Market Brief

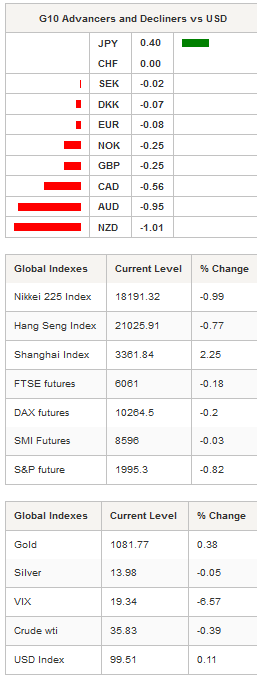

The US dollar was trading broadly higher during the Asian session and extended gains against almost G10 currencies; only the JPY managed to gain value. Emerging currencies and especially Asian currencies were broadly sold off with the Korean won dropping 0.75%, the Indian rupiah retreating 0.20% and the Thai baht falling 0.30%. Separately, the People’s Bank of China devaluated the yuan for the seventh day in a row by setting the fix to 6.5314 for $1, up 0.22% from yesterday’s mid-price. The PBoC appears more prone to devaluate the yuan now that the IMF included the Chinese currency in the SDR basket. Nonetheless, there is accumulating evidence that further adjustment to the downside is still to come. The latest data from China suggests the central bank is not done with easing measures. Caixin PMI services contracted to 50.2 in December from 51.2 in the previous month, while the Composite PMI fell below the 50 mark, which indicates a contraction, to 49.4 from 50.5 in November. Expect further cuts in the 1-year lending rate and the reserve requirement ratio.

Given Australia’s exposure to the demand from China, which absorbs more than 30% of Australia’s exports, the Australian dollar suffers spillover effects from renewed Chinese worries. The Aussie fell 0.75% in Sydney and is down more than 2.80% since the beginning of the year. Obviously, iron ore prices were under heavy selling pressure as futures collapsed 1.40% overnight. The New Zealand dollar fell 0.70% in Auckland and is currently testing the strong resistance at 0.6672 (50-day moving average). The Kiwi is set to pursue its ride to the downside. We expect further depreciation of the New Zealand dollar against the greenback, with the $0.6430 level as the next target, due to the country’s sensitivity to external demand.

After a rough start into 2016, EUR/USD stabilised above the $1.07 level. The pair broke the 1.0796 key support (low from December 7th), which sent a strong bearish signal; however, since then the single currency has been moving sideways. On the downside, the low from December 3rd standing at 1.0524 is the last obstacle before the 13-year low (1.0458) reached on March 20th last year. In spite of the monetary policy divergence between the euro zone and the US, we believe that the downside is quite limited for EUR/USD as the faltering recovering in the US will prevent the Fed from rapidly tightening its monetary policy.

On the equity market, the risk-off sentiment continues to weigh on most indices. However, Chinese markets recovered somehow and end up the session in positive territory with the Shanghai composite and Shenzhen Composite up 2.25% and 2.61% respectively. In Japan the Nikkei 225 fell 0.99%, while the broader TOPIX index slid 1.05%. Hong Kong’s Hang Seng fell paired losses, down 0.77%. In Europe, equity futures are wearing red this morning. Euro Stoxx 600 down 0.14%, DAX -0.20%, FTSE -0.18% and SMI -0.03%.

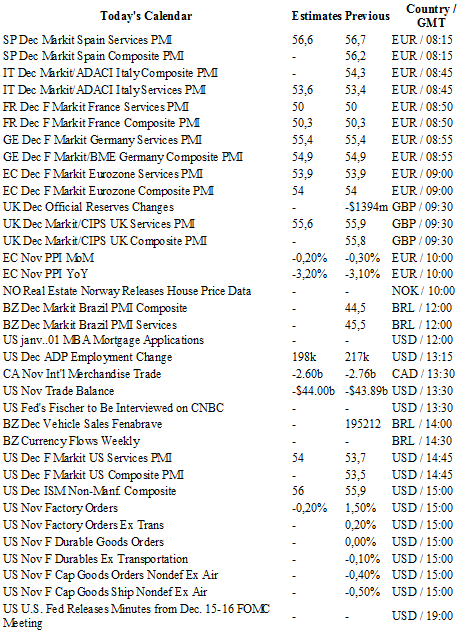

Today traders will be watching Service/Composite PMIs from Spain, Italy, France, Germany, UK, US, Brazil and the euro zone; PPI from the euro zone; MBA mortgage application, durable goods orders, ADP employment change, trade balance, ISM non-manufacturing and factory orders from the US.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0727

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5529

R 1: 1.5242

CURRENT: 1.4625

S 1: 1.4566

S 2: 1.4321

USD/JPY

R 2: 125.86

R 1: 123.76

CURRENT: 118.56

S 1: 118.07

S 2: 115.57

USD/CHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 1.0098

S 1: 0.9786

S 2: 0.9476