Here are the latest developments in global markets:

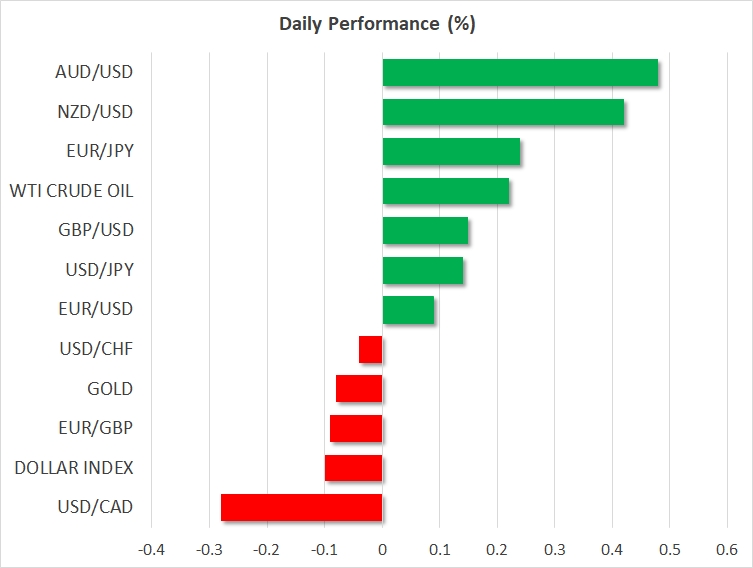

- FOREX: The US dollar traded 0.1% lower against a basket of six major currencies on Tuesday. Yesterday, the major mover was the Japanese yen, which surged on safe-haven demand, as trade concerns remained at the forefront. The Canadian dollar also gained amid speculation that the NAFTA talks could bear fruit soon.

- STOCKS: US markets sank once more yesterday, beginning the new quarter on the back foot as worries over protectionism and the outlook for technology companies crippled demand for stocks. The tech-heavy Nasdaq Composite led the charge lower, falling by 2.7%, while the S&P 500 and the Dow Jones dropped by 2.2% and 1.9% respectively. Nonetheless, futures tracking the Dow, S&P and Nasdaq 100 are all flashing green at the moment, pointing to a higher open today. Asian markets were mixed, with Japan’s Nikkei 225 and the Topix falling by 0.45% and 0.3% correspondingly, while in Hong Kong, the Hang Seng rose 0.5%. In Europe, futures tracking all the major indices are well into negative territory at the moment, suggesting these a lower open today.

- COMMODITIES: In energy markets, oil prices traded a little higher today, recovering some of the significant losses they posted yesterday. Both WTI and Brent crude plunged more than 2% on Monday, mimicking the sharp declines in equity markets. Today, prices will continue to respond to any changes in risk appetite, while investors will also look to the release of the private API crude inventory data for an update on the state of US production. In precious metals, gold soared yesterday, as continued trade uncertainties led traders to seek the safety of the yellow metal. Prices are currently consolidating near $1340 per ounce, and in case of further advances, resistance may be met near the metal’s recent highs at $1356.

Major movers: Yen and gold shine, stocks drop as “China strikes back”

Trading at the start of the new quarter was largely characterized by heightened risk aversion. Major stock indices plummeted, while safe-haven assets like the yen and gold came under renewed buying pressure, as American traders returned to their desks and digested the latest chapter in the trade war saga, that China imposed its own tariffs on the US. Besides worries around trade, the tech sector also took a heavy hit, with fears of increased regulation following Facebook’s privacy scandal and President Trump’s salvo of Twitter attacks on Amazon taking their toll on these stocks.

The S&P 500 closed below its 200-day moving average, a critical support territory that had halted multiple declines in the recent past, tilting the technical picture to the downside and eroding one of the last lines of defense that had held in the index.

Moving forward, the spotlight may remain on whether the trade standoff will escalate further. Note that the latest Chinese tariffs on the US were retaliation to the original US steel and aluminum levies, not to the recent tariffs the US administration announced last week, which will be aimed at Chinese technology imports. This suggests more countermeasures by China may be in store soon, once the US formally unveils its technology tariffs. In fact, the Chinese Ambassador to the US said yesterday that his nation will counter any new US tariffs with measures of equal proportion, scale, and intensity. Overall, risk sentiment is on wobbly legs right now, and for it to recover, investors may need to see clear signs that this situation is just a prelude to serious trade negotiations, not the beginning of a tit-for-tat trade skirmish.

