VIX had an inside week, closing above Short-term support at 11.20 but beneath its Intermediate-term resistance at 11.81.An aggressive buy signal may be forthcoming should the VIX rally back above its Intermediate-term resistance.The breakout above its consolidation area may produce a slingshot move.

(CNBC) A striking stat about the CBOE Volatility Index provides yet more testimony to the anomalous quiet seen in the equity market.

In all the sessions since Jan. 4, the index known as the VIX has not risen above 13.28. The VIX hasn't previously stayed below 13.5 for as many straight sessions since before the financial crisis.

"The markets are literally gorging on risk, and the VIX tells that story," Max Wolff, strategist at 55 Capital, wrote to CNBC on Thursday.

SPX has its first weekly loss in seven.

SPX had a loss for the week after six straight weeks of gains.A decline beneath its weekly low at 23574.54 and Short-term support, both near 2320.54,gives the SPX an aggressive sell signal.A break of those supports may send the SPX to its cycle Bottom at 1888.33, or possibly lower.

(Reuters) Crude oil resumed a sharp decline and global equity markets rose on Friday after a robust U.S. jobs report drove home the strength of the world's biggest economy and set the stage for the Federal Reserve to raise interest rates next week.

Nonfarm payrolls rose by 235,000 jobs as the construction sector recorded its largest gain in nearly a decade due to unseasonably warm weather, the U.S. Labor Department said.

Nasdaq 100 Has A Flat Week

NDX made a sideways consolidation through Thursday, with a Jobs market bounce on Friday. There was no new high. NDX is still extended, so a breakdown may not register until it declines beneath Short-term support at 5234.05. However, the Cycles Model suggests continued weakness.

(DailyNews) U.S. stocks are moving higher Friday morning after a strong February jobs report. Technology companies are rising more than the rest of the market, but renewed losses for energy companies are limiting the gains overall. Federal Reserve is widely expected to raise interest rates next week following the strong employment report.

KEEPING SCORE: The Standard & Poor’s 500 index rose 4 points, or 0.2 percent, to 2,368 as of 11:15 a.m. Eastern time. The Dow Jones industrial average advanced 16 points, or 0.1 percent, to 20,874. The Nasdaq composite added 14 points, or 0.2 percent, to 5,853.

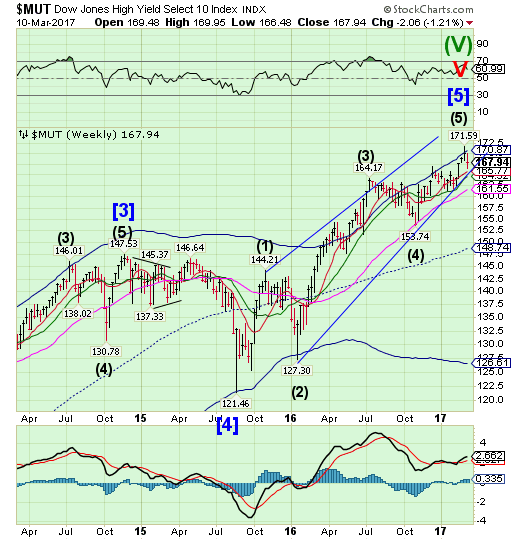

High Yield Bond Index tests Short-term support.

The High Yield Bond Index declined beneath its Cycle Top resistance at 170.87, testing Short-term support at 165.77.A break beneath the Diagonal trendline and Short-term implies a complete retracement of the rally may occur. The Cycles Model suggests weakness ahead.

(Barron’s) Junk bonds are getting hit with a perfect storm of headwinds this month: Rising rates, falling oil prices (about 15% of junk bonds are tied to oil), and redemptions from high-yield funds.

Junk bonds had beat Treasuries for the last eight months in a row, tying prior records, but that’s not the case so far in March.

