Thursday 15 March: Five Things The Markets Are Talking About

Euro stocks are better bid despite an uncertain Asian session as the market assesses the implications of the latest personnel changes at the White House.

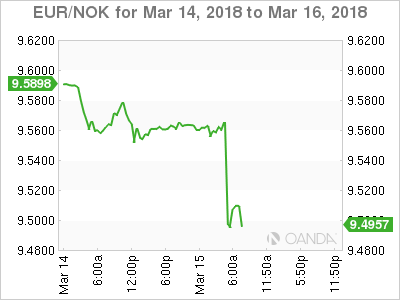

In currencies, the NOK (€9.4980) rallies +0.7% outright to a four-month high after Norges Bank’s interest rate decision, at which officials said there are chances of a “somewhat earlier” rate increase than seen in the previous report.

US Treasury yields continue to hover atop of last months low yields on market bets that the Fed will not signal quicker rate hikes when policy makers meet next week (March 20-21).

Elsewhere, crude oil is holding its gains as signs of stronger US fuel consumption is been balanced by OPEC’s forecasting. Bitcoin (BTC – $8,196) has touched its lowest level in four weeks.

On tap: EU – 27 government officials discuss the E.U’s Brexit position.

1. Stocks mixed bag

In Japan, the Nikkei share average eked out small gains overnight with the Bank of Japan (BoJ) buying up ETF’s, offsetting weakness in machinery makers. The Nikkei ended +0.1% higher, while the broader TOPIX was little changed.

Down-under, a -1% drop for Aussie banks helped keep the country’s stock benchmark in the red for a third session. The S&P/ASX 200 fell -0.2% even as the materials sector rose +0.6%. In South Korea, the KOSPI closed out advancing +0.25%.

In Hong Kong, stocks rallied on Thursday, led by property and IT shares, as investors shrugged off concerns that growing trade tensions will hurt the global economy. The Hang Seng index rose +0.3%, while the China Enterprises Index gained +0.2%.

In China, stocks traded relatively flat, with any gains offset by investors dumping new listings. At the close, the Shanghai Composite index was unchanged, while the blue-chip CSI300 index gained +0.6%.

In Europe, regional indices trade mostly higher across the board with notable strength in the DAX, which leads the gainers after declines yesterday.

US stocks are set to open in the ‘black’ (+0.2%)

Indices: STOXX 600 +0.3% at 376.2, FTSE +0.4% at 7158, DAX +0.6% at 12313, CAC 40 +0.5% at 5261, IBEX 35 -0.1% at 9682, FTSE MIB +0.6% at 22576, SMI -0.2% at 8853, S&P 500 Futures +0.2%

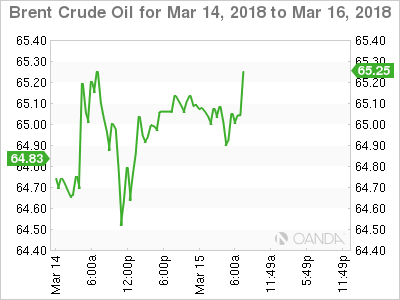

2. Oil prices stable on healthy demand, but oversupply worries loom

Oil prices are little changed, supported by healthy global demand, but at the same time, held back by a relentless rise in U.S production that is undermining OPEC’s efforts.

Brent crude futures are at +$64.91 per barrel, near yesterday’s close, while US WTI crude futures CLc1 are up by +9c to +$61.05 a barrel.

Prices continue to receive support from healthy demand. OPEC said yesterday that oil consumption was expected to grow by +1.62m bps in 2018.

But looming over markets has been a relentless climb in US crude output. EIA data this week hit another record last week by rising to +10.38m bpd, up by more than +23% since mid-2016. Commercial crude inventories were up by +5m barrels, at +430.93m barrels.

