Market Brief

US jobs data surprised to the downside on Friday with nonfarm payrolls printing at 142k versus 201k expected, while the previous month reading was downwardly revised to 136k from 173k first estimates. As a result, the greenback suffered a quick and heavy sell-off with the dollar index losing -1.15% within seconds before stabilizing around the key support area at around 95.20. But the biggest reaction came from the bonds market where investors rushed into treasuries, bringing US rates significantly lower with the 2-year reaching 0.5458%, down 11bps from its pre-NFP levels while the 10-year fell as much as 15bps to 1.9022% as traders started to price out an October rate hike and lowered their expectations for a December one. We think that the US economy is not as strong as anticipated and investors are beginning to wonder whether the fed is not too optimistic regarding the economic outlook. Besides the NFPs, unemployment rates remained stable at 5.1% while participation rates continued to fall, reaching 62.4% in September. Finally, wage pressures remained subdued as average hourly earnings didn’t grow at all in September while market participants expected a read of +0.2%m/m. Finally, the strong US dollar continues to hurt manufacturers as factory orders (s.a.) contracted -1.7%m/m in September versus -1.2% median forecast.

EUR/USD jumped 1.45% on Friday but was unable to break the resistance standing at 1.1327 (Fib 38.2% on August - September sell-off). Subsequently, the pair stabilized slightly below 1.1250 and traded sideways in the Asian session. On the downside, the closest support can be found at 1.1087 (low from September 3rd), while the next one stands at 1.0809 (low from July 20th).

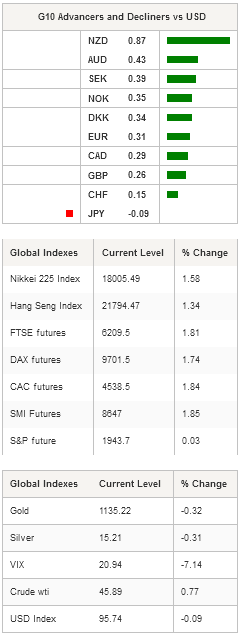

The US jobs report wasn’t a disappointment for everyone as most emerging markets welcomed the news. The Brazilian Bovespa index rose 4%, the Argentinian Merval climbed almost 6.50%, while in Asia this morning, equities are blinking green across the board. The Japanese Nikkei 225 is up 1.58%, while the broader TOPIX index adds 1.31%. In Hong Kong, the Hang Seng climbs 1.34%, in Australia the S&P/ASX is up 1.95% and in New Zealand, shares climbed 0.66%. European futures are also trading significantly higher this morning with the FTSE 250 up 1.81%, the DAX 1.74%, the CAC 40 1.84% and the SMI +1.85%.

In the FX market, USD/JPY almost completely erased Friday’s losses with the dollar back above ¥120 as market continue to expect further yen weakness due to high probability of the expansion of the BoJ’s monetary stimulus. AUD/USD is on its way to test the resistance lying at $0.71 (psychological threshold) as the latest inflation data from TD securities suggest that inflation pressures continue to build up in Australia. We therefore expect the RBA to remain on hold at tomorrow’s meeting. On the long-term, we do not expect the central bank to cut rates further as the pick-up in inflation is reducing its manoeuvring room.

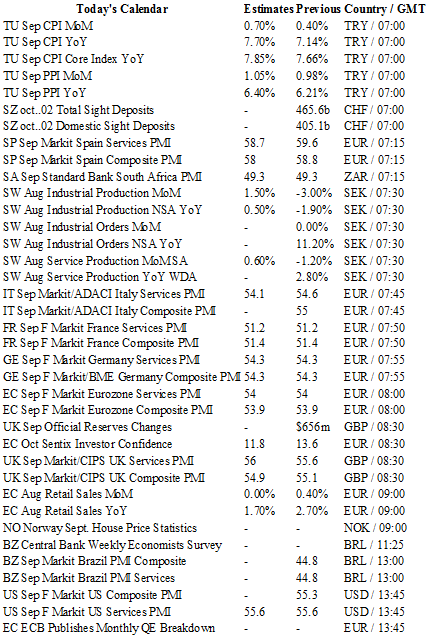

Today traders will be watching industrial production from Sweden; market PMI from Germany, Italy, France, UK and the US; ISM non-manufacturing composite from the US: Halifax house price from the UK.

Currency Tech

EUR/USD

R 2: 1.1561

R 1: 1.1330

CURRENT: 1.1248

S 1: 1.1017

S 2: 1.0809

GBP/USD

R 2: 1.5659

R 1: 1.5383

CURRENT: 1.5223

S 1: 1.5089

S 2: 1.4960

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 120.05

S 1: 118.61

S 2: 116.18

USD/CHF

R 2: 1.0240

R 1: 0.9903

CURRENT: 0.9708

S 1: 0.9513

S 2: 0.9259