Market Brief

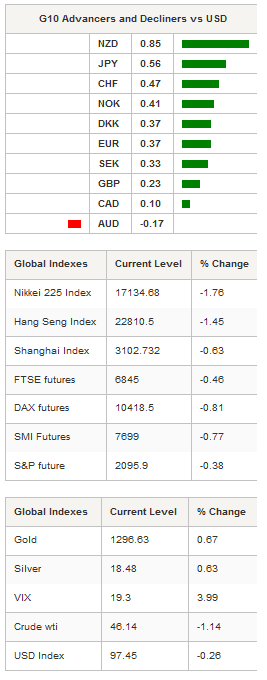

The US dollar extended losses on Wednesday amid uncertainty regarding the outcome of the US election. Following recent development in Hillary’s emails story, uncertainty regarding the outcome of the US election has increased again. Looking at the equity and FX markets, global investors did not welcome the news. After falling 0.70% on Tuesday, the dollar index fell another 0.10% in Tokyo as it hit 97.61.

The greenback was down 0.12% against the single currency, 0.21% against the Swedish krona and 0.10% against the NOK. Safe haven currencies stood out as the best performers in overnight trading as investors fled risky assets. The Swiss franc and Japanese yen rose 0.30% against the dollar in overnight trading. USD/JPY slid 1.50% over the last two day, falling from 105.10 to 103.55, as traders took shelter in the Japanese currency ahead of next week US election.

The Swiss franc was in strong demand yesterday as uncertainty reached a new peak. EUR/CHF tumbled roughly 1% over the last 24 hours, moving below the key 1.08 threshold, which would most likely prompt SNB intervention. CHF also strengthened substantially against the USD, with USD/CHF falling below 0.97 for the first time since early October. On the downside, the currency pair is getting closer to the key support that stands at around 0.9650 (low from early October).

Nevertheless, the best performer within the G10 complex was the New Zealand dollar that got a fresh boost yesterday evening amid better-than-expected job report. Indeed, the unemployment rate fell to 4.9% - the lowest level since 1Q 2009 - in the third quarter (versus 5.1% consensus), while previous quarter’s figure was downwardly revised to 5%. NZD/USD rose 0.85% to 0.7245 and is on its way to test the next resistance that lies at 0.7266 (high from October 20th).

On the downside, the closest support stands at 0.7110 (multi lows). On the medium-term, the kiwi is still trading within its multi-month uptrend channel, even though it tried several time to escape the channel to the downside. For now, the positive momentum is still there.

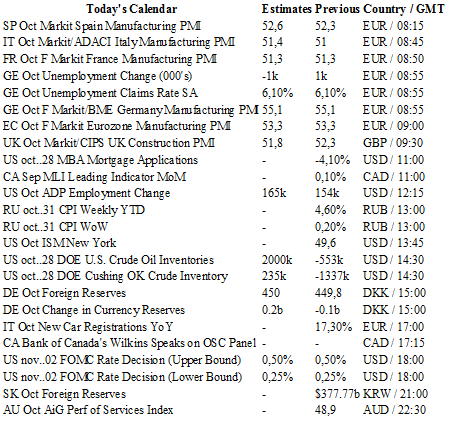

In the equity market, the global sell-off geared up on Wednesday as investors dumped risky assets as uncertainty rose another notch. Asian equities fell across the board with the Nikkei down 1.76%, while the Shanghai Composite slid 0.63%. In Europe, equity futures are broadly trading in negative territory with the Footsie and DAX down 0.39% and 0.79% respectively. Finally, US futures are also blinking red on the screen as S&P 500 futures were down 0.38% and the Dow Jones fell 1.13%.

Currency Tech

EUR/USD

R 2: 1.1352

R 1: 1.1210

CURRENT: 1.1096

S 1: 1.0822

S 2: 1.0711

GBP/USD

R 2: 1.2857

R 1: 1.2477

CURRENT: 1.2267

S 1: 1.2083

S 2: 1.1841

USD/JPY

R 2: 111.45

R 1: 107.49

CURRENT: 103.56

S 1: 102.80

S 2: 100.09

USD/CHF

R 2: 1.0093

R 1: 0.9999

CURRENT: 0.9707

S 1: 0.9843

S 2: 0.9632