Dow slips

US stocks hit new record highs on Monday. The dollar strengthening accelerated on Fed officials’ hawkish comments: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.4% to 92.328. S&P 500 gained 0.2% settling at new record 2747.71 led by utilities and technology shares. The Dow Jones Industrial Average though slipped 0.05% to 25283. The NASDAQ Composite index rose 0.3% to fresh record 7157.39. Futures point to lower market openings today.

The dollar got support from Cleveland Fed President Loretta Mester comment Friday she sees a strong US economy as helping make the case for four interest rate increases in 2018. On Saturday San Francisco Fed President John Williams said the central bank should lift interest rates three times this year, because of the stimulus tax cuts will provide. Atlanta Fed President Raphael Bostic, who is a voting member of the central bank’s policy committee in 2018, said on Monday that only two increases might be needed in 2018. In economic news, consumer borrowing rose to $27.9 billion in November from $20.5 in the previous month, by the largest monthly amount in 16 years.

Weaker euro lifts European stocks

European stocks closed higher on Monday helped by weaker euro as German manufacturing data disappointed. The euro fell 0.7% against the dollar closing below $1.20 per euro level while British Pound inched higher. The Stoxx Europe 600 index gained 0.3%. The DAX 30 rose 0.4% to 13367.78. France’s CAC 40 added 0.3% while UK’s FTSE 100 finished 0.4% lower. Indices opened 0.1%-0.4% higher today.

Trading in upbeat mood continued despite data showed manufacturing orders in Germany unexpectedly fell 0.4% over the month in November.

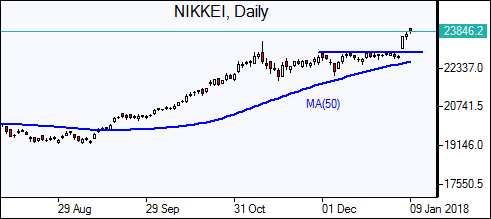

Bank of Japan trims its bond purchases

Asian stock indices are rising today. Nikkei rose 0.6% to 23845.00 as the yen extended strengthened against the dollar after the Bank of Japan trimmed the size of its bond repurchase by 5% to ¥190 billion ($1.7 billion) of bonds maturing in 10 to 25 years. Chinese stocks are rising: the Shanghai Composite Index is 0.2% higher and Hong Kong’s Hang Seng Index is up 0.3%. Australia’s ASX All Ordinaries is 0.1% higher as Australian dollar resumed its climb against the US dollar.

Oil higher on US rig count drop

Oil futures prices are extending gains today. Prices rose Monday after Baker Hughes weekly report showed a decline in the number of active US drilling rigs: March Brent crude settled 0.2% higher at $67.78 a barrel on Monday.