Wednesday April 4: Five things the markets are talking about

Sino-US Trade fears

Investors trade fears are back with a bang as trade tension is again the markets central focus, with Asian and European equity bourses turning lower amid an escalation of protectionist rhetoric and action between China and the US.

Ahead of the US open, investors have piled into safe-haven assets (JPY, AUD, and Silver) as China unveiled retaliatory measures against US tariffs.

Beijing plans to levy a +25% tariff on soybeans, auto, and chemical products among +106 products.

Stateside, equities will open deep in the red, down close to -2%, while the ‘big’ dollar drifts with Treasury prices.

On Tap: Up next is US ADP non-farm employment change at 08:15 am EDT and US ISM non-manufacturing PMI at 10:00 am EDT and DoE crude oil inventories at 10:30 am EDT.

1. Stocks see red on retaliation to tariffs

Ahead of China’s tariff retaliation announcement, Japanese stocks edged higher on Wednesday in choppy trade as some automakers rose after they reported strong US sales numbers, helping to offset the impact of a stronger yen (¥106.19). The Nikkei added +0.1%, while the broader Topix rallied just shy of +0.1%.

Down-under, the Aussies S&P/ASX 200 added +0.2% on stronger than expected retail sales data (March +0.6% vs. +0.3% m/m), while in S. Korea, stocks hit a week’s low with the KOSPI down -1.4%. Tech giant, Samsung (KS:005930), dropped -2.5% to hit a fresh four-week low.

In China, stocks, which started steadily, ended, lower with benchmarks in Shanghai and Shenzhen down -0.2% and -0.6% respectively after Beijing said it would levy tariffs on soybeans, autos and chemical products.

In Hong-Kong, the Hang Seng declined late in the session and was last down -1.8% at a seven-week low.

In Europe, regional indices trade lower across the board tracking sharp declines in US futures as China’s levies reciprocal tariffs on US goods totaling +$50B.

US stocks are set to open deep in the ‘red’ (-2%)

Indices: STOXX 600 -0.7% at 366.4, FTSE -0.5% at 6998, DAX -1.2% at 11859, CAC 40 -0.6% at 5123, IBEX 35 -0.8% at 9480, FTSE MIB -0.8% at 22336, SMI -0.9% at 8558, S&P 500 Futures -2%

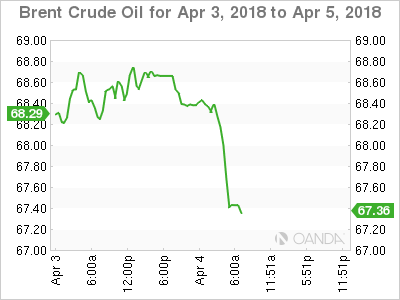

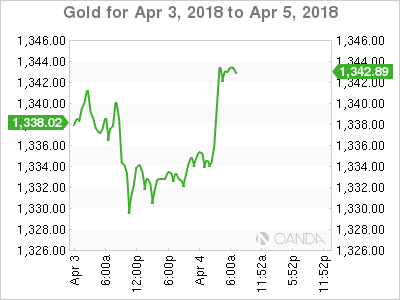

2. Oil inches lower on US crude stock build, gold higher

Oil prices have slipped a tad on market expectations for a build in US crude inventories. However, Russian comments on prospects for stepping up cooperation with OPEC to coordinate output cuts broke steeper declines.

Brent Crude have eased to +$67.94 per barrel, down -18c, or -0.26%, after it rallied +0.7% yesterday. US Crude Oil WTI Futures were at +$63.36 a barrel, down -15c, or -0.24%, from Tuesday’s close.

Investors are expected to take their cues from this morning’s DoE data at 10:30 am EDT. Market consensus is looking for a US crude inventory build for the second straight week, while refined product stockpiles are forecast to have declined last week.

Earlier this morning, Russian Energy Minister Alexander Novak said that a joint organization between OPEC and non-OPEC countries may be set up after the current deal on production cuts expires at the end of this year.

Note: Russia’s oil output rose last month to +10.97m bpd, up from +10.95m bpd in February.

The markets trade risk-off nature has pushed gold prices higher ahead of the open stateside. Spot gold has climbed +0.2% to +$1,336.04 an ounce.