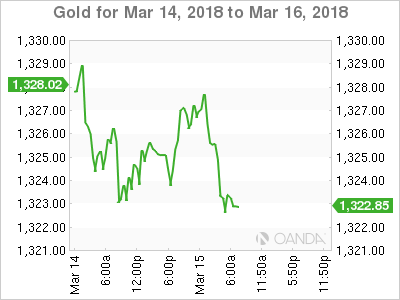

Ahead of the US open, gold prices are steady atop of their one-week high print in yesterday’s session amid political tensions between Britain and Russia, and renewed worries about a global trade war. Spot gold is nearly flat at +$1,325.06 per ounce.

3. Sovereign yields little changed

Earlier this morning, Norway’s central bank (Norges) left its key policy rate unchanged, but said that rates are likely to rise “after summer 2018,” slightly earlier than previously indicated. The vote was unanimously in favour of leaving the sight deposit rate at a record low of +0.5%, where it has been since March 2016. But the board indicated it is ready to follow the Fed and the BoE and raise rates this year.

“The outlook for the Norwegian economy suggests that it will soon be appropriate to raise the key policy rate,” it said.

Note: If the Norges Bank were to raise its key rate this summer, it would likely do so ahead of the ECB, since the market does not expect the ECB to lift its key policy rate before 2019.

Also this morning, the Swiss National Bank (SNB) kept its key policy rate at -0.75% despite recent signs of a pickup in the Swiss economy, as officials continued to warn about fragile conditions in currency markets and the “highly valued” Swiss franc.

In its policy statement, the SNB said it expects Swiss GDP to expand around +2% this year amid a broader pickup in the global economy. Unemployment should decline gradually, it said. The SNB’s deposit rate has been at its current level since January 2015.

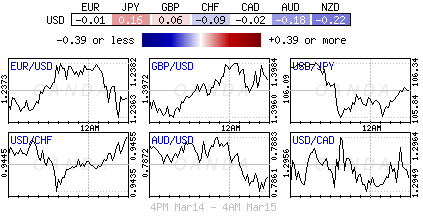

4. Dollar little changed

The USD is again little changed against the major European pairs.

Earlier this morning, the SNB kept its rhetoric unchanged with the CHF currency ($0.9451) seen as ‘highly valued’ thus showing it was in no hurry to change rates any time soon.

The EUR/SEK (€10.0905) has crossed its two-week lows and is firmer after Swedish February unemployment data beat expectations.

The NOK currency has appreciated after the Norwegian Central bank (Norges) tweaked its view on the first potential rate hike to after summer from its prior view of in the autumn. EUR/NOK hit a 4-month low of under €9.50 in the aftermath of the commentary as Norges new rate path suggested 100% chance of a September rate hike.

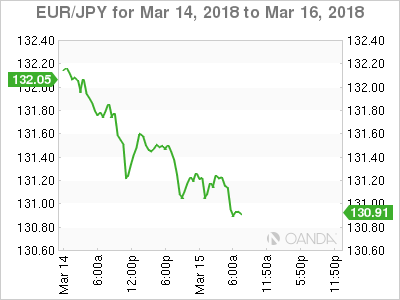

The yen has strengthened by as much as 6% against the dollar since the start of the year due to a combination of persistent dollar weakness, the BoJ monetary policy outlook and safe-haven demand as a result of political risks. These factors have pulled the ‘big’ dollar down from levels around ¥113 in early January to a 16-month low of ¥105.25 early this month.

5. French CPI was stable on the month and up on the year

Data this morning showed that French consumer prices (CPI) for February was unchanged, following a -0.1% downturn in January.

Digging deeper, food prices barely edged down (-0.1%), in the wake of fresh product prices. Those of “manufactured product” decreased again, but less markedly than in January (-0.3% after -2.2%). Services prices slowed down for the second consecutive month (+0.1% after +0.2%). Lastly, energy prices were stable, the decrease in petroleum product prices being offset by a rise in gas and electricity prices.

Seasonally adjusted, consumer prices dropped by -0.3%, after an acceleration to +0.7% in January.

Year-on-year, the CPI fell on the month to +1.2% from +1.3%. This slight decrease resulted from a lesser rise in prices of services, food and tobacco.