Tuesday May 22: Five things the markets are talking about

Markets traded mixed overnight, with global equities drifting and a number of risk currencies finding support as investors digest easing trade tensions and the latest comments from a plethora of central bank members.

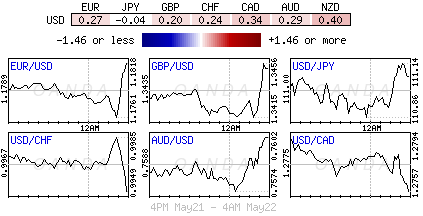

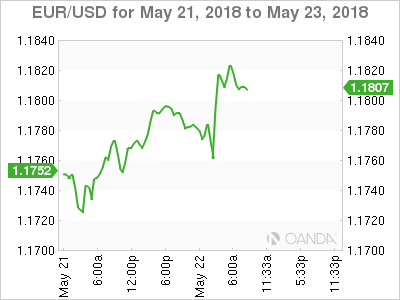

The EUR (€1.1809) has found some traction as Italian bonds recover from a two-session slide as the market focuses on whether Italy’s president will veto the populist coalition’s plans to form a government. The pound (£1.3465) is rallying amid speculation over another UK election.

On the geopolitical front, US President Donald Trump meets South Korean President Moon Jae-in in Washington to coordinate their approach to North Korea, while Brexit negotiations are ongoing.

The Federal Reserve releases minutes of the central banks May 1-2 meeting tomorrow and a slew of US debt sales this week is expected to dominate proceedings.

1. Stocks mixed results

In Japan, stocks edged lower overnight, backing away from their four-year high print yesterday, with financial shares leading declines as investors booked profits on signs of an apparent peak in US bond yields. Both the Nikkei and broader TOPIX ended -0.2% lower, weighed down by financial shares.

Down-under, Aussie shares tumbled to a three-week low on Tuesday, led by banks following admissions of misconduct. The S&P/ASX 200 index fell -0.7%.

Note: South Korea and Hong Kong exchanges were closed for holidays.

In China, Shanghai stocks erased early losses to end flat overnight, amid signs of easing trade tensions, after the US and China are said to be nearing a deal to settle ZTE (HK:0763) controversy. The blue-chip CSI 300 fell -0.4%, while the Shanghai Composite Index ended flat.

In Europe, markets opened higher and have remained positive. Equities are catching up after the extended weekend. Higher oil prices is supporting the energy sector, while automakers are supported as China is said to cut import duty for cars.

US stocks are set to open in the ‘black’ (+0.2%).

Indices: STOXX 50 +0.2% at 3,580, FTSE 100 +0.2% at 7,875, DAX +0.2% at 13,094, CAC 40 flat at 5,636; IBEX 35 +0.5% at 10,119, FTSE MIB +0.6% at 23,229, SMI +0.1% at 8,951, S&P 500 Futures +0.2%

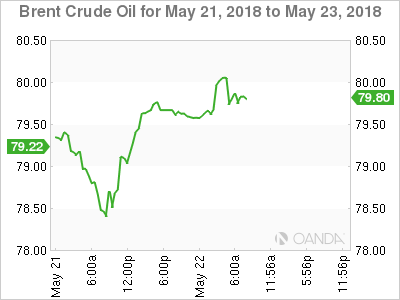

2. Oil prices firm on supply worries, gold lower

Oil prices have rallied overnight on concerns that Venezuela’s crude output could drop further following a disputed presidential election and potential US sanctions on the OPEC-member.

Brent crude futures are at +$79.37 per barrel, up +15c, or +0.2%, from their last close.

Note: Brent broke through $80 for the first time since November 2014 last week.

US West Texas Intermediate (WTI) crude futures are at +$72.45 a barrel, up +21c, or nearly +0.3%.

The US has also toughened its stance on Iran, which could further curb the country’s crude oil exports and boost oil prices. They have demanded Iran make sweeping changes – from dropping its nuclear program to pulling out of the Syrian civil war – or face severe economic sanctions.

