Monday March 27: Five things the markets are talking about

Investors are questioning Trump’s reflation trade now that the U.S healthcare reform bill failed to make it onto the ‘floor’ Friday.

Heightened political risk has the market worried that the GOP’s failure to get Friday’s bill across the finish line will inhibit other pro-business reform agenda items from the White House, namely tax reform and fiscal spending measures.

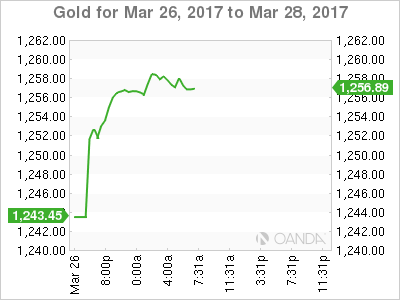

Risk aversion has the dollar printing four-month lows outright, global equities and yields extending Friday’s slide and the go-to safe haven asset, gold, rallying more that $17 overnight.

Will this rift between Trump and GOP congressional leadership still widen? There is a very good chance of this happening making Trump a ‘lame duck’ in his first 100 days in the White house.

Note: Trump has promised to lower individual middle class taxes, while House leaders view tax reform as a catalyst for growth and could prioritize tax cuts for the top +1%.

Elsewhere, it’s a heavy week on the data front. Japan releases its key monthly statistics for February including retail sales and household spending, unemployment, consumer prices and industrial production.

France and Germany post consumer-spending data. Both the U.K and U.S report final estimates of Q4 GDP, while U.K’s PM Theresa May is expected to formally begin divorce proceedings and trigger Article 50 to begin two-years of negotiations on her country’s exit from the E.U.

1. Global stocks stumble on U.S policy woes

Trump’s failure on healthcare reform is raising questions about his ability to push through tax cuts and fiscal spending to boost the U.S economy.

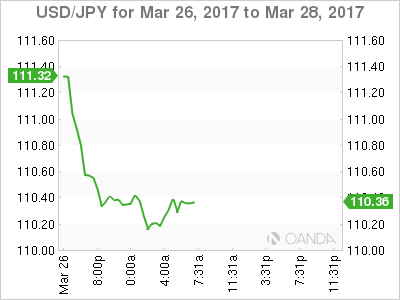

In Japan, the Nikkei's share average fell -1.4% overnight, trading atop its six-week low, adding to last week’s -1.3% loss, on pressure from a resurgent yen (¥111.19). The broader Topix was down -1.3%.

In Hong-Kong, China developers have dragged down HK shares after fresh property curbs, offsetting data showing strong profit growth for industrial companies early in the year. The Hang Seng index fell -0.7%, while the China Enterprises Index lost -1.1%.

In China, stocks slipped as tightening worries have offset strong industrial profits. The blue-chip CSI 300 index fell -0.3%, while the Shanghai Composite Index shed -0.1%.

In Europe, equity indices are trading sharply lower. Banking stocks see red on the Eurostoxx, while commodity and mining stocks trading notably lower on the FTSE 100.

U.S stocks futures are to open deep in the red (-0.9%).

Indices: Stoxx50 -0.5% at 3,426, FTSE -0.8% at 7,280, DAX -0.8% at 11,967, CAC 40 -0.5% at 4,996, IBEX 35 -0.6% at 10,246, FTSE MIB -0.8% at 20,024, SMI -0.6 % at 8,561, S&P 500 Futures -0.9%

2. Liquid gold prices falter, hard gold prices rally

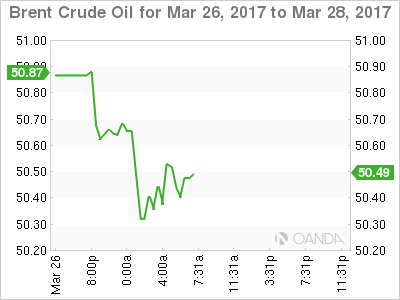

Oil prices start the week on the back foot, pressured by uncertainty over whether an OPEC-led production cut will be extended beyond June in an effort to counter the global glut of crude.

