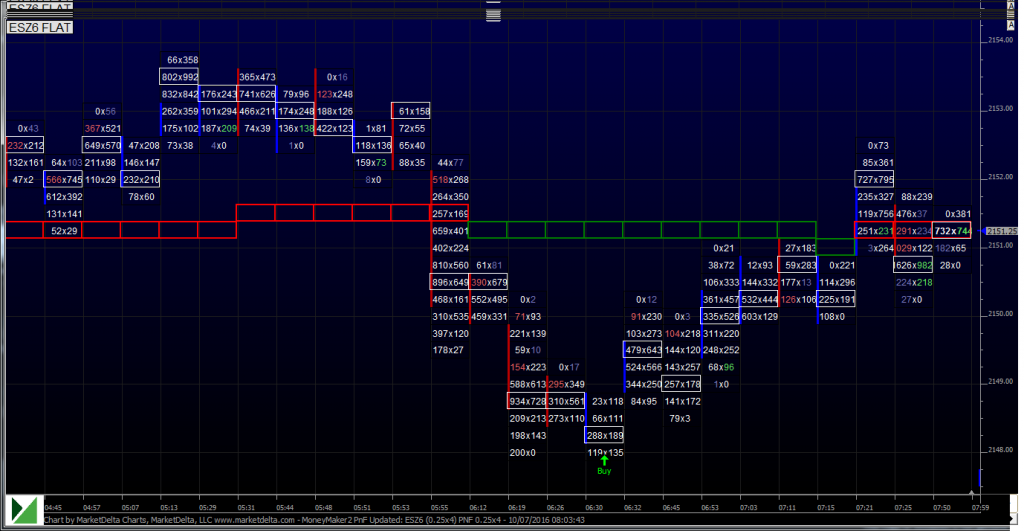

Yesterday’s price action in the S&P 500 futures was pretty much what we expected it to be. It was a quiet range of thin to win ahead of today’s NFP number. After a weak globex session the ESZ opened the cash session at 2149.75 and sold off down to 2143.25 just after 10:00 am cst. From there the S&P began to rally. The rally was helped when comments hit the wire from the ECB’s Constancio that the chatter concerning tapering was unconfirmed rumors. This helped the ES gun higher for 2157.25, a 19 handle bounce, and the index settled just three ticks off that high, up six handles on the session.

It was more of what we have been seeing. It was a quiet market for much of the day with the movement coming during the period of the slowest volume. The move only took minutes to accomplish and then settled back down into the chop. Also helping to calm the markets was news out of Europe suggesting that German companies are prepared to inject Deutsche Bank (DE:DBKGn). This will help them remain solvent even as they are reportedly still negotiating with the U.S. Department of Justice concerning a reduction of their $12 billion dollar fine.

Hurricane Matthew

The big story, particularly on the lower Eastern coast of the U.S. and for MrTopStep, was Hurricane Matthew pounding the Bahamas after tearing through Hati. The storm is making landfall in southern Florida and is pressing toward the Jacksonville area of northern Florida this morning. The energy complex yesterday saw a spike in crude oil, and natural gas futures saw a rally even as the U.S. dollar rallied.

British Pound Collapse

The big story overnight was the sudden collapse of the British Pound Sterling. The GBP/USD saw a 700+ pip loss in just a matter of minutes, before mostly recovering, as the pair sold off to a new low exceeding the post Brexit low. The pair had been weakening as concerns have once again become relevant of the economic consequences of the Brexit. Reuters reported that:

“This was even a bigger move than what we saw after the Brexit vote. There were almost no offers, no bids when this happened,” said a trader at a European bank in Tokyo.

There was expected chatter last night concerning some awful fills for customer accounts. Many forex traders were noting that they could not close their positions and their account were in the negative. After the Swiss changed their pegging procedures from the CHF/EUR 18 months ago the market reaction was severe thrusting several brokerages out of business. Last night’s move in the Sterling was not on any news, but a lack of liquidity on what could have been a “fat finger” trader in the currency markets, which claim to be the most liquid in the world.

Just yesterday I mentioned in the Opening Print how Philips, Interactive Brokers and TradeStation have all discontinued their forex brokerage operations in recent months. It’s get more and more difficult to navigate these markets. As much as computers control the futures markets, I’m afraid their influence over the offshore, over-the-counter, semi-regulated markets is even greater.

While You Were Sleeping

In the equity futures last night, the S&P opened at 2155.25, traded up to 2156.25 and then dipped early on. The ES eventually made a low on the European open at 2148.00, double bottomed there, and is now charging higher back up to 2152.25. All in all, as equities dipped in Asia and Europe, the S&P’s remained stable ahead of today’s NFP.

In Asia, 10 out of 10 open markets closed lower (Nikkei -0.23%), and in Europe 8 out of 11 markets are trading lower this morning (DAX -0.44%). Today’s economic calendar includes the Employment Situation, Stanley Fischer Speaks, Loretta Mester Speaks, Baker-Hughes Rig Count, Esther George Speaks, Consumer Credit, Treasury STRIPS, and Lael Brainard Speaks.

Our View

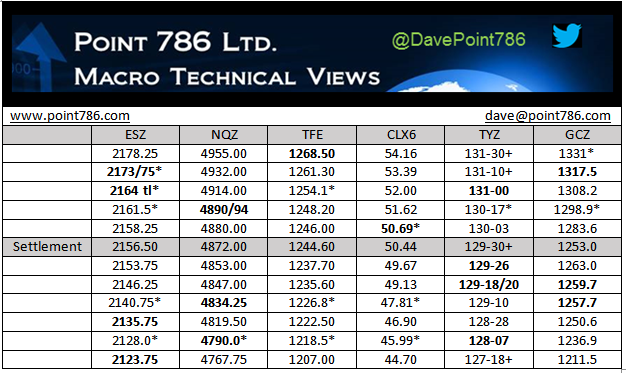

Today is NFP, and historically the September number is a miss, while the August number is revised higher. The first move typically is faded, but we tend to think that currently it’s a case of “bad news is good news” for the S&P. The ESZ may have sold off enough this week for buyers to come in and push up to 2170, but there are some sell stops below 2140 that lead to 2120. Our view is that between the 7:30 reaction and the 8:30 cash open a reversal may come. We are watching for that, but once it begins to trend in the regular session, we don’t want to step in front of the train. Remember, with a 50/50 chance of a December rate hike, every piece of key economic data will come into play.

As always, please use protective buy and sell stops when trading futures and options.