Market Brief

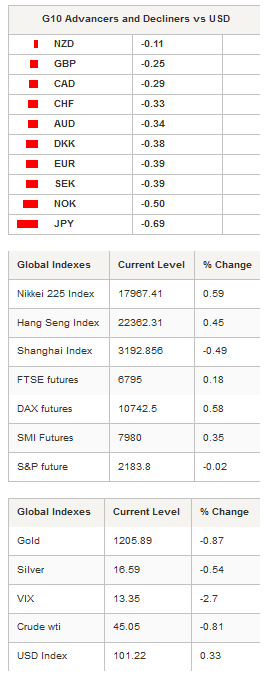

The Japanese yen continued its free-fall on Friday as risk sentiment continued to improve. USD/JPY rose another 0.60%, reaching 110.93 - the highest level since early June this year, in spite of lacklustre US inflation data. In October, headline inflation rose 1.6%, matching the median forecast, while the core gauge slightly missed expectations of 2.2%y/y, printing at 2.1%.

Overall, the data showed that the core gap between headline and core continued to close in as energy prices stabilised. Core inflation is still struggling to show some real gains as wage pressures remain subdued. However, if Trump does what he promised, we may see a fresh boost to inflation.

EUR/USD continued to fall and is now heading towards the next key support at 1.0524 (low from March 12th) as investors anticipate that the ECB will have no choice but to announce an extension of its quantitative easing programme beyond March 2017. Indeed, the October CPI report, which was released yesterday, showed no improvement on the inflation front, raising the probability of an ECB move at its December meeting.

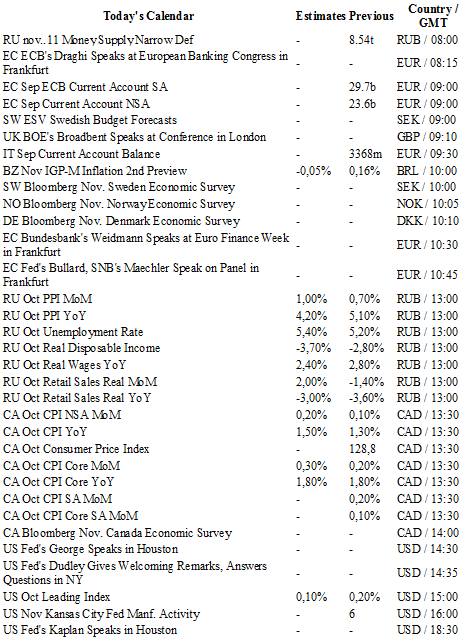

Mario Draghi is expected to speak today at the European Banking Congress which will be held just a couple weeks before the ECB meeting of December 8th. This would be an opportune platform to provide some hints about the potential modification of the QE programme; even though the ECB has always been reluctant to make announcements outside of the scheduled meetings. We are definitely bearish as next year’s EU political calendar is packed.

Asian equity returns were mixed this morning as mainland Chinese stocks extended losses, while Japanese equities moved higher. The Nikkei surged 0.59%, while the broader Topix index was up 0.38%. Hong Kong’s Hang Seng was up 0.37%, while Taiwan's TAIEX (HK:3089) rose 0.15%. In South Korea, the KOSPI was off 0.30%. In Europe, equity futures were broadly trading in positive territory with the DAX up 0.58%, the CAC +0.38% and the SMI 0.35%.

Today traders will be watching Mario Draghi’s speech at European Banking Congress; unemployment rate and retail sales from Russia; CPI from Canada; Leading index from the US.

Currency Tech

EUR/USD

R 2: 1.1259

R 1: 1.0954

CURRENT: 1.0590

S 1: 1.0524

S 2: 1.0458

GBP/USD

R 2: 1.2857

R 1: 1.2674

CURRENT: 1.2407

S 1: 1.2355

S 2: 1.2083

USD/JPY

R 2: 113.80

R 1: 111.45

CURRENT: 110.69

S 1: 106.14

S 2: 104.97

USD/CHF

R 2: 1.0328

R 1: 1.0257

CURRENT: 1.0111

S 1: 0.9632

S 2: 0.9537