-- VIX challenged its weekly Intermediate-term resistance at 16.45 before closing beneath its mid-cycle support at 14.32. VIX remains on a buy signal.

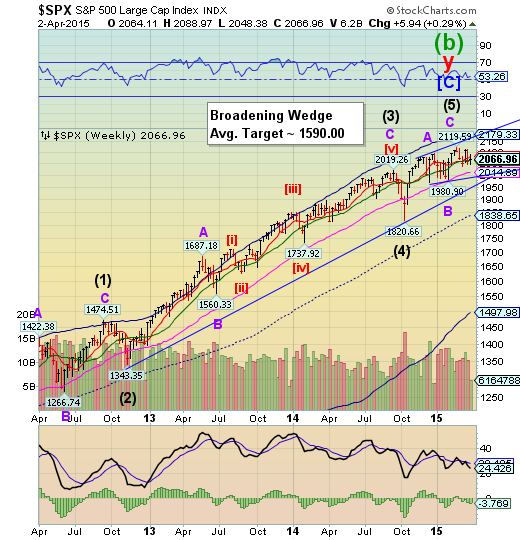

SPX closed above Intermediate-term support.

SPX challenged its Short-term support/resistance at 2080.89, but declined to close above Intermediate-term support/resistance at 2062.29. Further weakness may put its Long-term support at 2014.69 in its sights. Beneath that is the lower trendline for the Broadening Wedge formation. Crossing beneath that is a triggering event. The uptrend may be broken at the long-term trendline at 1962.00 The next decline may not be saved at Long-term support as the last one did on October 15.

(MarketWatch) — U.S. stocks finished the Easter-shortened week with modest gains after benchmarks advanced slightly on Thursday.

The session’s upward momentum was supported by better-than-expected jobless claims, which pointed to continued strength in the labor market, setting the stage for Friday’s closely watched nonfarm payrolls.

U.S. stock markets are closed for Good Friday and investors won't get a chance to react to the highly anticipated jobs report until Monday, but there might be some hints at what the market thinks reflected in futures, which are briefly open.

NDX bounces between support and resistance.

After failing weekly short-term support/resistance at 4368.66 last week, NDX challenged Intermediate-term support at 4301.49, but closed the week above it.A break of Long-term support at 4132.19 and the 3-year trendline at 4060.00 may send the NDX into a much deeper decline to the weekly Cycle Bottom at 2587.08.

(WSJ) In a research note out today, Credit Suisse CS -0.11% analysts Ravi Mehrotra, Jason Kantor, Anuj Shah and Jeremiah Shepard write that biotechnology stocks are not in a bubble but “rather in a new era,” evolving from “Biotech 1.0 to Biotech 2.0.”

On Twitter, the note was quickly mocked for implying that “this time it’s different,” the expression that the late investor Sir John Templeton said constitute the four most dangerous words in the English language.

Credit Suisse (SIX:CSGN) had no immediate comment.

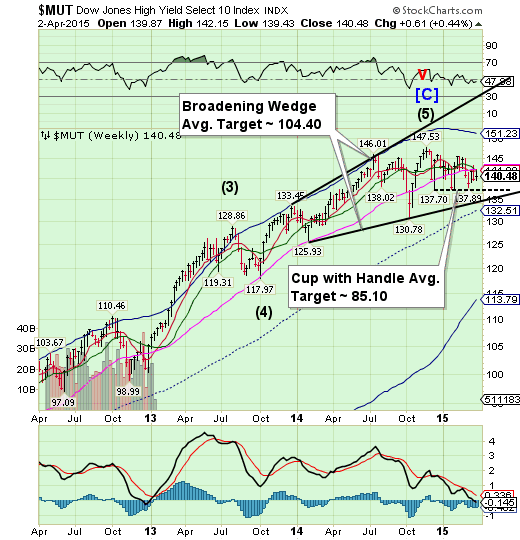

High Yield has an “inside week.”

