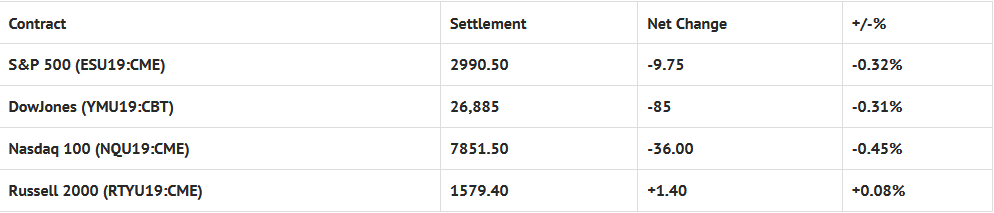

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 11 out of 11 markets closed lower: Shanghai Comp -2.58%, Hang Seng -1.54%, Nikkei -0.98%

- In Europe 11 out of 13 markets are trading lower: CAC -0.14%, DAX -0.21%, FTSE -0.03%

- Fair Value: S&P +3.34, NASDAQ +22.97, Dow -6.32

- Total Volume: 1.33 ESU & 358 SPU traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes the TD Ameritrade IMX 12:30 PM ET, and Consumer Credit at 3:00 PM ET.

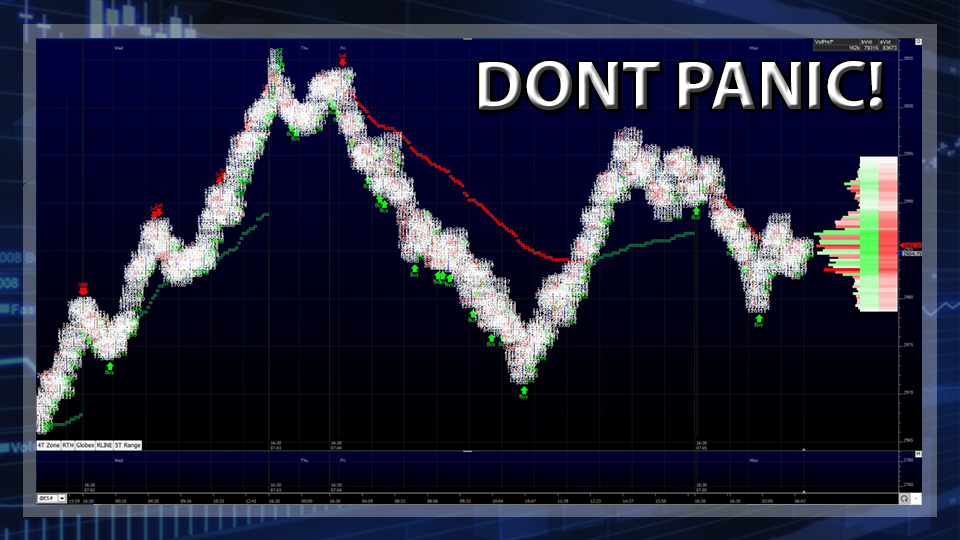

S&P 500 Futures: 30 Handle Drop And 27 Handle Pop

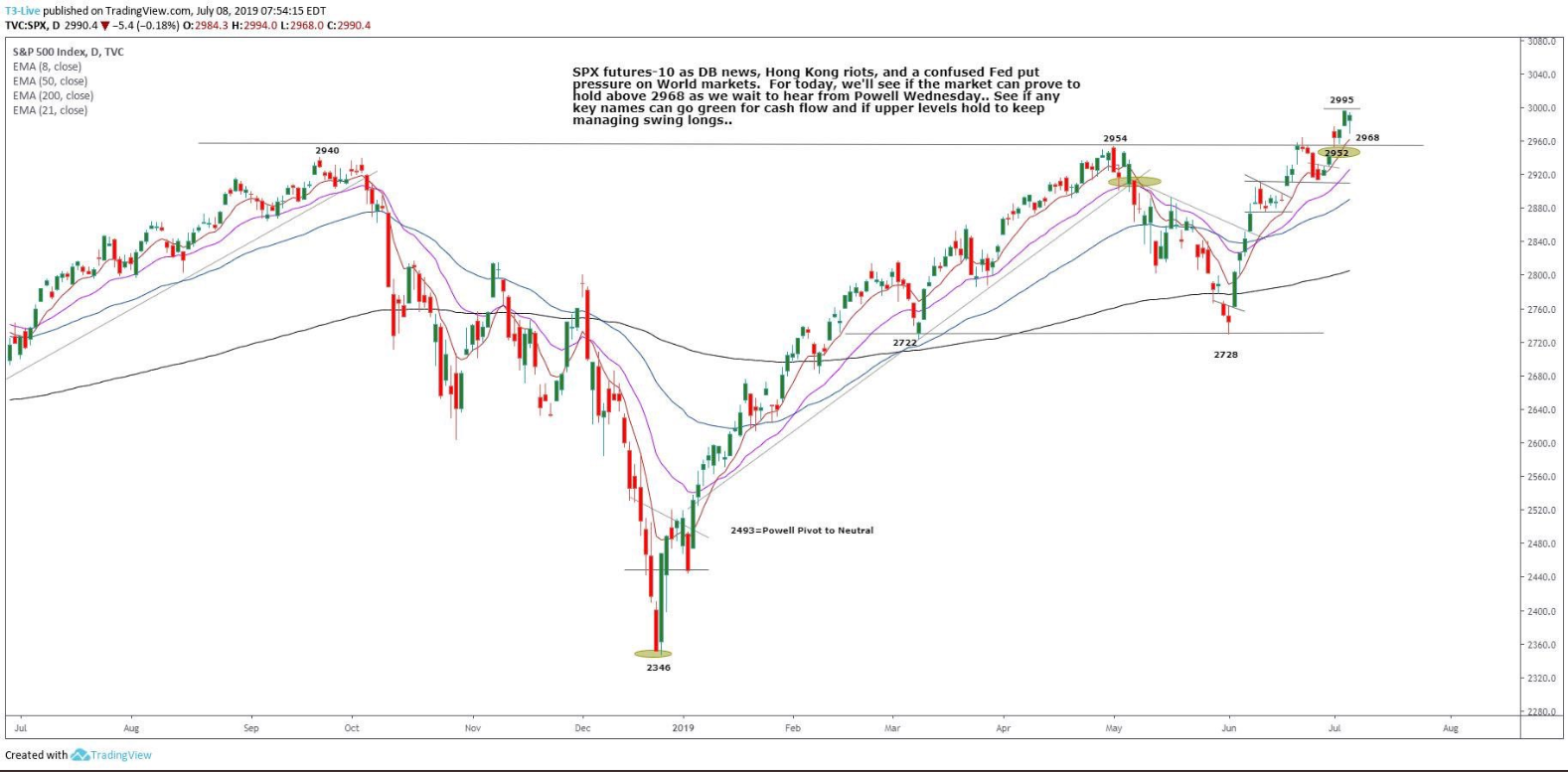

Chart courtesy of Scott Redler @RedDogT3 – $spx futures -10 as we see if markets can keep upper commitment and absorb the morning weakness.

During the extended Globex session from Wednesday night through Friday morning, the S&P 500 futures (ESU19:CME) printed a high of 3006.00, a low of 2983.00, and opened Friday’s regular trading hours (RTH) at 2985.75.

The positive jobs number wasn’t enough to keep stocks afloat after printing a new all time high overnight, and the race to sell was on. The ES was due for a pullback, and stops needed to be run. After the 8:30 CT bell, selling pressure continued to grow, and stocks continued to fall.

Just before 10:00, buy imbalances slowly started to creep into the market, and the ES wound up bottoming out at 2971.25. From there, bulls re-took control of the tape, forming a nearly perfect “V” formation (on a 5 minute chart), and by 11:30 the futures had traded back through the RTH opening range.

By the time the MiM reveal showed $244 million to buy MOC, the ES had rallied back through the RTH opening range, and went on to print 2995.00 on the 3:00 cash close, and ended the day at 2990.50 on the 3:15 futures close, down -10 handles on the day.