SP 500, Nasdaq end at record highs

US stocks ended higher on Friday on strong quarterly results from technology giants. The dollar strengthened as Q3 GDP grew at above-expected 3%: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, added 0.3% to 94.88. S&P 500 gained 0.8% to record high 2581.07 led by technology shares, up 2.9%. The US broad market index added 0.2% for the week. Dow Jones industrial average added 0.1% to 23434.19. The NASDAQ Composite jumped 2.2% to all-time high 6629.05.

European stocks advance

European stocks closed higher on Friday with market sentiment supported by positive reports. The euro and British Pound extended losses against the dollar as Catalonia parliament declared independence and Madrid ousted Catalonia’s President Carles Puigdemont and dissolved his government. The Stoxx Europe 600 index ended the session up 0.6%, posting 0.9% gain for the week. The DAX 30 rose 0.6% to 13217.54. France’s CAC 40 outperformed gaining 0.7% and UK’s FTSE 100 added 0.3% to 7505.03. Indices opened mixed today.

Asian indices mixed

Asian stock indices are mixed today. Nikkei ended flat at 22011.67 with yen little changed against the dollar. Chinese stocks are lower on concerns about bond market: the Shanghai Composite Index is down 0.8% and Hong Kong’s Hang Seng Index is 0.2% lower. Australia’s ASX All Ordinaries is up 0.2% despite a stronger Australian dollar against the greenback.

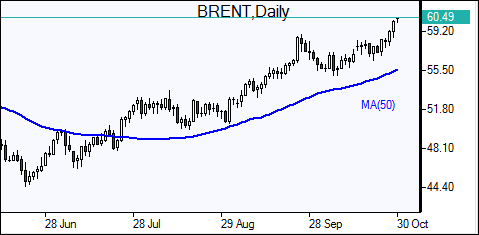

Oil rally continues

Oil futures prices are higher today on talk major producers’ production cut deal led by OPEC could be extended after March, current expiration date. Prices rose Friday: December Brent jumped 1.9% to $60.44 a barrel, gaining 4.7% for the week.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.