Elsewhere, dollar/loonie is nearly 0.3% lower today, extending the gains it posted yesterday after media reports suggested President Trump is pushing for a preliminary NAFTA deal within two weeks, reigniting hopes that these talks could bear fruit soon.

The antipodeans were higher, with both aussie/dollar and kiwi/dollar rising by 0.5% and 0.4% respectively. The RBA rate decision earlier on Tuesday was rather uneventful. The Bank remained on hold as expected and provided almost no fresh clues about its policy outlook. The reaction in the Australian currency was muted on the news, though it did surge a few hours later.

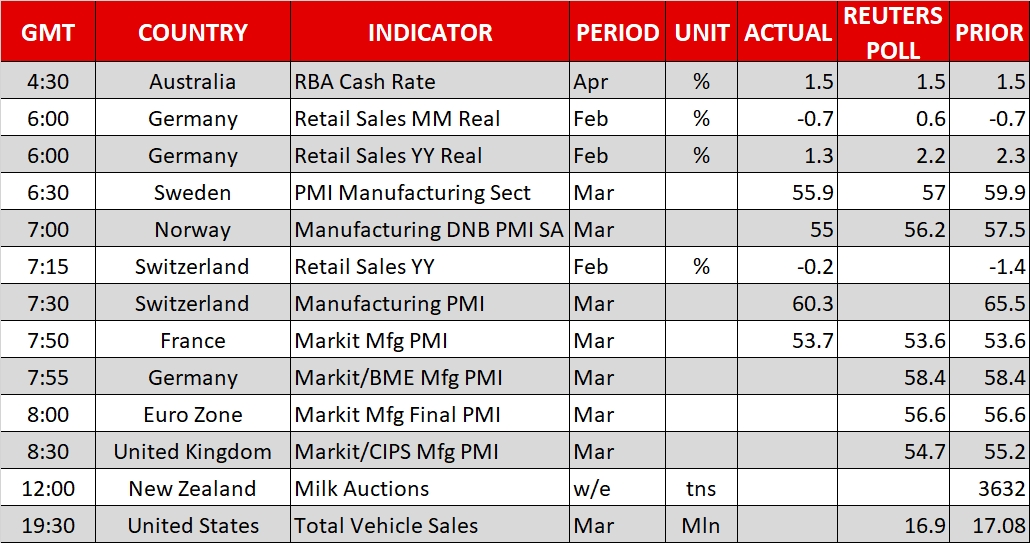

Day ahead : EU & UK deliver Markit Manufacturing PMIs; New Zealand waits for dairy prices

On Monday, liquidity is expected to return to normal levels as investors are all now back on their desks after a four-day weekend due to Easter Holidays. But after a noisy first quarter which included a significant sell-off in global stocks and strong demand for safe-havens, the second quarter does not seem to be any easier either and investors are likely to play safely once again, at least for the moment. Fears over a global trade war did not fade out but instead escalated after China decided to retaliate to the US import tariffs on steel and aluminum on Sunday, with its tariffs on US food imports taking effect yesterday.

It remains to be seen whether the US will continue the tit-for-tat game with China, putting the trade future of the Chinese-depended and commodity-linked economies such as Australia, Canada, and Brazil in danger. It is also worth mentioning that Friday’s NFP might bring fresh volatility to the markets as analysts predict further improvement in the US labor market. An upbeat report, for example, could provide substantial support to the dollar which faced severe pressure since the beginning of the year, raising the odds for further monetary tightening by the Fed.

In equity markets, the persistent sell-off in tech stocks will be closely watched as well after Trump unleashed fresh warnings to Amazon.com (NASDAQ:AMZN) over its pricing strategy and Apple (NASDAQ:AAPL) said that it would use its own chips over Intel’s components to build its products. Note that the next earning season begins in two weeks.

Turning to today’s economic releases, US total vehicle sales, another proxy for consumer spending, will attract attention at 1930 GMT, while in New Zealand, eyes will turn to global dairy prices delivered at a tentative time (Reuters expects the report to be issued around 1200 GMT).

In energy markets, the American Petroleum Institute will give an insight into the US crude oil stocks for the week ending March 30 at 2030 GMT.

