by Pinchas Cohen

The Week That Was

- Global growth leadership change

- Equity and bond investors tug-of-war

- Merkel distances herself from the UK and US

- US quits Paris Accord, widening the rift with Europe

- Draghi steadfast on stimulus

- UK PM Theresa May losing momentum in polls

The tug-of-war between equity and bond investors regarding whether global economic growth can absorb higher interest rates is intensifying. Trump reflation was unable to push global stocks beyond their March highs, where they sat till late May, when Fedspeak, combined with China's 'One Belt, One Road' summit—during which China launched a global infrastructure plan that stole Trump’s thunder—pushed markets higher, in some cases to new all-time highs.

However, while China’s summit may have provided a boost to global equities, the country's own economy has been showing signs of slowing down, with private economic data calling into question the validity of government releases. Even before latest bearish manufacturing PMI data converged from the government's rosier version, we questioned whether there's a global growth leadership change in process, from China to Europe.

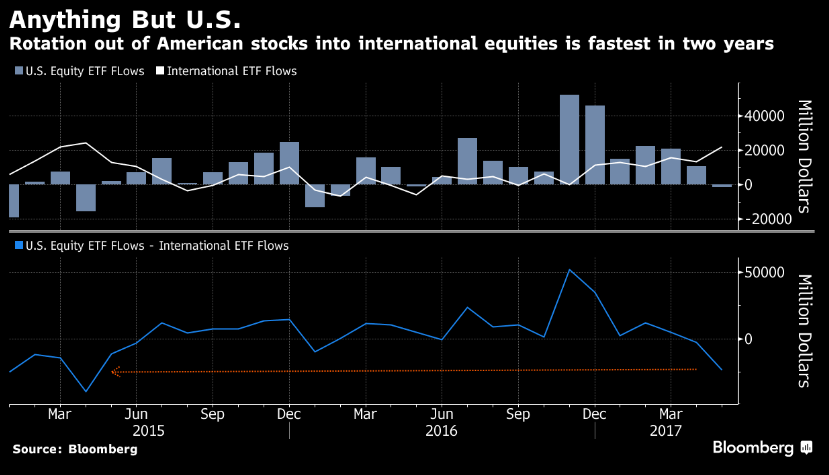

Of particular concern, while the S&P 500, Dow and NASDAQ all closed at all-time highs this past week, there are growing signs of a US economic slowdown, in particular a weaker than expected nonfarm payrolls report this past Friday, and investors are rotating from US stocks to anywhere but, at the fastest pace in two years, amid growing signs of a European economic strength. Moreover, bears are getting aggressive, increasing short positions in three of the past four months.

US Capital Flight

The record-breaking climb in US stocks last week, led by telecom companies and materials producers, added 1 percent to the S&P 500 and 0.6% for the Dow Jones Industrial Average. This puts US benchmarks at just under a 2 percent advance since March peaks.

This also marks one of the shallowest advances since Trump Reflation, suggesting even equity investors—whose focus is on reflation, as opposed to bond investors who aren't accumulating long-term debt if they believe higher interest rates are around the corner—are dragging their feet.

Safe Havens Rise

Despite the record-breaking headlines, safe-haven assets have been the beneficiaries of capital flight. Gold reached its highest level since April 24, with the previous peak from mid-April firmly in its crosshairs. If the yellow metal reaches $1,300, it will have realigned itself with its uptrend line since December.

Similarly, the Japanese yen reached the highest close since that same April 24. Are we seeing a pattern here?

U.S. 10-year Treasury yields reached their lowest point since November 10, the second day of the post-election Trump Reflation.

The Week Ahead

- UK Election: May to lose gamble or will terror help her out

- ECB to provide guidance on monetary shift

- Australian interest rates, as Aussie on the skids amid potential China slowdown

- Brown-Forman expected to decline by 5%

UK Prime Minister Theresa May is the second consecutive PM, after David Cameron, to feel confident enough to take a crucial political gamble. Cameron, who was a Prime Minister with high approval ratings, staked his career on what turned out to be the ill-fated Brexit referendum; May has damaged her approval ratings and possibly her legitimacy on the presumption a snap election will gain her more support. Will it all blow up in her face? Britain heads to the polls on Thursday, June 8.

When May first called for the snap election, in early April, the pound broke out of its six-and-a-half-month narrow, depressed range in which it had been trading following the October flash crash, on the display of strength by the British leader.

Since then, May's standing has gone from one of being on the offensive, in order to gain more Parliamentary seats, to being on the defensive, as she tries to keep the seats she already has. Last night's London terror attack that killed seven and injured dozens may, ironically, be the help May needs.

Mario Draghi was clear in Madrid on May 24, and clearer still when he addressed European lawmakers in Brussels on May 29 that:

“Overall we remain firmly convinced that an extraordinary amount of monetary support is still necessary, in spite of growing economic recovery."

So, although the ECB is highly unlikely to change rates at its upcoming Tallinn meeting later this week, rising economic conditions may lead to a discussion about exiting monetary stimulus. That would really stir things up, and it just might be what the euro needs to breakout of the 1.1500 resistance it couldn’t clear through since the beginning of 2015.

Warren Buffet auctions himself off for a meal. Last year the winning bid was close $3.5 million. Proceeds go to charity.

ECB, India and Australia decide on interest rates.

Monday

Economists expect the Institute of Supply Management to report at 10:00 EDT that US services industries expanded at roughly the same pace as that of the previous month. After the recent string of data pointing at an economic slowdown in the US, perhaps just meeting expectations could send the dollar and US equities higher.