The high yield sector’s two big exchange traded funds, the iShares iBoxx $ High Yield Corporate Bond (NYSE:HYG) and the SPDR Barclays (LON:BARC) High Yield Bond (NYSE:JNK) are both down about 2.5% so far in March, while the iShares 7-10 Year Treasury Bond (NYSE:IEF) is down about 1% and the iShares 20+ Year Treasury Bond (NASDAQ:TLT) down close to 2%.

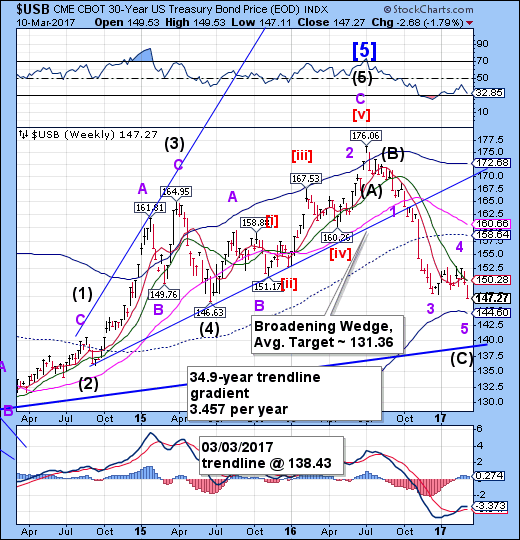

Is USB completing its decline?

The Long Bond declined to a new yearly low.The Cycles Model now suggests that a period of strength may develop through mid-March.The mid-Cycle resistance at 158.64 still appears to be the target.

(CNBC) U.S. government debt prices rose slightly on Friday as investors digested fresh economic data ahead of a likely U.S. interest rate hike next week. The yield on the benchmark U.S. 10-Year Treasury notes, which moves inversely to price, was lower at around 2.58 percent, while the yield on the 30-year Treasury bond was also lower at 3.165 percent.

The U.S. economy added 235,000 jobs last month, according to the Bureau of Labor Statistics. The U.S. unemployment ticked lower to 4.7 percent. Economists polled by Reuters expected the economy to have added 190,000 jobs last month.

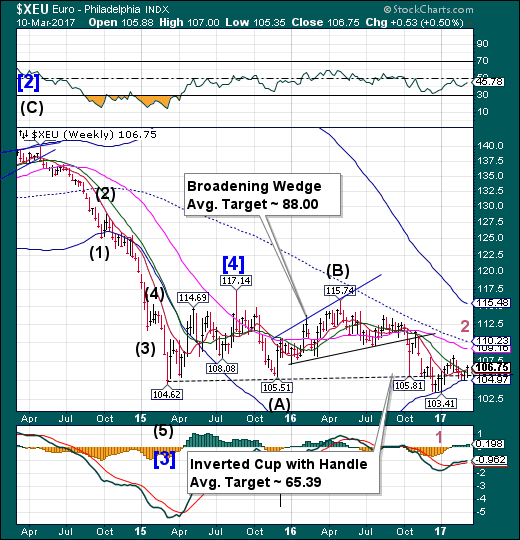

The Euro rises above Intermediate-term resistance.

The iShares MSCI Europe IMI (TO:XEU) broke through Intermediate-term resistance at 106.08.A bounce to Long-term resistance at 109.10 may be the next outcome. There may be some Cyclical strength in the next week or two.

(Reuters) Almost three quarters of French people are against leaving the euro zone currency bloc and returning to the franc, a survey showed on Friday, in bad news for far-right leader Marine Le Pen who advocates a so-called 'Frexit'.

Some 72 percent of the French polled by the Elabe polling institute in a survey published in Friday's Les Echos newspaper were opposed to ditching the euro and returning to a national currency, with 44 percent saying they were "very opposed".

Le Pen, one of the leading candidates in April-May's presidential election, wants to hold a referendum about France's EU membership and take France out of the euro to return to a new French franc.

Euro Stoxx 50 is repelled by the trendline.

The EuroStoxx 50 Index rallied to the Broadening flag trendline, then eased back on Friday.The period of strength may be coming to a hard stop.A break of short-term support at 3322.48 may offer a sell signal which may be confirmed beneath mid-Cycle support at 3237.68.

