by Eli Wright

Gold and oil moved lower to end the week and the Dollar Index edged higher, back over the 100 benchmark, albeit barely. The real excitement this past week was reserved for US equities at midweek, when all three major indices set new all-time highs, with the Dow in particular finally clearing the 20,000 benchmark on Wednesday January 25.

A number of disappointing US economic releases at the end of the week bear watching including Thursday's Initial Jobless Claims which came in lower than expected at 259K and New Home Sales which disappointed at 536K. Services PMI however surprised to the upside, coming in at 55.1, ahead of the 54.4 eyed. Friday's releases included Core Durable Goods Orders, which came in 0.5% as expected and a disappointing Q4 GDP release, showing growth at a paltry 1.9%

Nevertheless, markets were largely dominated by politics and earnings reports.

On the political front, President Trump's first week in office featured a dizzying array of executive actions including: a repeal of the Affordable Care Act; withdrawal from the TPP trade agreement; revival of TransCanada's (NYSE:TRP) Keystone Pipeline initiative as well as the Dakota Access Pipeline; and midweek a signed executive to build the US-Mexico border wall, one of his central campaign talking points. By Thursday, after Mexico indicated they would not pay for Trump's wall, Mexico's President Pena Nieto canceled his meeting with the US's new President. This led Trump to threaten the imposition of a 20-percent tax on all imports from Mexico, though this was later walked back by Trump staffers as "one idea."

Perhaps his most explosive action so far was signed at the end of the week, barring US entry to refugees and green-card holders from seven Muslim countries. A Brooklyn, NY judge issued a partial stay against the ban, but legal efforts to stop the entire action remain ongoing.

Earnings reports were an alternative highlight during the past week. Nearly one-third of S&P 500 companies have already reported quarterly results, showing an average earnings growth of approximately five percent.

Dollar begins to rebound

After a downside correction that lasted most of last week and drove the USD below 100 over four consecutive days, the US dollar finally appears to be rallying, rising 0.7% over the final two trading sessions of the week, to close at 100.53.

Upward momentum, however, remains weak. On the upside, the next level for the Dollar Index is 101, but on the downside, it could fall below 99.

Dow closes above 20,000

By mid-week, traders who had been waiting for Trump to act on his campaign promises got the evidence they needed to propel US equities out of their 1.5-month consolidation phase. Despite protectionist concerns, all the major US indices broke out. The S&P 500 finished the week up 1% at 2,294.69 though down on the day. The NASDAQ rose 1.9% to 5,660.78 finishing the week up as well.

The most notable jump was the much awaited Dow 20K. It only took 42 sessions for the Dow to travel from 19-20K. However, the index finished the week off 0.04%.

Key Commodities Lower

With risk-on sentiment returning to equity markets, gold lost out. The precious metal fell to a two week low, back below the psychologically significant $1,200 level, to $1,190.

Despite encouraging news that OPEC and non-OPEC countries had made a strong start in lowering their oil output and were sticking to freeze agreements, the EIA reported on Wednesday that US weekly supplies had increased by 2.9M barrels. And on Friday, Baker Hughes reported that the US oil rig count had increased from 551 to 566. On Friday, crude oil prices fell 1%, to $53.20 while Brent lost 1.26%, to $55.53.

Biggest Stock Market Gainers Last Week

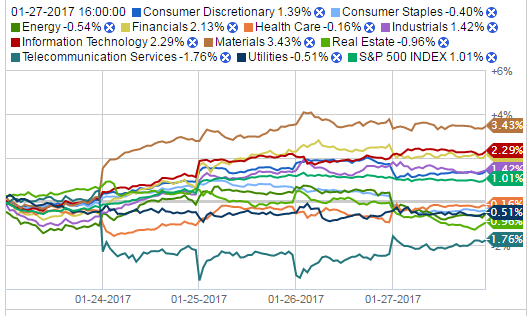

The largest S&P sector gains last week were seen in the materials sector, which increased 3.43%. Information technology grew 2.29%; and industrials gained 1.42%.

Source: Fidelity.com

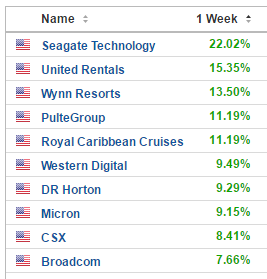

Despite the positive overall sector performances, none of the top ten individual performers were materials companies and just one industrial sector stalwart made the list:

United Rentals (NYSE:URI), which provides construction and industrial equipment rentals as well as homeowner equipment and tool rentals, rose 15.35% after announcing Q4 2016 EPS of $2.67, 82% more than the expected $1.46.

