Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Market Brief

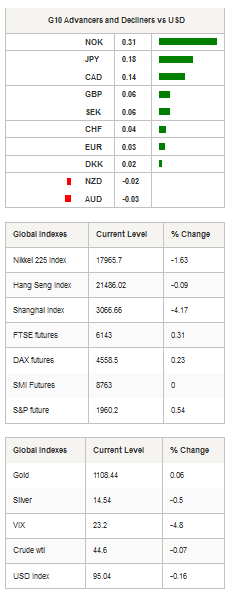

Heading into Thursday’s long-awaited FOMC meeting, the sentiment in USD remains comfortably negative as investors expect the central bank to remain on hold amid concerns about global growth. The dollar index is down 0.60% to 95.11 since Friday and the negative trend gaining momentum. The index broke the 95.19 resistance earlier this morning and is moving towards the next one standing at 92.62 (low from August 24).

EUR/USD hit 1.1359 during the late Asian session, this is the pair’s highest since August 24 and there is still some opportunity to buy the rally before the FOMC meeting. The single currency is about to test the resistance at 1.1368 (Fibonacci 38.2% on July-August rally), while on the downside, a support can be found at 1.1262 (Fibo 50%).

EUR/CHF is taking a breather after last week’s strong performance. The single currency at one point peaked above the key level of 1.10, reaching 1.1050, before returning quickly below as traders are still not used to seeing EUR/CHF above 1.10. However, we expect buying pressures to remain strong as negative interest in Switzerland, together with encouraging economic data from the euro zone, will renew interest in short positions in the CHF.

In Asia, Chinese mainland shares are off on Monday despite encouraging data for the month of August. Retail sales grew 10.8%y/y compared to 10.6% consensus and 10.5% in July while industrial production missed consensus estimates by 0.4%, printing at 6.1%y/y versus 6.5% expected but beating previous month reading of 6%. The Shanghai Composite is down -4.17% while in Shenzhen shares are heavily sold-off, down 6.90%.

In Japan, disappointing data weighs on the stock market. Industrial production came in on the soft side, printing at -0.8%m/m in July from -0.6% first estimate while July’s tertiary industry activity index was released in line with expectations at 0.2%m/m, below previous month reading of 0.3%. Finally, capacity utilization came in at -0.2%m/m versus 0.7% in June. USD/JPY is treading water between 120 and 121.35 as traders await the Fed’s decision. The Nikkei 225 lost 1.63% and the TOPIX -1.20%. In Hong Kong, the Hang Seng retreated 0.12% while in South Korea the KOSPI fell 0.51%.

In Europe, equity futures are mixed this morning with the FTSE 250 and the CAC 40 trading in positive territory, up 0.31% and 0.23%, respectively. On the other hand, the DAX edges lower, down 0.23% while the SMI and Stoxx 50 are roughly flat. USD/CHF is reversing momentum ahead of the Fed’s meeting, down 1.57% from its peak from last week. The dollar will find a support at 0.9608 (Fib 38.2% on August-September rally), while on the upside, the high from September 9 will act as support (0.9824).

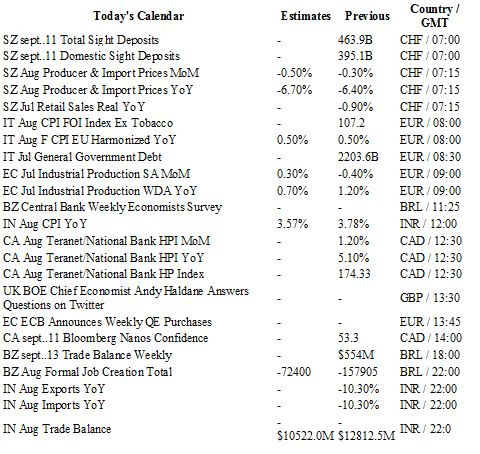

Today traders will be watching CPI from Italy; industrial production from euro zone; weekly trade balance from Brazil; import, export and trade balance from India.

Currency Tech

EUR/USD

R 2: 1.1714

R 1: 1.1438

CURRENT: 1.1348

S 1: 1.1017

S 2: 1.0809

GBP/USD

R 2: 1.5819

R 1: 1.5628

CURRENT: 1.5446

S 1: 1.5346

S 2: 1.5165

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 120.25

S 1: 118.61

S 2: 116.18

USD/CHF

R 2: 1.0240

R 1: 0.9903

CURRENT: 0.9696

S 1: 0.9513

S 2: 0.9259