(Bloomberg) European stocks trimmed earlier gains, trading little changed after people familiar with the matter said the European Central Bank discussed whether interest rates can rise before its bond-buying program comes to an end.

The Stoxx Europe 600 Index added less than 0.1 percent at 4:11 p.m. in London, paring its weekly drop to 0.6 percent. The benchmark yesterday erased an intraday drop after ECB President Mario Draghi said downside risks to the euro-area economy were less pronounced.

ECB Governing Council members meeting on March 9 exchanged views on ways of communicating and sequencing an exit from unconventional stimulus, according to people familiar with the matter.

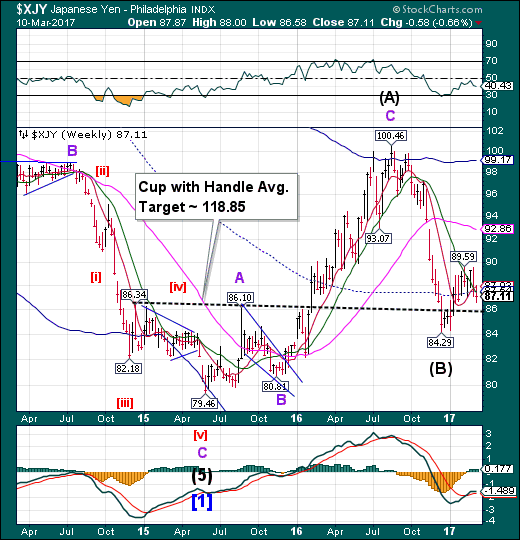

The iSTOXX MUTB Global ex Japan Quality 150 Price JPY tests mid-Cycle support.

The Yen fell back to retest mid-Cycle support at 87.54.A breakout may be considered a strong buy signal,but it would need to rise above the congestion zone to confirm it. The Cycles Model suggests a period of strength may last through mid-March.

(Bloomberg) The Bank of Japan will leave policy unchanged at its board meeting next week, according to a survey of economists by Bloomberg.

Most see the BOJ as done with adding stimulus under Governor Haruhiko Kuroda and are now focusing on how and when the BOJ will start tapering bond purchases and raising interest rates.

None of the 41 economists forecast the central bank will increase stimulus next week, and none forecast any changes to its interest-rate targets or bond buying. Thirty-eight said the BOJ was finished adding stimulus during Kuroda’s term, which ends in April 2018.

The Nikkei 225 has an inside week.

The Nikkei found support at a trendline (not shown) just above Intermediate-term support, but came short of making a new high. A breakdown beneath this consolidation zone and Intermediate-term support at 19114.71 confirms a sell signal. A loss of the next supports suggests a potential decline to the Cycle Bottom at 15157.24 or lower.

(JapanTimes) Stocks surged on the Tokyo Stock Exchange Friday against the backdrop of the yen’s further weakening against the dollar, sending the benchmark Nikkei average to the highest closing level in about 15 months.

The 225-issue Nikkei average jumped 286.03 points, or 1.48 percent, to end at 19,604.61, its highest finish since Dec. 7, 2015. On Thursday, the key market gauge gained 64.55 points.

The Topix index of all first-section issues closed up 19.33 points, or 1.24 percent, at 1,574.01, after rising 4.43 points the previous day.

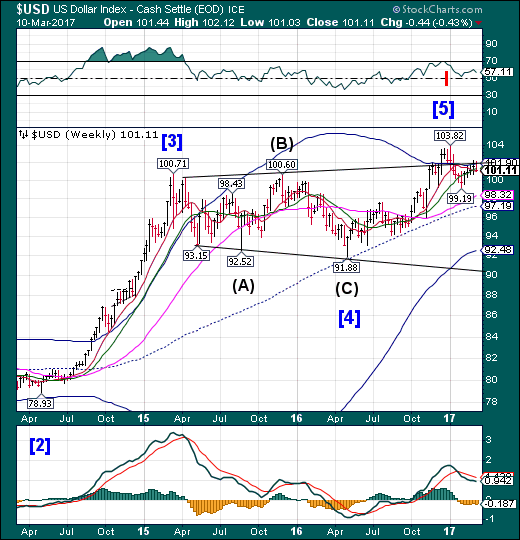

U.S. Dollar retreats beneath Inter mediate-term support.

