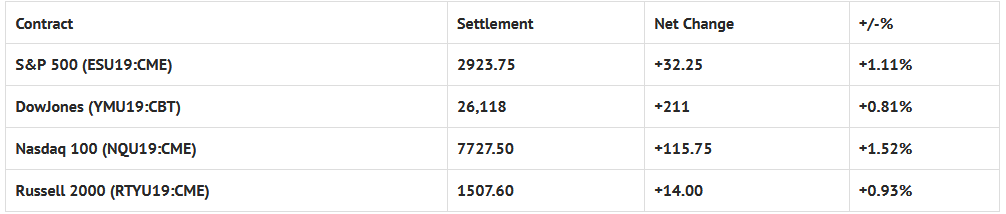

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes the 8-Week Bill Settlement, Redbook 8:55 AM ET, Mary Daly Speaks 4:30 PM ET, and Randal Quarles Speaks 6:00 PM ET.

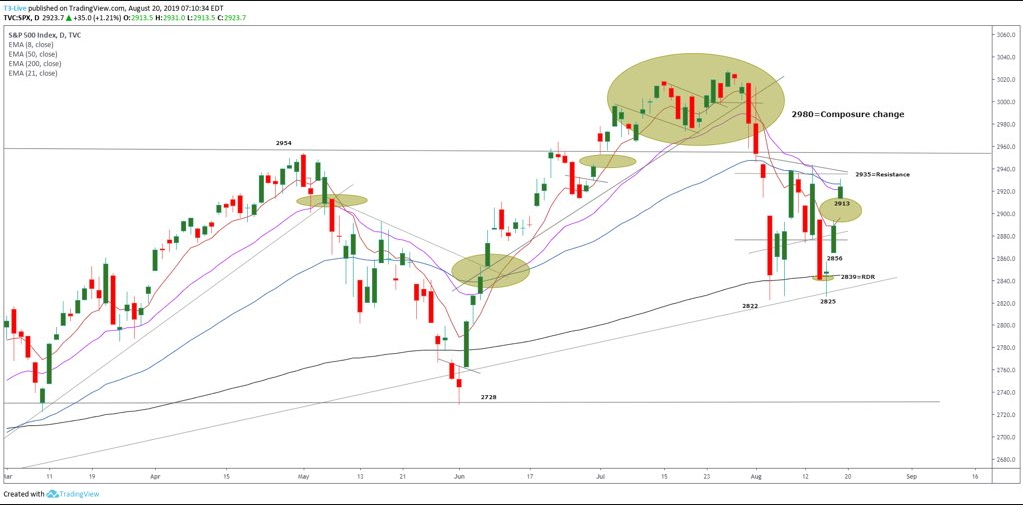

S&P 500 Futures: Mutual Fund Monday Revised

Chart courtesy of Scott Redler @RedDogT3 – $spx futures flattish after a big three day move. Now u see how it digests above 2913 (yesterday’s gap). Does it hold above (strong) or does it try and fill it (choppier)?There’s defined resistance above 2931-2936 area. If it holds the gap, leaders should show relative strength.

During Sunday nights Globex session, the S&P 500 futures (ESU19:CME) printed a low at 2892.50, then rallied 36 handles to print a high and 2928.50, and opened Monday’s regular trading hours (RTH) at 2923.50.

After the 8:30 CT bell, the ESU shook some weak longs off the stick by initially breaking 11 handles, printing an RTH low at 2915.50. The bears wouldn’t get anymore help during the early part of the day though. Thin-To-Win took over, and by 10:30 the futures had traded back through the opening range, topping out at the Globex high at 2928.50.

From there, we saw a little back and fill down to 2922.75, before trading higher to take out the Globex high and printing a new daily high at 2932.25. Things slowed down after that, and the ES traded sideways in a 6 handle range until the close came around.

When the MiM came out showing $891 million to sell MOC, the futures broke 8 handles to print 2922.00 on the 3:00 cash close, and finished the day at 2923.50 on the 3:15 futures close, up +32 handles.