Here are the latest developments in global markets:

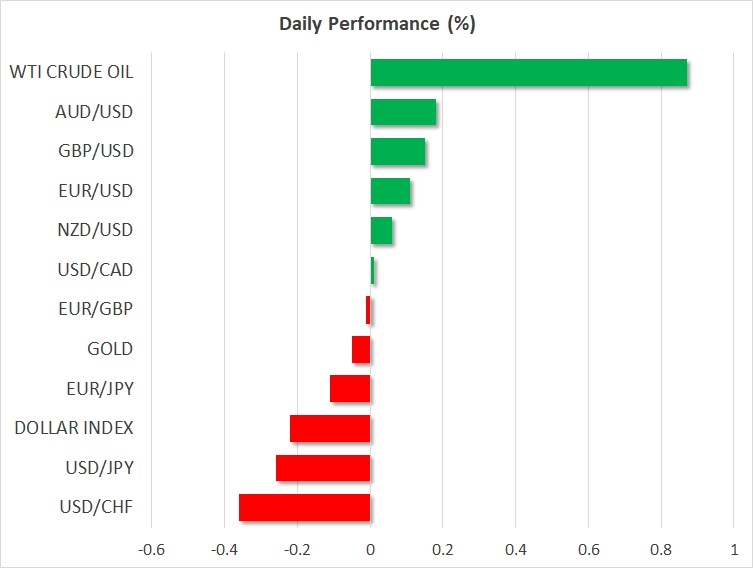

- FOREX: The dollar traded 0.2% lower against a basket of six major currencies on Friday, with a public holiday in Europe and the US set to keep many traders away from their desks today, and liquidity in the FX markets thinner-than-usual.

- STOCKS: US markets closed higher yesterday, recovering some of the losses they posted earlier in the week. Technology stocks led the way higher, for the most part, helped by some comments from the White House that the US administration isn’t planning to take action against firms like Amazon (NASDAQ:AMZN), as had been hinted by the President recently. The tech-heavy Nasdaq Composite led the pack, climbing by 1.6%, while the S&P 500 and the Dow Jones rose by 1.4% and 1.1% respectively. Note that US markets and almost all of the European markets remained closed in celebration of the Good Friday holiday. In Asia, Hong Kong stayed closed as well, but Japanese markets did open, with the Nikkei 225 and the Topix gaining 1.4% and 0.7% respectively.

- COMMODITIES: In energy markets, oil prices climbed with WTI gaining more than 0.8% and Brent crude rising by nearly 0.9%, in the aftermath of the Baker Hughes oil rig count. It showed that US drillers reduced the number of active oil rigs this week, which was likely seen as an early indication that the increase in US production may be slowing down a little. In precious metals, gold was practically flat, remaining stuck near the $1325 per ounce zone, without any major fundamental catalysts to drive the price action.

Major movers: Dollar softens a little, but still on track for a decent week

While the dollar index was 0.2% lower today, it is worth noting that it is higher overall this week, currently hovering near a 10-day high of 89.95. There were very few triggers or positive economic data to lift the world’s reserve currency, so its recovery appears to be linked more to traders taking profit on their prior short-USD positions, or covering those same positions as the quarter was drawing to an end.

Dollar/yen was also down by 0.2%, while euro/yen fell 0.1% Friday despite a disappointing raft of data out of Japan overnight. The nation’s unemployment rate ticked up to 2.5%, but still remains extremely low, while the core CPI rate for Tokyo – widely seen as a precursor to the nationwide rate – declined to 0.8% y/y, from 0.9% previously. These suggest there is little pressure on the BoJ to start shifting to a more hawkish stance anytime soon. Note that the BoJ’s Tankan survey for Q1 will be released right after markets open on Monday, and will provide a fresh indication of how Japanese businesses are coping with the recent trade risks, and the broader appreciation of the yen.

Pound/dollar is nearly 0.2% higher today, recouping some of the significant losses it posted yesterday. There were no updates on Brexit or any major UK data, so quarter-end flows appear to have been the culprits behind sterling’s latest underperformance.

Elsewhere, the commodity-linked currencies maintained relatively narrow ranges, with news flow also being very light. Dollar/loonie is practically flat in the day, after declining a little yesterday on the back of higher oil prices, even despite disappointing GDP data out of Canada. Aussie/dollar climbed 0.2%, but is still trading not far above a 3-month low, while kiwi/dollar was only marginally higher.

Overall, with a holiday in the US and Europe today, FX trading will probably be characterized by thinner-than-usual liquidity. This suggests that sharp moves could occur without much at all in the way of fundamentals.

Good Friday: Investors take a break ahead of the second quarter

On Friday, trading volumes are expected to be subdued as Western and European major centers will be shut for Easter Holidays and investors have already closed their positions before the start of the second quarter next week, which could bring fresh volatility to the markets.

