Wednesday April 11: Five things the markets are talking about

Ahead of the US open, European equities are under pressure following a mixed Asian session as capital markets weigh easing global trade tensions against the prospect of Euro/US military action in Syria.

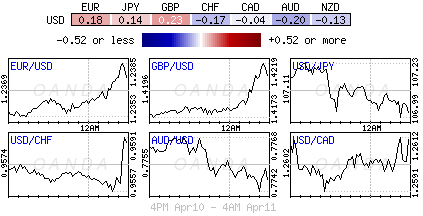

The ‘big’ dollar continues to drift, while US debt prices edge a tad higher before this morning’s US inflation data and this afternoon’s FOMC (02:00 pm EDT) minutes.

Stateside, inflation pressures appear to be building according to yesterday’s producer-price report, a trend that could also be visible in today’s US consumer-price data (08:30 am EDT).

US PPI rose +3% last month from a year earlier, matching the largest increase since prices grew +3% last November. Ex-food and energy, the volatile trade services category grew +2.9%, the strongest y/y increase in nearly four-years.

The markets focus has now officially shifted towards geopolitical stress around Syria.

1. Stocks mixed session

In Japan, stocks fell for the first time in three-days overnight, following a strong rally Tuesday, but index-heavy Softbank (T:9984) rose on rumors that Sprint (NYSE:S) is in new talks to merge with T-Mobile (NASDAQ:TMUS). The Nikkei ended -0.5% lower, while the broader Topix declined -0.4%.

Down-under, Australian shares ended lower overnight as investors switched from the defensive sector to resource plays on strength in commodities after China spoke of further opening their economy and lowering tariffs. The S&P/ASX 200 index slipped -0.5%. In S. Korea, the KOSPI was -0.2% lower.

Shares in China and Hong Kong posted the biggest gains as PBoC Governor Yi Gang offered more details on pledges to open the Chinese economy. In Hong Kong, equities rallied for a fourth consecutive session. The Hang Seng index rose +0.6%, while the Hang Seng China Enterprise (CEI) was unchanged. In China, stocks also ended higher. The blue-chip Shanghai Shenzhen CSI 300 rose +0.3%, while the Shanghai Composite Index gained +0.6%.

In Europe, regional bourses are trading mostly lower across the board, consolidating some of their recent gains and tracking US futures lower following yesterday’s strong session.

US stocks are set to open in the ‘red’ (-0.5%).

Indices: STOXX 600 -0.2% at 377.6, FTSE -0.1% at 7261, DAX -0.3% at 12359, CAC 40 -0.3% at 5294, IBEX 35 +0.1% at 9777, FTSE MIB flat at 23182, SMI -0.2% at 8736, S&P 500 Futures -0.5%

2. Oil hovers atop of 2014 peak as geopolitics vie with supply, gold higher

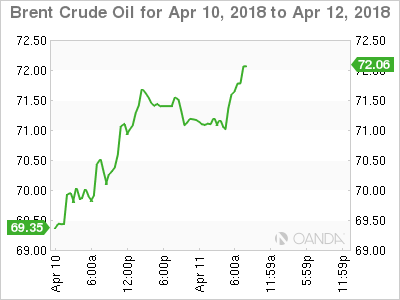

Crude oil prices trade atop of their four-year highs, supported by geopolitical tension in the Middle East, although higher US inventory reports are capping price gains.

Brent crude has gained +5.7% this week, rising to +$71.34 a barrel on Tuesday, although the price has since fallen back and was +$70.98 a barrel, down -6c. US crude futures are at +$65.55 a barrel, up +4c.

The US and its Euro allies are considering air strikes against Syrian forces following a suspected poison gas attack last weekend.

Note: Syria is not a significant oil producer, but any sign of conflict in the region would trigger concern about potential disruption to crude flows across out of the Middle East.

Earlier today, the Saudi energy Minister Khalid al-Falih said his country would “not sit by and let another supply glut surface,” implying that the OPEC would continue to withhold supply.