As of today’s, public appearances, the Minneapolis Fed President, Neel Kashkari (1330 GMT), and the FOMC Board Governor, Lael Brainard (2030 GMT), will speak out of the US, while in the eurozone, comments by the ECB executive member, Yves Mersch will be also in focus (1430 GMT).

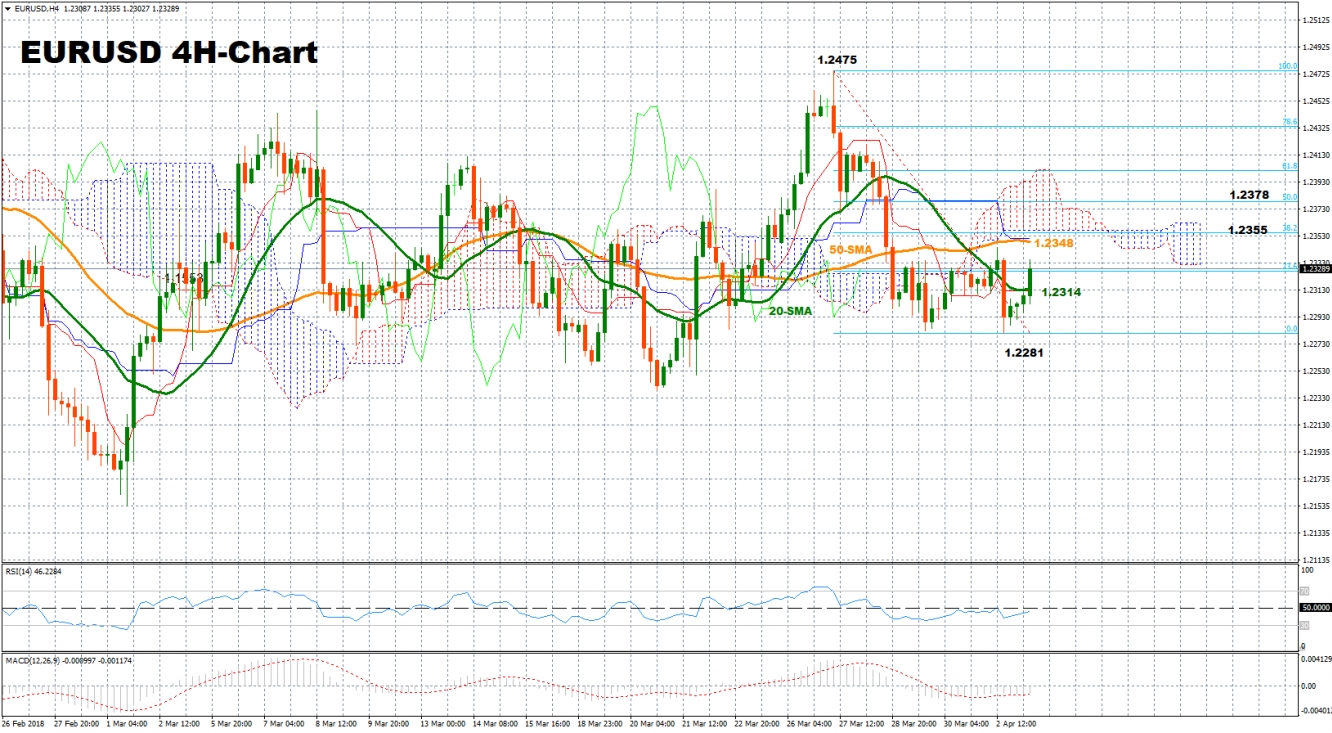

Technical Analysis – EURUSD bounces off from two-week lows but holds in a range

EURUSD made a big step towards a two-week low of 1.2281 yesterday but losses were short-lived, and the pair managed to rebound slightly above the 1.2300 key level today, remaining inside in a range started last week. The pair could maintain today’s positive momentum in the short-term as the RSI is currently heading up towards its neutral threshold of 50 and the MACD is deviating above its red signal line in the four-hour chart.

Should prices rise, the 50-period simple moving average which currently stands at 1.2348, could provide nearby resistance. Slightly above from here, the 38.2% Fibonacci of 1.2355 of the downleg from 1.2475 to 1.2281 could be the next target before the door opens for the 50% Fibonacci of 1.2378.

On the downside, the 20-period SMA at 1.2314 could offer nearby support, while steeper declines could also send prices back down to the two-week low of 1.2281.