So that's another year come and gone - and one of the weirdest from a trading perspective. I've seen one or two people refer to 2015 as 'The Year of the Failed Breakout', and I certainly wouldn't disagree with that!

I can remember that moving from 2010 to 2011 seemingly changed the state of the markets from a trending to a non-trending state - certainly on my preferred timeframe. It was literally like someone had flicked a switched on 01 January.

These kind of changes can occur at any time, and when they do, we never know how long the new market state will last for. And, in the case of the markets switching from a non-trending to a trending state, we do not know what the magnitude of the new trend will be - or initially even the direction it will take.

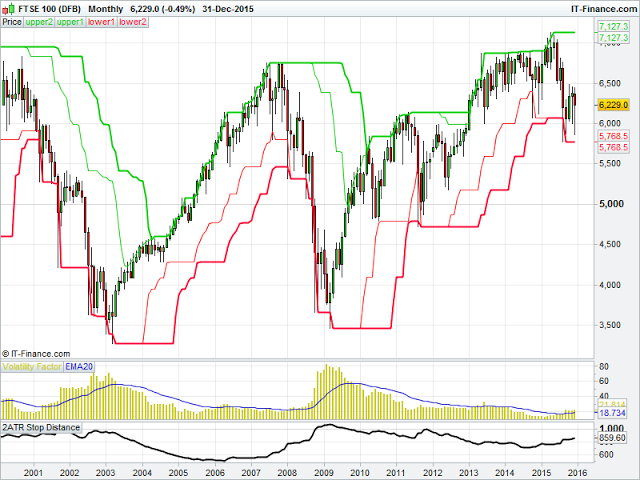

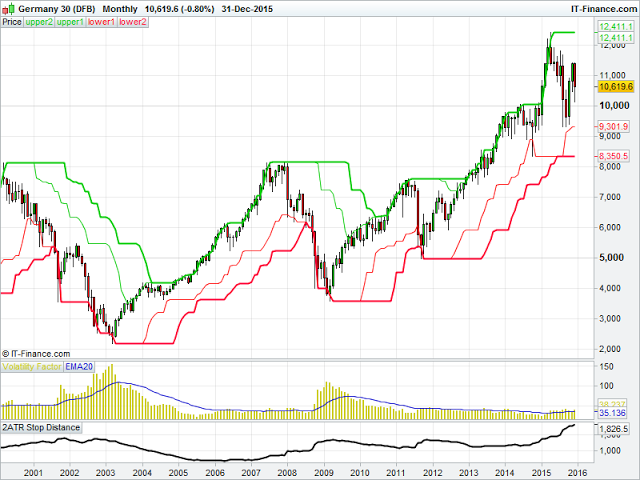

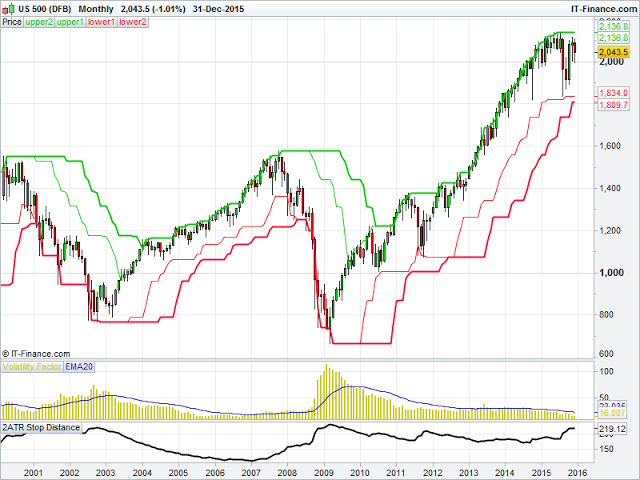

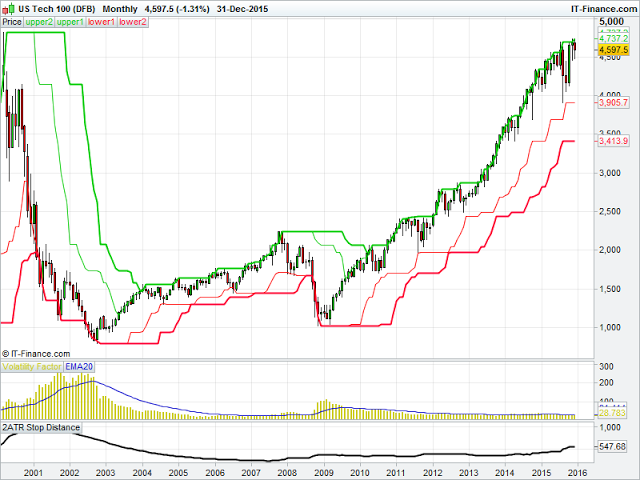

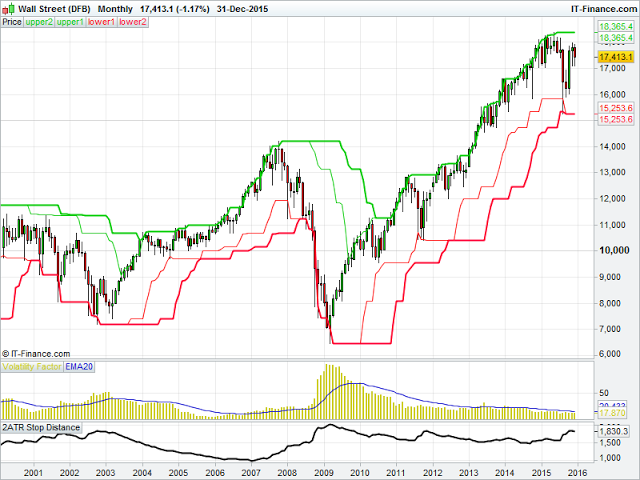

Below are the monthly charts of some of the major market averages which highlight the lack of a meaningful trend. The Nasdaq still shows an uptrend, but the others show price stalling over the last twelve months at best, or even falling back a bit. One noticeable thing about all these charts is the increase in the 2ATR measurement, demonstrating in increase in the intra-period volatility.