The High Yield Index attempted a rally to Long-term resistance at 142.19, but quickly reversed back down toward the Lip of the Cup with Handle formation, closing marginally higher than last week. The inability to break outside a trading range is called an “inside week.”The Cup with Handle formation has a very high probability of success once it is triggered .A failure at this point may cause difficulties in new high yield financing that has helped finance stock buybacks, especially in the NASDAQ.

(MarketRealist) Issuance volume had slowed down in the previous week, as the US Federal Reserve was to announce its monetary policy stance. Following that announcement, issuers of junk bonds, or high yield debt, returned to the market in the week leading up to March 27. With a rate hike looming in 2015, issuers returned to raise debt at still-cheap rates. The SPDR Barclays (LONDON:BARC), SPDR Barclays High Yield Bond (ARCA:JNK), and the iShares H/Y Corporate Bond (ARCA:HYG) track high yield debt.

According to data from S&P Capital IQ/LCD, dollar-denominated bonds amounting to $7.3 billion were issued across 16 transactions in the week ended March 27. The issuance volume rose by 49.0% from the week ended March 20. Issuance was evenly spread across the week.

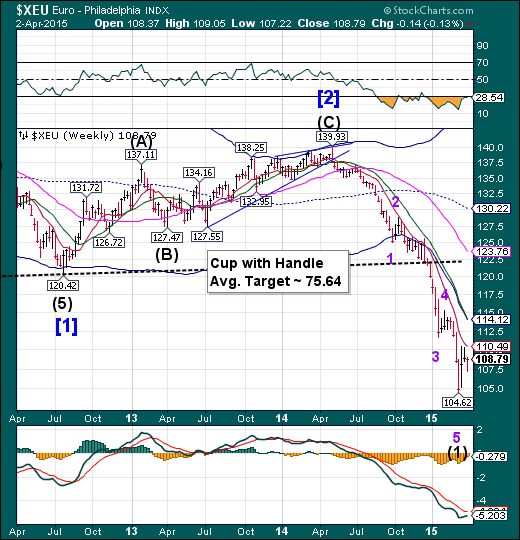

The euro is ready for its “second chance” rally.

The euro appears ready to attempt a “second chance” rally to its weekly Cycle Bottom at 114.12.Last week’s consolidation/stayed inside the range that was expected. A very likely target for this “second chance” may occur between 112.00 and 114.00, but could go higher. The consolidation and subsequent rally may last another 2 weeks. The euro shorts are a very crowded trade.

(WSJ) Greece may be the canary in the eurozone coal mine. But Italy is the elephant in the room.

For the eurozone to prosper, its members must be better off inside it than outside, as European Central Bank President Mario Draghi has highlighted.

The most obvious example of this is Greece. The new Greek government has submitted a fresh set of policy proposals to the eurozone in an effort to unlock €7.2 billion ($7.7 billion) in financing as deadlines for International Monetary Fund repayments and debt rollovers approach. The latest ideas rely heavily on generating new tax revenues and appear optimistic. Many investors still expect Europe to reach some agreement that keeps Greece in the euro, although nerves are being tested by the lack of progress so far.

EuroStoxx rally another week.

The EuroStoxx 50 remained above the upper trendline of the Orthodox Broadening top, but appear to be losing momentum.This rally may have received a boost from the declining euro this week. Could a rising euro reverse this trend?

(WSJ) European stocks climbed on Wednesday after better-than-expected eurozone manufacturing data, a further sign that the region’s economy is picking up.

The STOXX Europe 600 closed 0.3% higher, bouncing back from early losses. The turnaround came after manufacturing-activity figures for the eurozone were revised higher, meaning that the sector grew more quickly in March than initially estimated.

The data are the latest signal that a modest recovery is taking hold in the euro area, which has left investors bullish on European stocks despite a huge first-quarter rally. The onset of European Central Bank quantitative easing, or QE, has provided a further tailwind for stocks, helping exporters and multinationals by weakening the euro.