On the weekend, an OPEC and non-OPEC Joint Compliance Committee agreed to review whether oil output cuts should be extended by six-months. They stopped short of an earlier draft statement that said the committee recommended keeping the Nov. measure in place.

Also providing price pressures is the weekly Baker Hughes U.S Rig Count: 809 vs. 789, w/w (+2.5%) – the tenth consecutive weekly rise and the largest weekly increase since Jan.

Brent crude futures are down -19c at +$50.61, while West Texas Intermediate (WTI) is down -31c at +$47.66.

Gold has rallied more than +1% overnight, touching a one-month peak as the dollar plunges and stocks fall as POTUS suffered another setback, raising doubts about his ability to steer his economic agenda.

Spot gold has rallied to +$1,258 per ounce after hitting +$1,259.14, its highest since Feb. 27.

3. Global yields fall on questionable Trump

Borrowing costs across the globe have fallen sharply overnight, as investors question Trump’s ability to push through tax cuts and fiscal spending to boost the U.S economy.

Bond yields in Germany (10-Year Bunds +0.36%) and France (10-Year OATS +0.93%) have fallen to their lowest levels in around three-weeks, while other single currency bloc yields tumbled -6 bps as U.S 10-year Treasury yields hit a one-month low (+2.35%).

Note: Since Nov. U.S election, expectations that a large fiscal stimulus from Trump’s administration would help push up economic growth and inflation had boosted risk assets and dented safe-haven bonds in the U.S and Europe.

Elsewhere, Spanish yields fell to a one-month low at +1.64%, while Portugal's fell to more than two-month lows at +3.79%. Down-under, the yield on Australia 10-Year bonds slid -4 bps to +2.71%.

4. Fear of Trumponomics hammers dollar

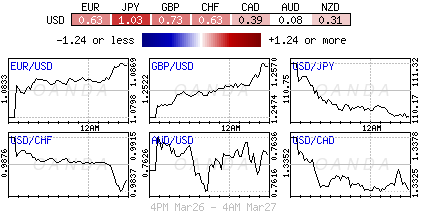

The “mighty” dollar remains on the back foot against its G10 peers due to rising doubts about Trumponomics.

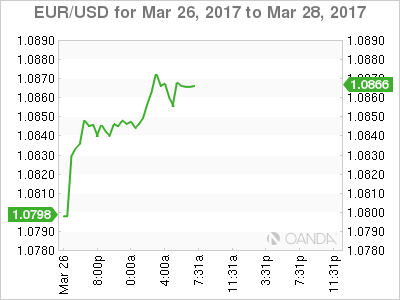

In overnight trade, the EUR/USD has gained +0.7% to a five-month high €1.0875. Also helping the ‘single’ unit Euro was Chancellor Merkel’s CDU weekend victory in a local election in the German state of Saarland. Also providing support was Germany’s IFO survey (see below) for March printing a seven-year high.

Note: The election weakened hopes that the SPD and its new leader Schulz would be aiming for easy victories in the upcoming state elections of North-Rhine Westphalia and Schleswig Holstein ahead of the German General Election in September.

Elsewhere, the pound has jumped +0.8% to its highest print in nearly two- months at £1.2581. USD/JPY has also dropped more than -1% to a four-month low ¥110.14. ”

Expect North America to play catch up, especially now that long dollar’ trades are currently seen unwinding in both the Asia and the European session.

5. Germany’s Mar IFO Business Climate near 7-year highs

Data in Germany this morning indicates that business morale is high, which suggests that company executives in Europe’s largest economy are brushing off concerns about the threat of rising protectionism and Germany’s own election issues.

Ifo business climate index rose to 112.3 from an upwardly revised reading of 111.1 in Feb. The rise was driven by improved sentiment in manufacturing, construction and retailing, while the business climate in wholesaling deteriorated.

Note: Today’s release follows Friday’s PMI print that showed Germany’s private sector growing at the fastest pace in nearly six-years this month, driven mainly by strong demand for manufactured goods from the U.S, China, U.K, and the Middle East.