Bespoke Investment Group provides some of the best investment insight to individual and institutional investors alike. That said, their “tweet” Friday morning described the jobs report as a definitive sign of a tight labor market. The implication? Employment in America is firing on all cylinders.

I beg to differ.

Let’s begin with several key particulars. Media outlets reported that U-3 unemployment ticked higher from 4.6% to 4.7%. When the “headline” U-3 number goes down, most commentary focuses on a lower percentage of unemployed workers in the labor force. When the headline data point climbs as it did in December, media personalities express optimism that the uptick meant that more people were looking for work. So up or down… the direction of U-3 unemployment is always a positive?

Incidentally, the more important U-6 unemployment data point—all unemployed in the labor force, those who are marginally attached, and those who work part-time because they cannot get full-time work—ticked down to 9.2% from 9.3%. It comes closer to representing real unemployment, of course. On the other hand, it ignores nearly 96 million adults who are longer counted as part of the workforce at all.

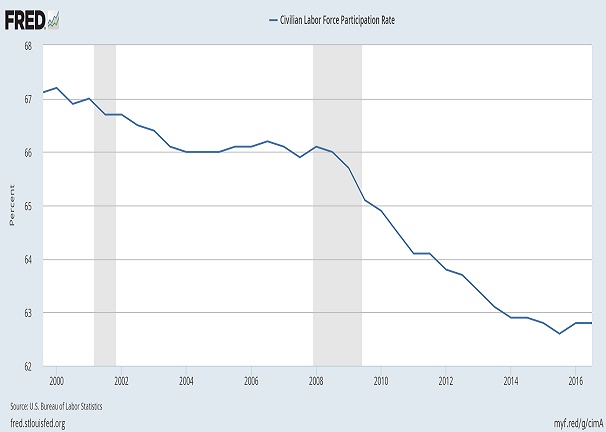

In truth, more working-aged individuals than ever before no longer seek employment. Moreover, the 62.7% labor force participation rate hovers near 40-year lows. Do the 96 million (37.3%) all fall into a camp of retiree, student or disabled American? Not a chance.

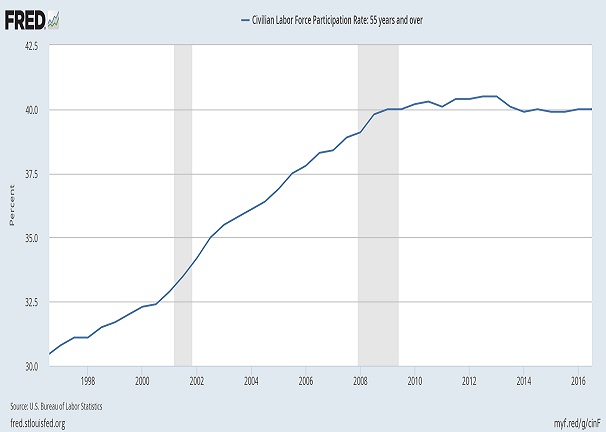

In fact, on a percentage basis, the 55-plus crowd is working well into the twilight years. Whereas many in the 25-50 crowd have simply given up on looking for employment, many would-be retirees are keeping at it. (See the graph below.)

It’s not that many baby boomers have not chosen to retire. They have. And it’s not that Americans are not increasingly choosing to retrain or go back to school, while others seek advanced degrees. That is happening too. Yet it is disingenuous to describe the labor market as tight when there is so much slack.

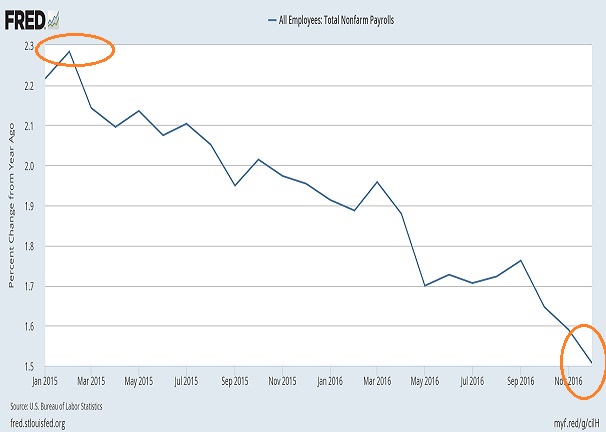

The recent jobs report presented several additional trouble spots. For example, the fact that the economy “added” 156,000 jobs last month ignores a more sobering trend on job growth. Specifically, as the Fed completed its final asset purchase (December 18, 2014) as part of its QE3 stimulus, job growth peaked at 2.3% year-over-year. Where is it now? 1.5%. In other words, rather than accelerating, the pace of job growth is slowing.

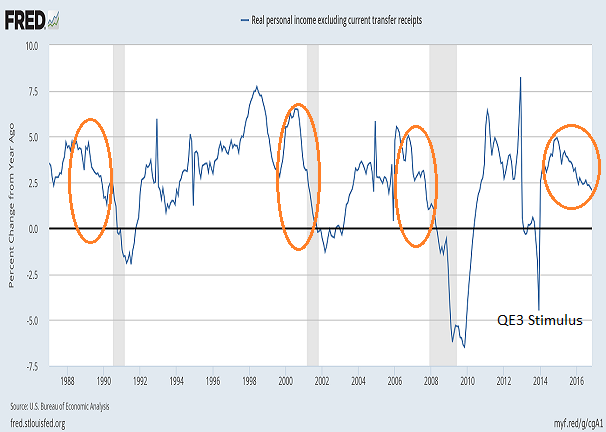

Another positive in the Friday (1/6/17) jobs report was a pick-up in wage growth. Average hourly earnings jumped 0.4% to $26 per hour. They’re now 2.9% higher on a year-over-year basis. And from two years earlier? Wages have grown 5.7%. Theoretically, these wage increases should compensate for CPI inflation and boost consumer spending.

Not so fast. Inflation-adjusted income that strips out government social benefits like Social Security and retiree business benefits like pensions appears to be on the wane. Does this signal an imminent recession? Hardly. Yet the slowdown may be another sign that consumption might not be as robust going forward as economists hope.

In aggregate, I’d say that the jobs report was relatively neutral. It certainly did not suggest to me that the economy is accelerating. On the contrary. All things being equal, I’d say that the warning flags of a slowdown are present.

Still, the stock market dances in and around Dow 20,000. Due to a wonderful jobs picture? No. Due to the hope that President-elect Trump might bring tens of millions of the 96 million non-participants out of the shadows.

Can the new administration achieve its lofty ambitions? His plans rely heavily on the loosening of regulations, the lowering of taxes, the re-building of infrastructure and the replacing of the federal health law. From my vantage point, hope has trumped common sense about how much will be accomplished and how much will be accomplished without sending rates and the greenback through the proverbial roof.

Bottom line? U.S. stocks are priced to absolute perfection and beyond. History alone suggests that some aspect in some area of “Trumponomics” will fall short. And when it does, a pullback in equity prices will present far more compelling opportunities than exist at Dow 20,000.

Does it mean that I advocate “shorting?” Because I am bearish? It does not. I have maintained roughly the same 50/25/25 stock-bond-cash mix since the Federal Reserve completed its final asset purchase as part of quantitative easing (December 18, 2014). The risk-adjusted performance has been splendid. And the 25% cash position? The day to put it to work will come.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients June hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.