3. Sovereign yields mixed results

US Treasury yields initially rallied overnight as stock markets firmed and as investors looked ahead to Friday’s closely watched US employment report for March. However, news that China would retaliate against Trumps tariffs initiative has changed the landscape with investors applying ‘risk-off’ trading strategies and buying short-term product.

The yield on 10-Year Treasuries declined -2 bps to +2.77%. In Germany, the 10-Year Bund yield has dipped -1 bps to +0.50%, the lowest in 12-weeks, while in the UK the 10-YearGilt yield fell -1 bps to +1.359%, the lowest in almost 11-weeks.

In Japan, longer-dated Japan Government Bond Futures’s prices gained overnight on steady investor demand for debt at the start of the new domestic fiscal year. Super-long (30-years+) Japan 30-Year yields fell to a new 16-month low amid demand from life insurers and pension funds who were purchasing product to balance their portfolios at the start of the fiscal year, which began April 1. The 30-year yield fell -0.5%.

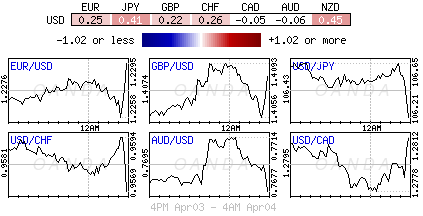

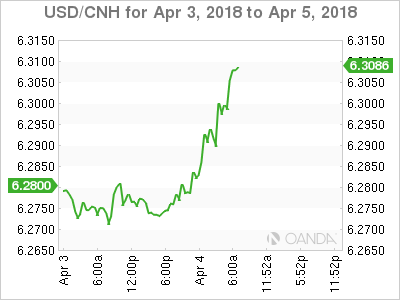

4. Dollar rallies vs. EM pairs

The ‘big’ dollar has added to its earlier gains versus currencies of big Asian exporting nations after China unveiled plans to levy tariffs on several US products.

USD has rallied as much as +0.8% vs. KRW following the move compared with its earlier gain of +0.4%. The dollar is up as much as +0.3% vs. CNH vs. its earlier advance of +0.2%. Meanwhile, the yen (¥106.13) – a safe haven asset – strengthened outright. For the yen, ¥105.50 remains a key level on the dollar downside.

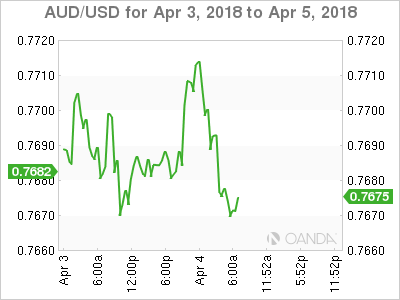

AUD too could not escape China’s retaliatory trade measures despite Aussie March retail sales beating expectations (+0.6% vs. +0.3%). The AUD is down -0.4% vs. EUR and -0.6% vs. JPY after China’s move to impose a tariff on 106 US products. AUD to remain under pressure as risk-off takes a firmer grip.

In Europe, EUR/USD began the session below the psychological €1.23 level as dealers noted that the EMU data had been disappointing recently. However, the escalation of trade tension is now weighing somewhat upon the greenback vs. G7 pairs. EUR gains were slightly eroded after the EU flash CPI (see below) came in-line, while core registered a miss.

GBP/USD (£1.4053) continues to lag in price action as March construction PMI contracted (see below) for the first time in six-months.

5. EU inflation ticks up, UK construction PMI falls

Data this morning showed that eurozone consumer prices picked up in March for the first time in four-months. The headline print should reinforce the ECB’s belief that they are on track to meet its inflation target over coming years.

Consumer prices for March were +1.4% higher than a year earlier, an increase from the +1.1% rate of inflation recorded in February. The less volatile core measure of inflation is expected to record a slower, but more encouraging climb. The measure has not been higher than +1.2% over the last five-years – the core rate of inflation was unchanged at +1.0% in March.

Note: Analysts expect today’s headline print to mark the start of a steady climb higher over coming months, and inflation may touch the ECB’s target later this year.

UK construction PMI falls sharply

UK data this morning showed that business activity in the UK’s construction sector dropped in March following five-months of marginal growth.

IHS Markit construction PMI fell to 47.0 in March, down from 51.4 a month earlier.

Digging deeper, the fastest pace decline in two-years was driven by the sharpest reduction in civil-engineering activity for five-years and a renewed fall in commercial work.