- The food industry is a major economic force, constantly adapting to new demands.

- AI and financial stability are helping key players stay ahead in a competitive market.

- With market shifts underway, some stocks may be primed for significant growth.

- Looking for more actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to ProPicks AI winners.

The food industry is inherently one of the key economic pillars for both developing and developed economies worldwide. The global value of this sector is projected to reach $7.4 trillion this year, with an expected upward trend in the coming years. A growing market, rising consumer demands, and increasing competition drive companies to focus on optimization, particularly in areas such as cost management, supply chains, and warehousing—all of which have been increasingly supported by the artificial intelligence revolution in recent years.

In general, companies in this sector are considered defensive, characterized by moderate revenue and earnings growth while demonstrating greater resilience to economic downturns. The recent discounting of U.S. stock indices has prompted investors to seek companies with attractive valuations and growth potential, making the consumer staples industry an interesting area to explore.

1. Ingredion Incorporated – Is the Stock Market Correction Over?

U.S.-based Ingredion Incorporated (NYSE:INGR) is a global leader in food and beverage ingredient supplies, operating in over 120 countries. The company's product portfolio is dominated by starches, sweeteners, and biomaterials. With a $50 million investment in its Cedar Rapids facility, Ingredion aims to strengthen its position in the starch market while continuing to expand its product portfolio.

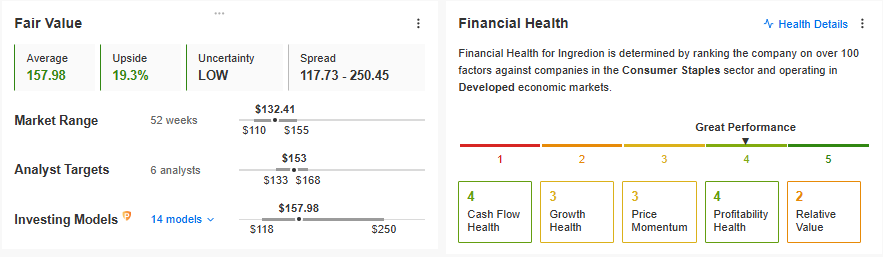

From a fundamental perspective, the company currently has an upside potential of nearly 20% based on fair value estimates. Additionally, Ingredion holds a high financial health rating, further reinforcing its stability.

Source: InvestingPro.

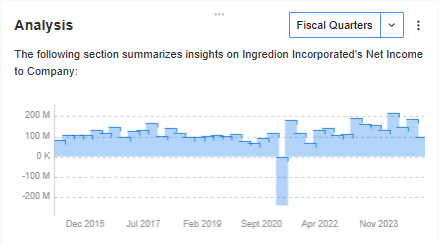

A look at long-term quarterly net profits reveals significant stability, except for a single quarter in 2021. This aligns with the company’s defensive and stable business model.

Source: InvestingPro.

If the current market correction stabilizes and the uptrend resumes, the fair value estimate suggests Ingredion's stock could reach new all-time highs.

2. Post Holdings – Over 20% Upside Potential

Post Holdings Inc (NYSE:POST) specializes in the distribution of consumer packaged goods. Similar to Ingredion, the company has a strong upside potential, which awaits confirmation from technical signals.

The stock has been moving within a long-term consolidation range between $105 and $126 per share, with the upper boundary marking its historical highs.

Currently, local support is holding in the $110 per share price area. If the stock manages to break upward, the next key target for buyers is the resistance level at $119 per share.

3. Nomad Foods – Struggling to Break Out of Consolidation

The final company on today’s list, Nomad Foods Ltd (NYSE:NOMD), is an American-British frozen food consortium. As the stock price rises, bulls are attempting to break through the upper boundary of a long-term consolidation zone near $20 per share.

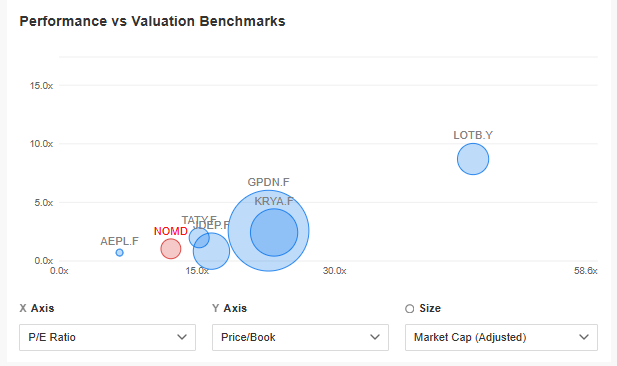

The primary reason for optimism is the company's highest fair value indication at 28%—the strongest among the group—as well as attractive price-to-earnings (P/E) and price-to-book (P/B) ratios compared to its competitors.

Source: InvestingPro.

If the upward breakout materializes, the next technical and fundamental price targets range between $24 and $25 per share.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.