Capping price are US inventory reports. Yesterday’s US API data showed that crude inventories rose by +1.8m barrels in the week to April 6 to +429.1m, compared with market expectations for a decrease of -189k barrels.

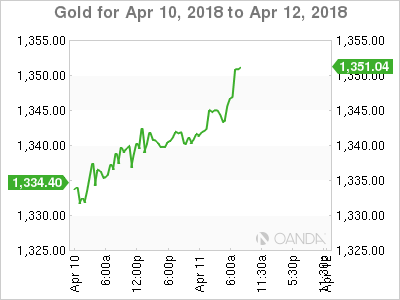

Ahead of the US open, gold prices have touched a one-week high, as the dollar falls to a two-week low and as a host of geopolitical factors stoked demand for the safe-haven metal. Spot gold has rallied + 0.4% to +$1,344.16 an ounce, its fourth straight session of gains. US gold futures have gained +0.2% at +$1,348 an ounce.

3. E.U. yields drop as ECB plays down Nowotny’s comments

E.U. sovereign yields eased back towards their multi-month lows after the ECB distanced itself from one Nowotny’s comments of a move away from deeply negative deposit rates yesterday.

Note: Nowotny indicated yesterday that there was a possibility of a +20 bps hike in the deposit rate as part of ECB’s efforts to normalise policy.

The yield on Germany’s 10-Year Bund is -1 bps lower at +0.505% while other sovereign yields across the bloc saw yields drop -1 to -2 bps.

Elsewhere, the yield on US 10-Year Treasuries dipped -1 bps to +2.79%, while in the U.K., the 10-Year Gilt yield decreased -1 bps to +1.402%.

4. Dollar feels the pressure

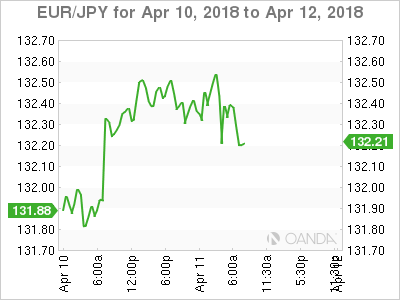

The USD remains on soft footing, somewhat pressured by a number of Euro central bankers commenting on their future rate outlook.

Bank of England’s (BoE) McCafferty (dissenter) noted the U.K. policy makers should not delay its next rate hike, while European Central Bank’s (ECB) Nowotny stated, “a good place to start on its normalization would be a +20 bps hike in the discount rate.”

EUR/USD (€1.2374) is making an attempt to penetrate the psychological € 1.24 handle despite the ECB playing down Nowotny hike comments.

EUR/CHF (€1.1853) has crossed its highest level since the Swiss National Bank (SNB) removed the $1.20 floor back in January 2015.

Sterling (£1.4195) fell slightly on this morning’s IP news (see below), given that further data showed the U.K. trade deficit shrank to £10.2B in February. EUR/GBP has rallied to €0.8718.

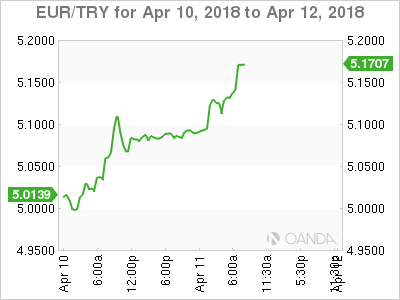

Russia’s rouble (RUB) extended it recent losses to hit its weakest since November 2016 as selling continued in the wake of new US sanctions and as geopolitical tensions over Syria rose, with Turkey’s lira (USD/TRY) also falling another record low atop of $4.1502).

5. U.K. factory output fell in February

Data this morning showed that U.K. factory output declined in February, the latest sign the U.K. economy slowed in Q1.

Manufacturing output fell -0.2%, though overall industrial production recorded a +0.1% gain, thanks largely to higher energy generation as U.K. citizens consumed more energy during this past winter’s deep cold snap.

Market expectations were for the U.K. to lag its peers for a second consecutive year as uncertainty over the country’s future ties to the E.U. weigh on activity.