by Eli Wright

US equities started the year on a high note. On Friday, the Dow came within one point of the 20K benchmark, while the S&P and NASDAQ both closed at record highs, 2,276.98 and 5,521.06, respectively.

Bitcoin had an up-then-down week and Friday's Nonfarm Payrolls report came in mixed, but still helped the dollar rebound.

Also on Friday, Apple (NASDAQ:AAPL) announced that due to missed annual sales targets and profit goals in 2016, top ranking executives—including CEO Tim Cook—wouldn't be receiving cash incentives tied to their annual compensation packages.

Bitcoin on a Roller-Coaster

Bitcoin skyrocketed 44% higher since the week leading up to Christmas, with analysts suggesting the rapid propulsion was a result of Chinese and Indian investors looking to shield themselves from local currency depreciations, capital controls and cash crunches. During the early part of last week, the crypto-currency reached a peak of $1,135. Many thought it might continue its strong uptrend, to its all-time high of $1,216.

China's yuan, however, gained more than 2% last Wednesday and Thursday, and Bitcoin reacted by losing nearly one fifth of its total value.

The digital currency has since regained some balance and is up 4%, to $938.99.

Bitcoin is no stranger to wild swings. Over the past five years it has experienced eight dives of 20% or more, 20 tumbles of 15% or more, and 38 slips of 10% or more.

Apple misses 2016 targets, but the App Store wins

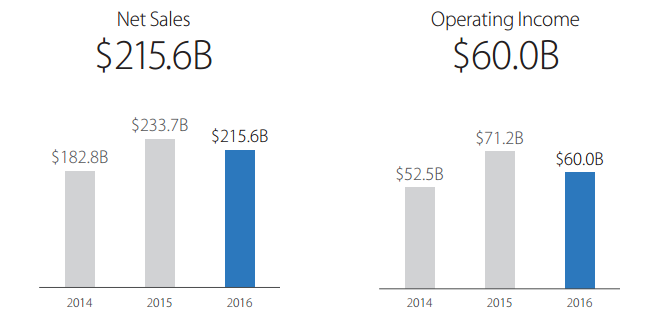

Apple’s SEC filing for fiscal 2016 indicated that the company's annual revenue decreased for the first time since before the iPod was unveiled in 2001. Revenue dropped 8% to $216 billion, while Apple's operating profit declined 16% to $60 billion. Net sales came in 3.6% short of the $223.68 billion target, while operating income came in at $60 billion, missing the $60.3 billion forecast by 0.5%.

Source: Apple SEC filing

CEO Tim Cook was forced to take a 15% pay cut as a result; his compensation package was a valued at $8.7 million, down from $10.3 million a year earlier.

Nevertheless, Apple shares rose 1.1% before the weekend; even as unit sales declined, it was confirmed that December was the App Store’s most successful month ever, and the company rang in $3 billion in revenue from a combination of in-app purchases, paid downloads, and subscription fees. Customer spending at the App Store jumped 40% in 2016.

While the US is still the App Store's largest customer base, the Chinese market has grown by 90% from a year ago. China represents a key opportunity for Apple to extend its edge in the mobile app market, since Google Play (NASDAQ:GOOGL) is blocked in the region.

Apple is currently trading at $117.91 and could break its major line of resistance at $123.

Nonfarm Payrolls Disappoint, but Wages satisfy

The US jobs report on Friday was mixed, disappointing some analysts but not others. Nonfarm payrolls rose by only 156,000 in December, down from November’s upwardly revised figure of 204,000, and less than the 178K expected. The unemployment rate ticked ten points higher, to 4.7%. Wages, however, increased, as average hourly earnings rose to 0.4%, following a drop of 0.1% in November.

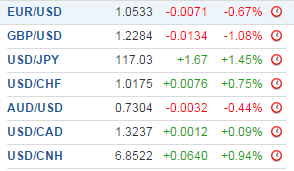

Despite the mixed results, the US dollar moved higher on the report. It's currently up against a variety of major global currencies:

Commodities get some lift

Gold has bounced up 4% since its lows in mid-December. The precious metal is now up to $1,171.90. It’s possible the yellow metal could reach $1,200 in the coming week, a point which until late November, had been strong support.

Still, the price of gold is usually closely tied to the value of the US dollar. When one goes up the other generally falls. Last week saw the greenback lose some traction, which coincided with gold’s move up. With the dollar making gains to close out the week, gold simultaneously lost some of its value.

Oil prices remain elevated as OPEC, along with eleven other global producers, begins to cut output. Thus far, all involved seem to be in compliance with the agreement. It is therefore possible prices could move higher in the coming weeks.

Crude is currently trading at $53.71. Brent is at $56.83.

Last Week’s Biggest Gainers

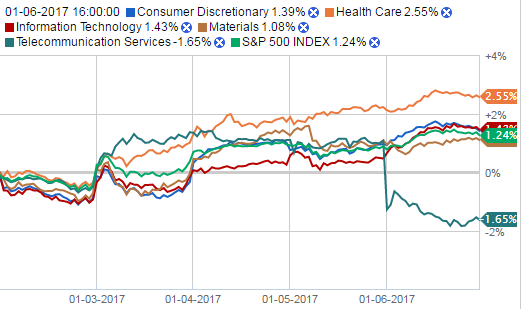

The S&P 500 gained 1.24% on the week last week, led by large gains in the Health Care, Information Technology, Consumer Discretionary, and Materials sectors.

Source: Fidelity.com

The biggest mover was tech company Xerox (NYSE:XRX), which spiked more than 20% after completing the spinoff of its business services unit, Conduent (NYSE:CNDT).

In health care, Alexion (NASDAQ:ALXN) jumped 17.38%; Illumina (NASDAQ:ILMN) gained 10.50%; and AmerisourceBergen (NYSE:ABC) rose 8.45%.

Mattel (NASDAQ:MAT) led all Consumer Discretionary gains, rising 10.60% on the week, while TripAdvisor (NASDAQ:TRIP) finished up 9.49%.

Though telecom was the worst performing sector last week, broadband provider Frontier Communications (NASDAQ:FTR) was still one of the top ten gainers, up 10.95%.

In Materials, mining company Freeport-McMoran (NYSE:FCX) rose 12.96%, while Arconic (NYSE:ARNC)—spun off in November from Alcoa (NYSE:AA)—gained 11.27%.

Rounding out last week's top ten gainers was energy company NRG (NYSE:NRG), which rose 8.97%.

Last Week’s Biggest Losers

Retailers made up the bulk of last week’s biggest losers. After disappointing holiday sales, Kohl’s (NYSE:KSS) plummeted 16.10%, while Macy’s (NYSE:M) dropped 13.93%. Everything from fashion, to jewelers, to grocers did poorly: Urban Outfitters (NASDAQ:URBN), L Brands (NYSE:LB), Signet Jewelers (NYSE:SIG), Nordstrom (NYSE:JWN) and Kroger (NYSE:KR) all made an appearance on the list.

In energy, Southwestern (NYSE:SWN) lost 5.27% while Tesoro (NYSE:TSO) dipped 4.23%.

Bringing up the rear, NVIDIA (NASDAQ:NVDA)—the best performing stock of 2016—fell 3.41%.

What to expect this coming week

After two holiday-shortened weeks in a row, we're finally entering the first full trading week of 2017, so volatility may drop a bit as trading volume increases.

This could finally be the week the Dow extends past 20K, and the SPX and COMPQ could also reach new highs. Key economic announcements this coming week include Crude Oil Inventories on Wednesday and US Retail Sales and PPI on Friday.