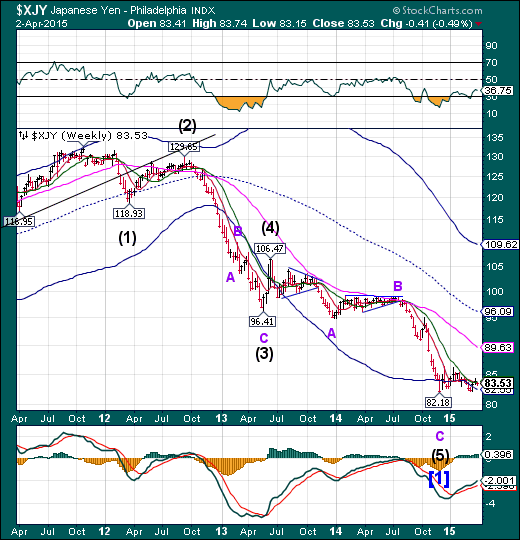

The yen rides above Intermediate-term support.

The yen managed to stay above Intermediate-term support at 83.52, but giving back some of last week’s gains. It appears to have another week or two of potential rally, so climbing above the lower resistance allows it to seek the next resistance level at 89.63.the declining dollar may give it impetus to go even higher.

(MarketWatch) — The dollar dipped against the yen and the euro on Thursday, with many investors sitting on the sidelines ahead of U.S. jobs data Friday or staying away from the market before the Easter holiday season.

The U.S. currency USD/JPY, +0.01% exchanged hands at ¥119.58, compared with ¥119.75 late Wednesday in New York. The euro EUR/USD, -0.05% was at $1.0825 from $1.0763.

Market participants said thin trading volumes ahead of the Easter holiday season and the release of the labor report often make currency trade vulnerable to fluctuations even with relatively small amounts of orders.

The Nikkei reaches upper trendline resistance, reverses.

The Nikkei probed the upper trendline of its Orthodox Broadening Top on Monday then spent the rest of the week in decline. The Broadening toprepresents a market that is out of control and has a highly emotional public participation.Danger signs will become more pronounced once it declines beneath the Cycle Top support at 18585.81.

(BBC) Asian markets experienced mixed fortunes after weak economic data from Japan underlined the struggle policymakers face in reviving the world's third-largest economy.

Consumer inflation, excluding the impact of the April 2014 tax rise, returned to zero for the first time in nearly two years in February.

Meanwhile, household consumption was 2.9% lower than a year ago, while retail sales were down 1.8%.

The Nikkei closed down 1% at 19,285.63.

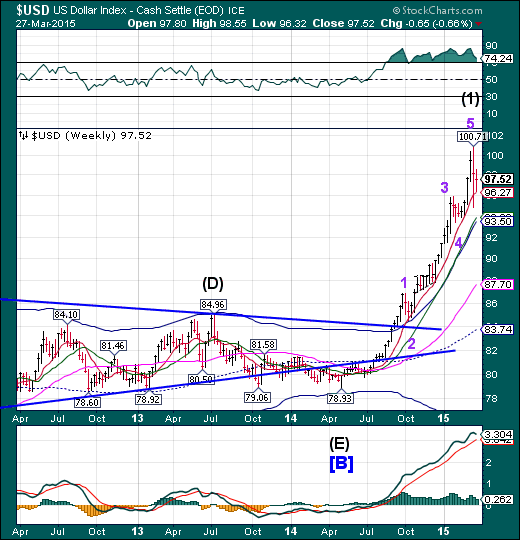

U.S. dollar closes lower, but still above support.

The US dollar bounced off Short-term support at 96.27, but closed lower for the week.The Cycles Model calls for a probable month-long decline as far as mid-cycle support, currently at 83.74. Critical support is at the Cycle Top at 93.50. Dollar longs may be crushed in the next decline.

(Reuters) - Positive bets on the U.S. dollar rose in the latest week, while net shorts on the euro jumped to a record high, according to data from the Commodity Futures Trading Commission and Thomson Reuters that was released on Friday.

The value of the dollar's net long position increased to $43.91 billion in the week ended March 24 from $38.59 billion the previous week. Last week, net longs in the dollar fell under $40 billion for the first time in 12 weeks.