Four tech companies made the top ten:

Data storage solutions provider Seagate (NASDAQ:STX) rose 22% last week after posting Q2 2017 earnings per share of $1.38, beating expectations by more than 30%.

Its rival, Western Digital (NASDAQ:WDC) gained 9.49% on the week, after reporting Q2 2017 earnings of $2.30, beating expectations by 10.5%.

A third memory device manufacturer, Micron (NASDAQ:MU), rose 9.15 last week. Collectively, Seagate, Western Digital, and Micron are all in "the sweet spot up" for investors according to CNBC's Jim Cramer.

Semiconductor company, Broadcom (NASDAQ:AVGO) rose 7.66% on the week.

In hospitality/tourism, Royal Caribbean Cruises (NYSE:RCL) and Wynn Resorts (NASDAQ:WYNN) gained 11.19% and 13.5% respectively. RCL reported Q4 2016 EPS of $1.23, beating expectations by nearly 40%. Wynn actually missed Q4 earnings expectations by 40%, with EPS of $0.50, but shares rose nevertheless on signs that the company’s new Wynn Palace in Macau is paying off.

Despite the S&P Real Estate Index dropping 0.96%, on the news of the decline in both existing and new home sales in December, two homebuilders were among the S&P’s biggest gainers: PulteGroup (NYSE:PHM) and DR Horton (NYSE:DHI) rose 11.19% and 9.29% respectively, as orders rose 14.6% in the quarter ending December 31.

Railroad CSX (NASDAQ:CSX) rounded out the week's top ten, jumping 9.41% after holding the #1gainer position on the S&P the week before.

Biggest Losers Last Week

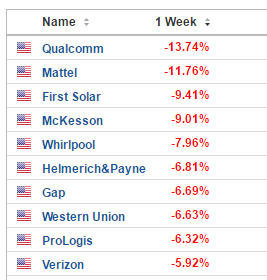

Telecom was the S&P’s worst-performing sector, falling 1.76%. This was due in large part to Verizon (NYSE:VZ), which reported Q4 2016 earnings per share of $0.86, missing expectations by 14%.

The S&P 500 Consumer Discretionary Index gained 1.39% last week, but three components were among last week’s biggest losers: Toy maker Mattel (NASDAQ:MAT) lost 11.76%; home appliance manufacturer Whirlpool (NYSE:WHR) fell 7.96%; and clothing retailer Gap (NYSE:GPS) declined 6.69%.

Leading REITs lower was ProLogis (NYSE:PLD). The company announced Q4 2016 EPS of $0.82, beating expectations by a whopping 300%. Nevertheless, shares fell 6.32%, pulled down in part due to the negative home sales reports.

Helmerich & Payne (NYSE:HP), an oil and gas contract driller, lost 6.81% last week after posting Q1 2017 earnings per share losses of $0.41.

Western Union (NYSE:WU) shares declined 6.63% after the company agreed to pay $586M to settle money laundering allegations.

Big Pharma company McKesson (NYSE:MCK) fell 9.01% after posting Q3 2017 EPS of $3.05, less than the expected $3.16.

Perhaps due to Trump’s focus on oil and gas as opposed to renewable energy, shares of First Solar (NASDAQ:FSLR) fell 9.41%.

And finally, Qualcomm (NASDAQ:QCOM) took the biggest hit on the week, on pressure from an Apple (NASDAQ:AAPL) lawsuit alleging unfair royalty charges. The stock fell 13.74%.

The Week Ahead

Politics and earnings will likely once again be major market drivers. President Trump is expected to continue the torrid pace he set during his first full week in office. At the same time, earnings reports will continue, as approximately 20% of S&P 500 companies are scheduled to report, including three of the world’s largest companies, Apple, ExxonMobil (NYSE:XOM), and Facebook (NASDAQ:FB).

There's a full economic calendar, as well:

- US Pending Home Sales and the Bank of Japan interest rate decision on Monday

- Fed interest rate decision on Monday, as traders await confirmation of the FOMC’s continued hawkishness

- Nonfarm Payrolls on Friday, with an expected jobs increase of 170K