Monday, February 4Domestic Markets

S&P 500 Futures +2 as of 7:45AM

US 10-Year 2.70%

Dollar Index95.72

Oil$55.29.

International Markets

Nikkei +46 BPS

Shanghai– Closed

Hong KongHSI +21 BPS

KOSPI -6 bps

German DAX -30BPS

UK FTSE +25 BPS

Key Events for February 4

- Factory Orders

- Earnings:

International Markets Near Turning Point

KOSPI

The South Korean KOSPI has continued to rise in recent days and is now stalling out. The index has filled the gap at 2,210, which is the level we had looked for, now it is facing a steep downtrend at that level. This will be a big test not just for Korea but the entire global equity complex.

With the RSI at overbought levels, my expectations would be for a minor retracement in the index over the coming days. But the trend in the RSI is now higher, and that would suggest the index does move higher after a slight pullback.

Hong Kong Hang Seng

We can see that the Hang Seng is nearing a resistance level and is also facing a downtrend, which is it is trying to rise above. At this point the RSI suggests more gains to come longer-term. However, the RSI over the short-term is overbought and indicates the index pulls back as well.

UK FTSE

The UK FTSE does have further to climb from its current level of 7,040 to around 7,120.

Overall global equity markets are hitting a rough patch, and I’d expect this to play out during the next few days or perhaps the balance of the week.

US Markets

S&P 500 (SPY (NYSE:SPY))

The S&P 500 still appears to have a bit further to rise and has a reasonable chance to get to around 2,800 in the coming days. The chart shows that if the index can get over 2,720, it has a clear path higher towards 2,800.

Russell 2000 (RUT, IWM)

The Russell 2000 has already risen above resistance, and it has a good chance of advancing to around 1,562.

Amazon

There will be plenty of continued focus on Amazon.com (NASDAQ:AMZN) this week after its fourth quarter results last week. The stock continues to rest on technical support at $1,620. A drop below that level opens a path lower to around $1475.

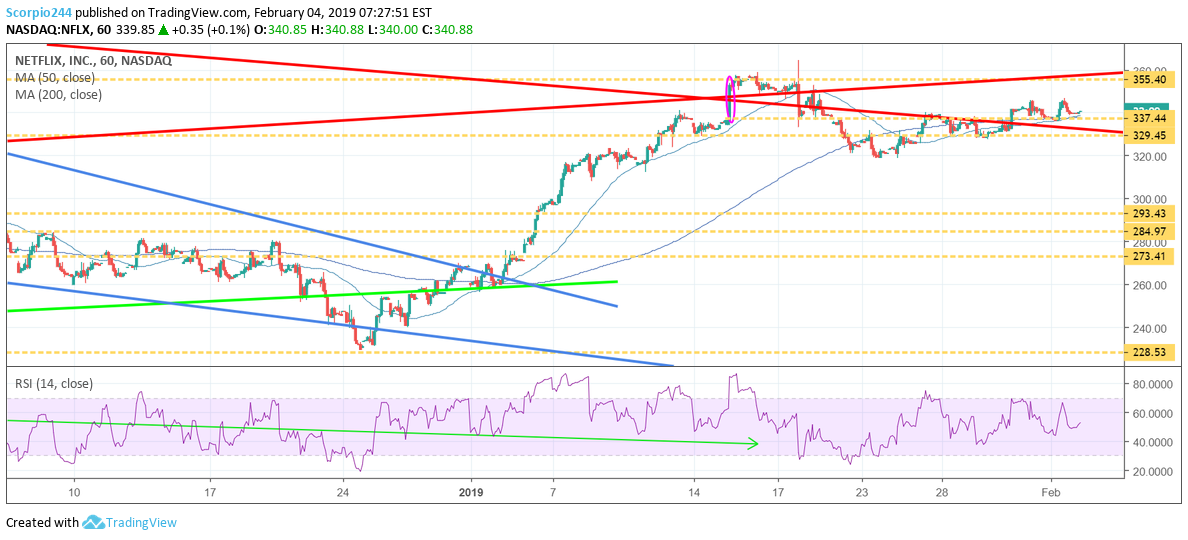

Netflix (NFLX)

Netflix (NASDAQ:NFLX) has been slowly grinding higher with the potential to rise back to $355.

Square

Square (NYSE:SQ) does continue to trend higher, but over the next few days, I think there may be a chance for it first to fall to back to $65.50.

Blackberry (TO:BB)

BlackBerry (NYSE:BB) continues to trend higher toward $8.75.

Tesla (TSLA)

Tesla (NASDAQ:TSLA) can likely rise back toward $333.

Acadia (ACAD)

ACADIA Pharmaceuticals (NASDAQ:ACAD) is back to the upper end of the range, and if can get through this $23 to $24 region it goes on to $27.

GE

General Electric Company (NYSE:GE) is hitting a wall of resistance at $10.65. There is a gap to fill, and that means it likely heads back to $9.

Michael Kramer and the Clients of Mott Captial own Netflix (NASDAQ:NFLX), Tesla (NASDAQ:TSLA), Acadia