To be long a currency is to take a view that it will rise, while being short is a bet its value will decline. The Reuters calculation for the aggregate U.S. dollar position is derived from net positions of International Monetary Market speculators in the yen, euro, sterling, Swiss franc, Canadian and Australian dollars.

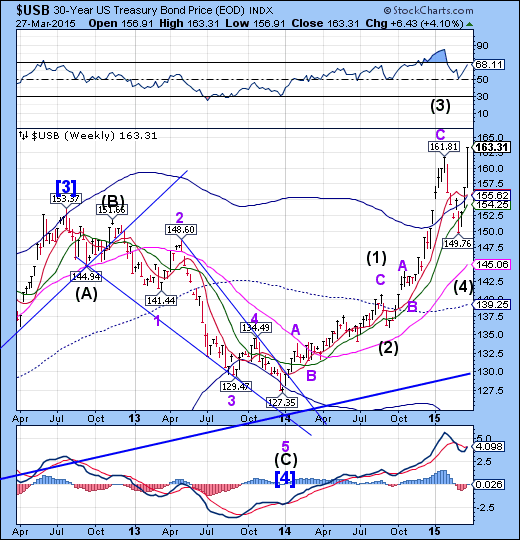

USB breaks out.

Money poured into the Long Bond despite rising rates ($TYX). Cycle rotation now favors bonds over stocks but caution is advised as rising rates may discourage bond investors.

(NASDAQ) U.S. government bonds strengthened for the first time in three days Friday after a report showed growth in the U.S. economy slowed in the final quarter of last year.

A selloff in U.S. crude oil--down about 5% Friday--reduced worries over inflation, a main threat to the value of fixed-income assets over time, contributed to the bond market's strength.

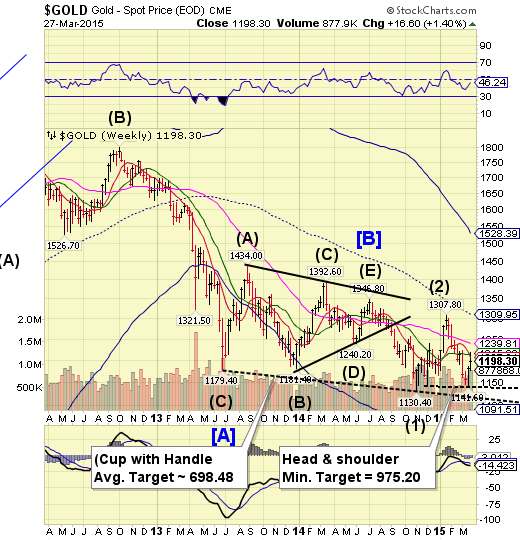

Gold bounces may have completed a right shoulder.

Gold appears to have been repelled by weekly Intermediate-Term resistance at 1215.38. This completes nearly a 50% retracement of the most recent decline and the right shoulder of the Head and Shoulders formation. Today was a major turn date for gold. A failure beneath 141.60 triggers the formation with a minimum target of 975.20.

(MineWeb) Analysts at the French Bank SocieteGenerale (SocGen) in their latest research report have forecast that the gold price, having given away all its early year gains, was headed sharply lower, as it saw the dollar continue its gain in strength. They thus expected the bear market in gold to continue further and saw the price as falling to average only $925 an ounce between 2016 and 2019. The timing of this report was perhaps unfortunate in that the forecast for a virtually immediate downturn in gold, together with dollar strength, predated the events of the past few days, which has seen the reverse occur. Gold bulls will be fervently hoping that the bank’s analysts are equally incorrect in their forecast of gold’s longer-term prospects.

Crude completes an irregular correction...

Crude appears to have been repelled by its Intermediate-Term resistance at 51.41 and closed beneath Short-term support/resistance at 49.20.This was a bit of a surprise, since the reversal was not expected until Monday. Crude has a new potential Wave 5 target at 32.00.

(Bloomberg) -- The slowdown that North American railroad companies had been bracing for in crude oil shipments has turned into a rout, with volumes falling faster than executives had predicted.