USD challenged the upper trendline of its Broadening Top near 102.00 again, but retreated beneath Intermediate-term support at 101.37.This puts the USD on a potential sell signal, should it remain beneath that level. The Cycles Model suggests a significant low in the next week or two.

(ZeroHedge) First, the dollar dropped following comments from commerce secretary Wilbur Ross, who said that he expected to start renegotiating NAFTA within two weeks and that Japan will be high on the list for trade agreements.

Now, in a second salvo against the strong dollar on the same day, Bloomberg reports that during his first appearance at next week's G-20 meeting in Baden-Baden, Germany, Treasury Secretary Steven Mnuchin plans to drive home the message that the U.S. won’t tolerate countries that engage in currency devaluation to gain an edge in trade, a statement which would clearly refute Mnuchin's recent praise for a stronger dollar, and provides further evidence that the Trump administration's preliminary focus will be on getting the dollar weaker, not stronger, which may in turn impact the Fed's decision-making, especially if indeed Yellen hopes to hike rates three (or more) times in 2017.

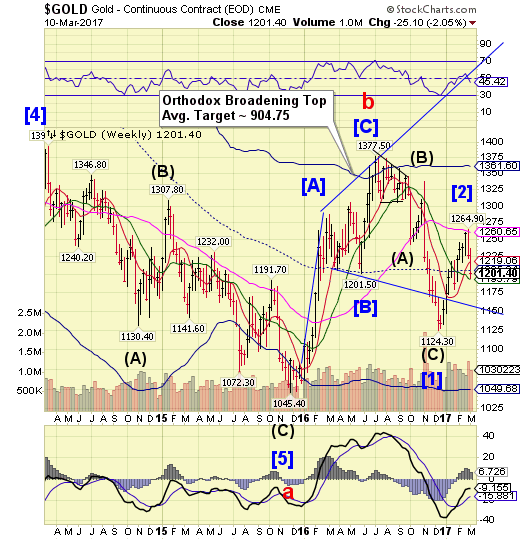

.Gold sells off.

Gold continued declining this week, making a possible Trading Cycle low on Friday. Both the Cycles Model and Orthodox Broadening Top pattern anticipate a continued decline with only short-term bouncesuntil it reaches its target illustrated on the chart.

(CNBC) Gold logged its ninth straight losing session on Friday, for the metal's longest string of declines since July 2015. And some say the drop spells opportunity.

"We think right now could be a good entry point for gold," RBC Capital Markets commodity strategist Christopher Louney said Friday on CNBC's "Power Lunch."

In prior months, Louney has staked a bearish view on the metal, arguing that gold had been driven higher by investor demand which would eventually dry up. This call has proved prescient; after peaking above $1,335 in July 2016, the metal briefly fell below $1,200 in Friday trading.

Crude broke down from its consolidation.

After breaking beneath its short-term support at 53.50 last week, Crude fell hard to close beneath Long-term support at 48.87.Crude is now on a sell signal.The Cycles Model suggests a significant low may occur in the next two weeks.

(OilPrice) Oil prices plunged on Wednesday and Thursday, dropping to their lowest levels since December when the optimism surrounding the OPEC deal was just getting underway. WTI dipped below $50 for the first time in 2017 on March 9, a two-day loss of more than 8 percent.

The catalyst for the sudden decline in prices was yet another remarkably bearish report from the EIA, which showed an uptick in crude oil inventories by 8.2 million barrels last week. That takes crude stocks to another record high, and it was the ninth consecutive week of inventory builds.