The first three months of the year kept investors on edge given the ups and downs in the White House involving Trump’s massive tax cuts and his surprising decision to impose tariffs on aluminum and steel which raised speculation of a global trade war. On the monetary front, the Fed’s plans to continue to raise interest rates faster than other major central banks added further stress to the markets, whereas a deal between the EU and the UK regarding the Brexit transition period was a relief.

The second quarter now brings new questions, with investors wondering whether risks around trade developments could ease further after China and the US showed the willingness to start negotiations. It would also be interesting to see how the North Korean story will wrap up following Kim Jong Un’s statement that he is willing to give up his nuclear weapons if the US and South Korea create an atmosphere of peace. Brexit and NAFTA are also important spots and any significant progress could increase confidence in pound and loonie respectively.

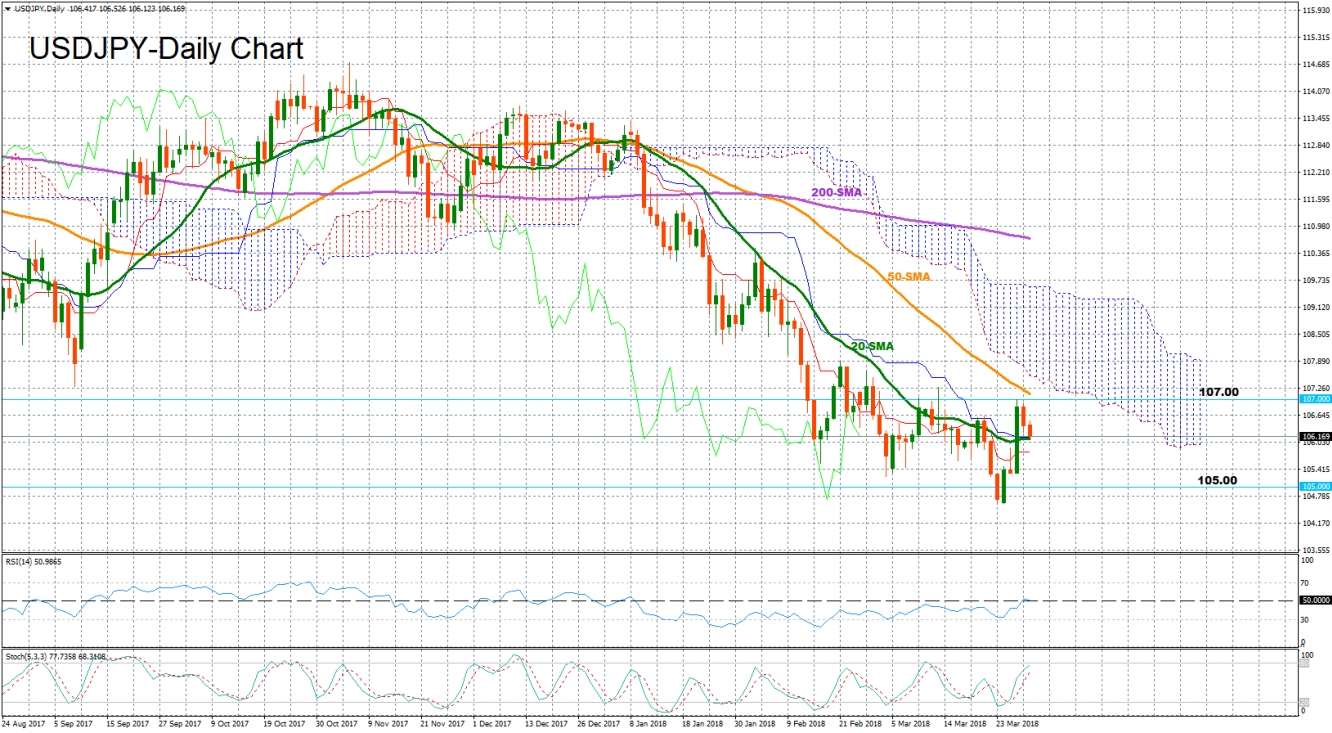

Technical Analysis: USD/JPY neutral but risk tilted to the downside in short-term

USD/JPY recorded an impressive run on Wednesday, bringing the market back into neutral mode. Moreover, it managed to close significantly above the 20-day simple moving average for the first time since early January, but the pair might not hold above it for long as Stochastics are on track to enter overbought levels. The RSI is currently around its neutral threshold of 50, though, the index seems to be gathering negative momentum. Therefore, the pair could consolidate for a while until we see Stochastics posting a bearish cross.

Should the pair move lower amid uncertainties around the US-China trading relationship, support could come at the 105 key-level. Conversely, sufficient progress on this front at the beginning of the second quarter could send prices up to the 107 handle.