to three weeks

Gasoline demand is rising again in the U.S., helping to drain the exceptionally high levels of refined product inventories. That provides a small bit of bullish evidence for a market running a little low on reasons to feel optimistic about oil prices.

All eyes tend to be on the crude oil inventory figures when the EIA releases its weekly data, and this past week was more of the same: no drawdown in crude stocks, which still remain at all-time highs.

That would normally induce another sell off in oil prices. However, investors overlooked that bearish news because of another more interesting development. Gasoline stocks have declined rather significantly in recent weeks, at a much faster rate than at this point in the 2016 season.

Shanghai Index is at the trendline again.

The Shanghai Index has declined to the trendline again. The inability to make new highs at this critical juncture suggests an increasing probability of a trendline failure. Critical support lies at Intermediate-term support 3216.98 which, when broken, may lead to a sell-off. The fractal Model suggests the Shanghai is due for another 1,000 point drop.

Beijing sought to play down tensions with the United States and put on a positive face on Friday as the U.S. administration slammed China on a range of business issues ahead of President Xi Jinping's first meeting with President Donald Trump.

Trump set the tone for what could be a tense meeting at his Mar-a-Lago retreat next week by tweeting on Thursday that the United States could no longer tolerate massive trade deficits and job losses.

Trump said the highly anticipated meeting, which is also expected to cover differences over North Korea and China's strategic ambitions in the South China Sea, "will be a very difficult one."

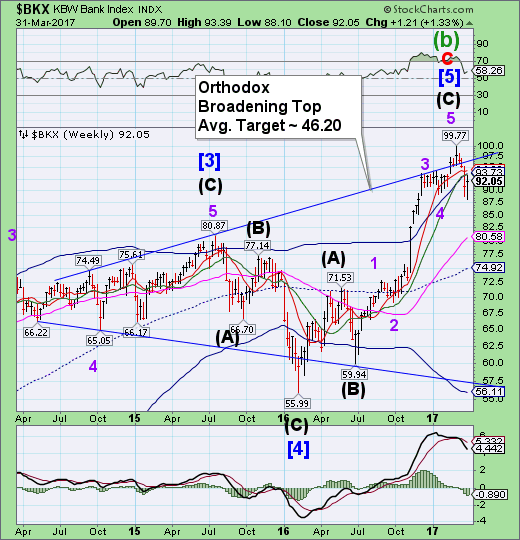

The Banking Index probes lower.

BKX broke three different technical supports last week, putting it on a sell signal as it probed lower. The subsequent bounce recovered 41% of the losses, but the sell signal remains.Serious investors may be well served to sell any rally rather than buy the dip.

Credit Suisse (SIX:CSGN) has confirmed that the Swiss bank, some of its employees and hundreds of account holders are the subjects of a major tax evasion probe launched in UK, France, Australia, Germany and the Netherlands, setting back Swiss attempts to clean up its image as a haven for tax evaders.

According to Bloomberg, Dutch investigators seized jewellery, paintings and even gold bars as part of a sweeping investigation into tax evasion and money laundering in the Netherlands. They added that the sums involved amounted to “many millions” of lost tax revenue.

Here’s Why Italy’s Banking Crisis Has Gone Off the Radar

For a country that is on the brink of a gargantuan public bailout of its toxic-loan riddled banking sector, or failing that, a full-blown financial crisis that could bring down the European financial system, things are eerily quiet in Italy these days. It’s almost as if the more serious the crisis gets, the less we hear about it — otherwise, investors and voters might get spooked. And elections are coming up.

But an article published in the financial section of Italian daily Il Sole lays out just how serious the situation has become. According to new research by Italian investment bank Mediobanca, 114 of the close to 500 banks in Italy have “Texas Ratios” of over 100%. The Texas Ratio, or TR, is calculated by dividing the total value of a bank’s non-performing loans by its tangible book value plus reserves — or as American money manager Steve Eisman put it, “all the bad stuff divided by the money you have to pay for all the bad stuff.”

If the TR is over 100%, the bank doesn’t have enough money “pay for all the bad stuff.” Hence, banks tend to fail when the ratio surpasses 100%. In Italy there are 114 of them. Of them, 24 have ratios of over 200%.

The Wall Street Journal reports Margin Debt Hit an All-Time High in February. Given that Margin debt has a history of peaking right before financial collapses this seems like a warning to me but analysts say it’s different this time.

Margin debt climbed to a record high in February, a fresh sign of bullishness for flummoxed investors trying to navigate the political and economic crosscurrents driving markets.

The amount investors borrowed against their brokerage accounts climbed to $528.2 billion in February, according to the most recent data available from the New York Stock Exchange, released Wednesday. That is up 2.9% from $513.3 billion in January, which had been the first margin debt record in nearly two years.

Before January, the previous record high for margin debt was $505 billion in the spring of 2015. Margin debt then started falling, months ahead of a summer swoon that sent major indexes down more than 10%.