Note: Growing production of US shale oil could curb oil prices eventually and widen the price spread between WTI and Brent crude oil.

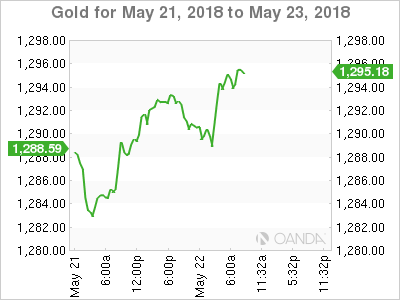

Ahead of the US open, gold prices have dipped slightly, hovering atop of this year’s low print in yesterday’s session as a firm US dollar nears its five-month highs and optimism in global markets curbed appetite for the precious metal. Spot gold is down -0.2% at +$1,290 per ounce. On Monday, it slid to +$1,281.76, its lowest since December, 2017. US gold futures, for June delivery slipped -0.1% to +$1289.8 per ounce.

3. Italian bond yields off highs after heavy selling

Italian government bond yields (BTP’s) have backed off from their 14-month highs as the market takes a breather after six days of heavy selling on concerns over the high-spending policies proposed by the 5-Star/League coalition in the eurozone’s third-largest economy.

Note: The likelihood of a coalition has pushed Italian 10-year yields up nearly +70 bps in May.

Ahead of the US open, Italy’s 10-year government bond yield has eased -2.5 bps to +2.31%, well below the 14-month high of +2.418% hit in earlier trade.

Note: The Italy/Germany 10-year bond yield spread hit +189.6 bps before settling at 182 bps.

Elsewhere, the yield on 10-year Treasuries increased +1 bps to +3.07%. In Germany, the 10-year Bund yield advanced +4 bps to +0.56%, the largest rise in more than a week, while in the UK, the 10-year yield advanced +4 bps to +1.517%.

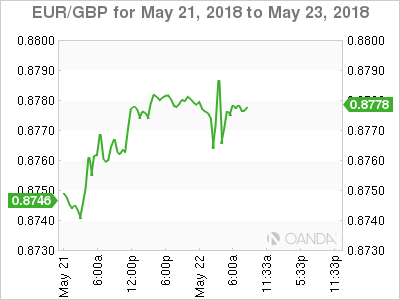

4. EUR may reverse losses if BTP-Bund spread narrows

The USD is consolidating just above its five-month highs, stalling as a higher US yield trend comes under pressure.

The dollar is reversing early gains versus the EUR and now trades lower, with EUR/USD up +0.3% at €1.1827. However, the market remains cautious on the Italian political situation. Italian President seems to be hesitant in confirming the proposed PM due to his lack of political experience.

USD/JPY is still flat at ¥111.02. Commodity currencies are also up against the dollar, with USD/CAD down -0.3% at C$1.2754 and AUD/USD up +0.3% at A$0.7604.

GBP/USD (£1.3473) has bounced back to approach the £1.35 handle. Hawkish rate outlook by BoE’s Vlieghe at his reappointment hearing is helping the pound recover. Vlieghe stated that he saw one to two rate hikes of +25 bps per year during the three-year policy horizon.

5. UK’s CBI – Manufacturing pauses for breath in May

According to the Confederation of British Industry’s latest monthly industrial trends survey, UK Manufacturing output was broadly unchanged in the three months to May and firms reported a further softening in order books (-3 vs. 2).

Digging deeper, the survey found that the volume of total order books fell to the lowest since November 2016, though orders remained above their long-run average.

Export order books held up better, having been broadly unchanged in recent months at a level that is also well above the historical average. Output was broadly unchanged in the quarter to May, the weakest performance since April 2016, but is expected to rebound over the next three months.

Note: Output grew in only 8 of the 17 sub-sectors, with the heaviest drag coming from the chemicals, and food, drink and tobacco, sectors.