Shanghai Composite hovers above support.

The Shanghai Index appears to be hovering above multiple supports at 3179.00 without making a new high or low.The fractal Model suggests the Shanghai is due for another 1,000 point drop. The index restores its sell signal beneath Intermediate-term support and trendline at 3164.50.

(ZeroHedge) It's a well-known risk, perhaps the biggest to the global financial system: China's debt is too high, with estimates ranging from 250% to 300% of GDP per the IIF:

And while China has largely ignored, or avoided, discussing the troubling implications of its unprecedented debt load, this changed today when the head of China's central bank, Zhou Xiachuan finally admitted that it has a debt "problem" saying that corporate debt levels are too high and that "it will take time to bring them down to more manageable levels", underlining what has become the defining battle to put the world's second-largest economy on a more sustainable footing: keeping GDP growing at 6.5% (or above) while injecting trillions in new debt.

"Non-financial corporate leverage is too high," PBOC Governor Zhou Xiaochuan told reporters at a news conference on the sidelines of the annual parliament session.

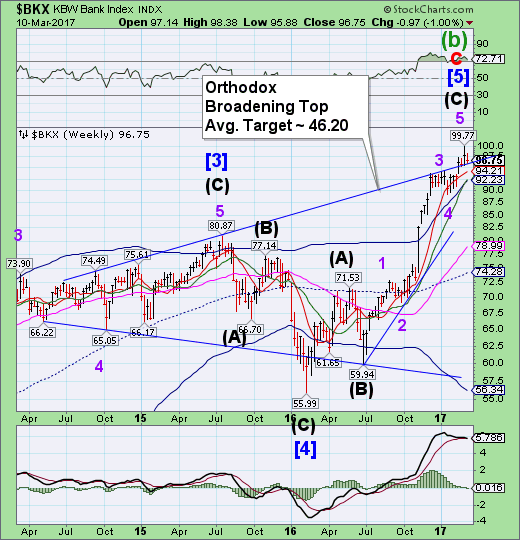

The Banking Index pull back to the trendline.

--BKX challenged its Orthodox Broadening Top trendline at 96.50, where it consolidated.The The rally from the June 27 low appears complete. BKX appears to be ready for a large decline that may extend through the next week or longer, according to the Cycles Model.

(Bloomberg) President Donald Trump assured a group of U.S. community bank executives he’ll deliver regulatory changes that will make it easier for them to lend money.

“We must ensure access to capital,” Trump said Thursday during the meeting at the White House. “You’ll be able to loan, you’ll be able to be safe, but you’ll be able to provide the jobs that we want and all create great businesses.”

Trump was seeking the bankers’ input on which regulations may be crimping their ability to lend to consumers and small businesses, according to a White House statement. Trump previously called the 2010 Dodd-Frank financial regulatory law a “disaster” for small lenders and pledged to “do a big number” on it.

(ZeroHedge) Russia's largest bank, Sberbank, has confirmed that it hired the consultancy of Tony Podesta, the elder brother of John Podesta who chaired Hillary Clinton's presidential campaign, for lobbying its interests in the United States and proactively seeking the removal of various Obama-era sanctions, the press service of the Russian institution told TASS on Thursday.

"The New York office of Sberbank CIB indeed hired Podesta Group. Engagement of external consultants is part of standard business practices for us," Sberbank said.

(ZeroHedge) The basic laws of physics have seemingly ceased to exist in Australia...water is no longer wet, the sky is no longer blue and home prices are not in a "speculative bubble," at least according to some conflicted commercial banking executives who are massively long Australian housing.

Testifying before a parliamentary committee, the chief executives of National Australia Bank, Westpac Banking and Commonwealth Bank of Australia all said that while they are worried about elements of the housing market, prices aren’t over-inflated.

(ZeroHedge) That's not what the bankers want to hear...

- *TRUMP STILL COMMITTED TO RESTORING GLASS-STEAGALL: SPICER

Interestingly this comment comes after President Trump met with a group of community bankers...