With energy companies scaling back drilling after prices for the commodity fell about 50 percent since July, industry executives and analysts anticipated that demand for hauling crude and extraction materials such as frac sand and pipes would slow after a four-year surge. They didn’t expect it to slow this much this fast.

“The impact is occurring more quickly than the rails originally projected to investors,” said Matt Troy, an analyst with Nomura Securities International Inc. in New York. “The consensus view was that very high double-digit growth would moderate to low double digits, and as we have seen in recent weeks we’ve broken that floor and in some cases gone negative.”

Shanghai Index nearing the end of its rally?

The Shanghai Index appears to be approaching the end of its year-long bull run. The Cycles Model suggests a probable turn at the end of March. Retail investors are piling onto this index, which is an good indication of an overbought market. In addition, with nowhere to lend money, China’s shadow banking complex is turning to stocks.

(WSJ) China’s economic growth is slowing, corporate earnings are under pressure, bank loans are souring and the property market is in a funk.

The surprise financial bright spot: China’s long-maligned stock market.

Seven years after a 72% crash from the market’s 2007 peak destroyed over $3.5 trillion worth of investor wealth, Chinese stocks are on track to be among the strongest in the world for a second year. The Shanghai Composite Index has about doubled since its 2008 lows, with the index up nearly 14% this year.

Unfortunately,what’s flowing into stocks is dumb money.

The Banking Index loses all supports.

--BKX declined beneath its final line of defense, its Long-term support at 71.46. This virtually assures a decline to its cycle Bottom, currently at 56.13. This would likely trigger the Orthodox Broadening Top formation. The Cycles Model now implies that the next decline may last through mid-April. Could this be a waterfall event?

(TheGuardian) Big Wall Street banks are so upset with Elizabeth Warren’s call for them to be broken up that some have discussed withholding campaign donations to SenateDemocrats in symbolic protest, sources familiar with the discussions said.

Representatives from Citigroup, JP Morgan, Goldman Sachs and Bank of America have met to discuss ways to urge Democrats, including Warren and Ohio senator Sherrod Brown, to soften their party’s tone toward Wall Street, sources familiar with the discussions said this week.

Bank officials said the idea of withholding donations was not discussed at a meeting of the four banks in Washington but it has been raised in one-on-one conversations between representatives of some of them. However, there was no agreement on coordinating any action, and each bank is making its own decision, they said.

(ZeroHedge) As we’ve discussed twice this month, the world has now officially given up any pretensions that Japan’s elephantine QE program isn’t underwriting the rally in Japanese stocks. Not only is the Bank of Japan buying ETFs, they’re targeting their purchases to (literally) ensure that stocks can’t fall by stepping in when things look weak at the open. Unfortunately, Kuroda looks set to run up against the extremely inconvenient fact that while, in his lunacy, he can print a theoretically unlimited amount of money, the universe of purchasable ETFs is limited and so eventually, the BoJ will own the entire market.

(ZeroHedge) Nearly a month after the Hype Alpe Adria bad bank Heta Asset Resolution "unexpectedly" imploded under a house of non-GAAP and misreported cards, and which led to only the second European creditorbail-in after Cyprus in what until then was considered the safest European nation, unleashing a herd of black swans which will result in not only the insolvency of one of Austria's provinces, Carinthia, but a week ago led to its first foreign casualty, German DuesseldorferHypothekenbank AG which had to be bailed out by the German FDIC-equivalent, the ECB has finally realized it may have a major problem at hand.

(ZeroHedge) When it comes to the sweeping of (trillions of) toxic assets until such time as the ECB starts purchasing not only government bonds but equities, bank loans and really anything else that in a normal world would have some "mark to market" value, Europe had a ready answer: bad banks. A tradition which started with Switzerland and the semi-bailout of UBS during the great financial crisis, "bad banks" have been proposed every time there are a few hundred billion in bad assets that need to be swept away or otherwise removed from the public eye.

In fact, it was just a few hours ago that Spain's economy minister praised the usefulness of bad banks, which have certainly seen their fair share of use in Spain over the past 5 years.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.