South Korean President Moon Jae-in’s choice to lead the Fair-Trade Commission, chaebol (the Korean term for family-run conglomerates) reform activist Kim Sang-jo, will face questions at a parliamentary hearing. Why would that matter? The South Korean won has been looking for an excuse to break out of the tight trading base it's been in this year. Approval of the President's man could be the catalyst.

Apple's (NASDAQ:AAPL) Worldwide Developers Conference begins in San Jose and runs through June 9. CEO Tim Cook will deliver the keynote address, unveiling software updates and potentially new hardware products. Wonder if there will be any hints about the iPhone 8...10:00 local time (13:00 EDT).

US Services PMI for May will be released at 10:00 EDT. The previous read was 54.0. Labor Market Conditions are expected to decline from 3.5 to 3. Factory orders are expected to remain at 0.2%. Productivity is expected to rise from negative 0.6% to negative 0.2%. Labor costs are expected to decline (positive) from 3% to 2.4%.

Tuesday

The Reserve Bank of Australia is expected to keep its benchmark interest rate at a record-low 1.5 percent when it announces its policy decision at 14:30 in Sydney (00:30 EDT). The Aussie dollar may decline, if China’s economy continues to contracts since it's Australia’s biggest trading partner.

Business Roundtable releases its second quarter 2017 CEO Economic Outlook Survey. The survey of U.S. chief executives will detail corporate plans for capital spending, sales and employment for the next six months and their expectations for 2017 GDP. JPMorgan Chase & Co (NYSE:JPM) CEO Jamie Dimon, chairman of the Roundtable, will speak on a conference call. In Washington, at 10:30 EDT. After a strengthening case for an economic slowdown and record equity highs with weak internals, this event is important.

General Motors' (NYSE:GM) shareholder meeting will feature a proxy fight for board representation. Activist investor David Einhorn, president of Greenlight Capital LLC has submitted proposals that would create a dual class of common stock and replace three of the 11 board members. In Detroit at 09:30 EDT. If the shareholders win, the stock will likely jump, since it would send a clear message to management to optimize the company’s capital structure and lower costs, after GM management dismissed the plan, which was created byEinhorn.

Dave & Buster’s Entertainment (NASDAQ:PLAY) reports earnings after the close. The stock hit yet another all-time high on Friday, and Wall Street’s appetite is for another quarter of double-digit growth. Expectations are for a revenues of $299.85 million. That would make it a 14.5% advance YoY.

JOLTS Job Openings, released at 10:00 EDT, is expected to have grown by 5738, after the prior month's 5743.

American Petroleum Institute's weekly oil inventory report , EIA short-term energy outlook report.

Wednesday

OECD (Organization for Economic Co-operation and Development) publishes its Economic Outlook 2017 at 10:30 in Paris (04:30 EDT). Will this year's outlook confirm that China and the US are slowing down while Europe is expanding?

Jack Daniel’s whiskey maker Brown Forman (NYSE:BFb) earnings call will take place before the bell, at 8:00 EDT. Earnings will be released at 10:00 EDT. EPS are expected to decline by 5% in fiscal 4Q, reflecting recent brand divestment, lingering weak emerging-market demand and negative currency-exchange translation.

Mortgage Applications are reported at 7:00AM. Prior growth was negative 3.4%.

The US Energy Information Administration (EIA) reports weekly crude oil inventories.

Thursday

The ECB releases its policy decision. It’s a forgone conclusion that monetary policy will remain on course but investors are looking for any shift on guidance, following the recent economic growth. 8:30 EDT.

UK General Election. The gap between Labour candidate Jeremy Corbyn and PM Theresa May has narrowed, in what may turn out to be a foolish gamble on PM May's part to gain more strength for her version of Brexit.

Former FBI Director James Comey will testify before the Senate Intelligence Committee about his dismissal by President Donald Trump and ongoing investigations into the Trump administration’s contacts with Russia, in Washington at 10:00 EDT.

Chinese President Xi Jinping will attend the annual Shanghai Cooperation Organization summit in Astana, Kazakhstan. China has said it looks forward to “the early accession” of India and Pakistan to the SCO as full members so that they can work with existing members to contribute to the security and common prosperity of the region. Through June 9. China is taking advantage of rising isolationism in the US to increase its global influence.

Bank of Canada Governor Stephen Poloz and Senior Deputy Governor Carolyn Wilkins hold a press conference in Ottawa at 11:15 EDT to discuss the contents of the Financial System Review. The review, published twice a year, provides details of developments in the financial system and an analysis of policy directions in the financial sector. Released at 10:30 in Ottawa.

US weekly initial jobless claims will released at 8:30 EDT. Initial claims are expected to come in at 240K, down 8K from last week; continuing claims are expected to rise from 1915K to 1920K.

EIA's weekly natural gas storage report, U.S. Department of Agriculture weekly net export sales (weekly), Singapore's weekly oil-product stockpile data, China energy and commodities trade data (May prelim.) are all scheduled to be released.

Friday

Germany’s biggest opposition force, the anti-capitalist, anti-NATO Left Party, meets for a three-day convention to approve a platform for the national election in September. Beginning at 15:00 in Hanover (09:00 EDT). Any gain in popular approval for this group will hit the euro.

US Wholesale Inventories released at 10:00. Expected to remain flat at negative 0.3%.

The Commodity Futures Trading Commission releases their weekly report on futures and options positions; Baker Hughes U.S. Weekly Rig Count; U.S. Department of Agriculture WASDE grains and oilseeds report (June).