-

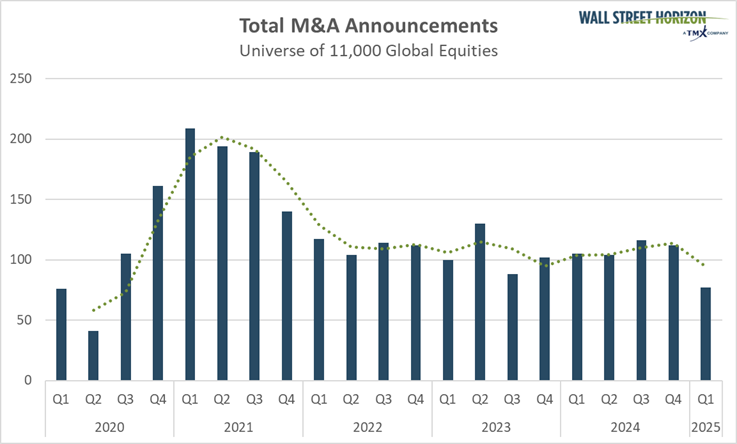

M&A activity is at its lowest since Q2 2020, with just 77 deals this quarter.

-

High interest rates and tough regulations are keeping dealmaking in check.

-

Yet, Google's $32B acquisition of Wiz proves big players are still making bold moves.

With only eight trading days left in the first quarter, M&A announcements are set to come in at their lowest level since Q2 2020. There have only been 77 M&A announcements in Q1 2025, compared to 112 last quarter and 105 in the same quarter one year ago. In Q2 2020, when the world was shut down due to the COVID-19 pandemic, there were only 41 M&A announcements.

Source: Wall Street Horizon. Note: we only include acquisitions made by publicly traded companies.

Let’s Make a Deal… or Not

Dealmaking has been more-or-less stagnant for the last three years, at least in part due to high interest rates and a tough regulatory environment. When President Trump was elected this past November, analysts predicted that dealmaking would open up again. At that time the Federal Reserve had just started to lower interest rates, starting with that jumbo 50 basis point cut in September, and signaled they intended to cut further in 2025. Lower rates make the cost of borrowing capital cheaper, and therefore tend to make deals more attractive to pursue. President Trump’s support of looser antitrust regulation was also anticipated to have a positive impact on M&A and IPO activity in the new year.

However, interest rates have remained elevated, as the progress on inflation seen in the last quarter of 2024 has been put on hold, forcing the Fed to say they were in no rush to lower rates any further. That may change however, as many of the economic indicators used by the Fed to make this decision are starting to weaken. At the FOMC meeting, the Central Bank held rates steady and indicated they still see two rate cuts coming in 2025. However, the Fed did downgrade their outlook for economic growth, now expecting the US economy to accelerate just 1.7% this year, vs. the prior estimate of 2.1% at their December meeting. They also increased their inflation projection for the year, now seeing core prices growing 2.8% in 2025, up from the prior estimate of 2.5%.

Complicating matters further, the US markets have been on a rollercoaster ride for the last several weeks, with the S&P 500 officially hitting correction territory last week when it closed down 10% from its record high on February 19. It is likely that investors are feeling uncertain about US trade policy with tariff implementations being announced and changed every few days, along with retaliatory tariffs being implemented from affected countries. This has also worried consumers who are feeling less certain about their jobs and purchasing power as tariffs would likely lead to higher inflation. The latest reading of the University of Michigan consumer sentiment shows the index falling to 57.9, the lowest reading since November 2022.

A Bright Spot - A Mag 7 Member Announces its Largest Acquisition Ever

Tuesday brought some positive M&A news when one of the Mag 7 announced their largest acquisition ever. Google (NASDAQ:GOOGL) announced they were acquiring New York-based cloud security startup Wiz for $32B in an all-cash deal. This comes after Wiz turned down a $23B offer from Google in July and announced they would pursue an IPO instead. This is Google's largest-ever acquisition and tops its $12.5B purchase of Motorola (NYSE:MSI) in 2021. Many are seeing this as the first big test for how the Trump administration will respond to Big Tech acquisitions, with the Justice Department under the Biden administration being notably staunch with regard to tech deals.

The Bottom Line

Companies interested in pursuing deals will be listening closely to Fed commentary in the weeks to come to understand where interest rates are heading. They’ll also be keeping tabs on the macroeconomic data coming in to make sure the economy remains steady before taking on further costs.

In our latest Later Earnings Report Index (LERI) reading, there were signs that corporations were feeling confident in Q1, but a lot has changed since those results were published in February, with more recently published measures of corporate sentiment showing a softening. The next reading on the LERI will be published on April 11 and should give more color on corporate confidence which would impact future dealmaking.

Original Post