S&P 500, Dow and NASDAQ close at records

US stocks closed at new record highs on Wednesday with tax reform Congressional deliberations in the focus. The dollar strengthened marginally: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, inched up to 94.87. The S&P 500 gained 0.1% to 2594.38 led by consumer staples and technology shares. The Dow Jones added less than 0.1% to fresh all-time high 23563.36. Nasdaq composite rose 0.3% to 6789.12.

Financial shares lead European stocks lower

European stocks continued retreating on Wednesday led by financial shares. The euro ended little changed against the dollar while the British Pound resumed the decline. The Stoxx Europe 600 closed lower less than 0.1%. Germany’s DAX 30 ended up less than 0.1% settling at 13382.42. France’s CAC 40 lost 0.2% while UK’s FTSE 100 added 0.2% to 7529.72. Indices opened lower today.

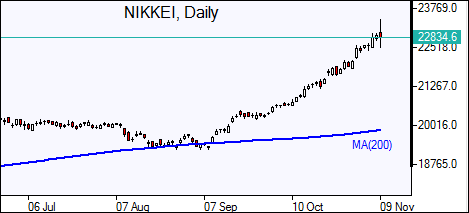

Higher Chinese inflation buoys Asian indices

Asian stock indices are mostly higher after upbeat Wall Street session overnight. Nikkei, however, fell 0.2% to 22868.71 as the yen resumed climbing against the dollar. Chinese stocks are higher buoyed by higher than expected October inflation report: the Shanghai Composite Index is up 0.4% and Hong Kong’s Hang Seng Index is 0.8% higher. Australia’s ASX All Ordinaries rose 0.5% despite Australian dollar’s continued gains against the greenback.

Oil steady as US crude inventories rise

Oil futures prices are steady today. Prices ended lower yesterday after the US Energy Information Administration reported domestic crude supplies rose by 2.2 million barrels last week. However, gasoline stockpiles fell 3.3 million barrels. Brent crude fell 0.3% to $63.49 a barrel on Wednesday.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.