Wednesday April 18: Five things the markets are talking about

Global equities have drifted higher overnight, as investors take heart from a solid start to the earnings season and signs of improving relations between the US and North Korea.

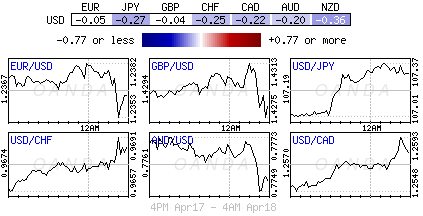

In FX, the ‘big’ dollar has found a small bid after the Fed said yesterday that US industrial production rose last month, a sign of underlying strength in the economy. Output at factories, mines and utilities rose a seasonally adjusted +0.5% from the previous month.

Note: Market consensus had expected the index to rise +0.4%, while February’s industrial production was revised to a +1% gain.

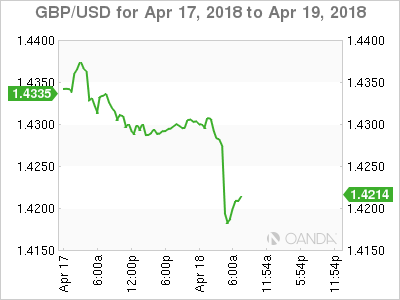

Sterling (£1.4186, down -0.75%) has been the big mover ahead of the US open, falling after UK annual inflation for March came in below expectations (see below) – the headline print has hurt rate ‘hawks’ as the miss may reduce the prospects for a May rate hike by the Bank of England (BoE).

In Europe, regional annual inflation rate also missed expectations in March (+1.3% vs.+1.4%e), which highlights the recent cautious rhetoric from ECB officials.

Elsewhere, oil has rebounded a tad after US crude stockpiles fell, while safe haven assets such as gold have declined.

On tap: The Bank of Canada (BoC) is next up with its monetary policy decision at 10:00 am EDT. Press conference is to follow at 11:15 am EDT.

1. Stocks in the ‘black’

In Japan, the Nikkei share average raced to a seven-week high overnight, supported by risk appetite and a weaker yen lifting shares across the board. Also helping the mood was an easing political tension on the Korean peninsula. The Nikkei ended +1.4% higher, while the broader TOPIX rallied +1.1%.

Down-under, Australia’s S&P/ASX 200 rallied +0.3% on Wednesday, buoyed by mining shares, but gains were capped by losses in banking and healthcare stocks. In South Korea, the KOSPI ended higher, closing up +1.07%.

In Hong Kong, stocks rallied overnight, breaking a four-day losing streak, as China’s surprise cut in banks’ RRR supported financial shares. The Hang Seng index rose +0.7%, while the China Enterprises Index also gained +0.7%.

In China, banking firms also buoyed stocks. The blue-chip CSI300 index rose +0.5%, while the Shanghai Composite Index gained +0.8%.

In Europe, regional indices trade higher once again with notable strength in the FTSE 100 as weaker UK inflation data lifts the index.

US stocks are set to open in the ‘black’ (+0.2%).

Indices: STOXX 600 +0.1% at 381.2, FTSE100 +0.8% at 7286, DAX +0.1% at 12601, CAC 40 +0.4% at 5374, IBEX 35 +0.2% at 9823, FTSE MIB +0.1% at 23675, SMI +0.7% at 8883, S&P 500 Futures +0.2%

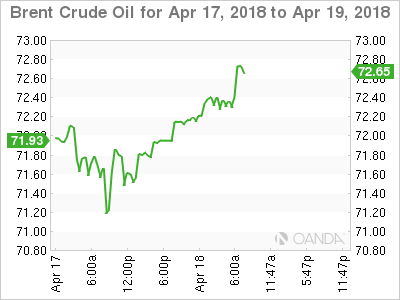

2. Oil bid on fall in U.S inventories and global supply risks, gold lower

Oil prices are better bid, lifted by a reported decline in US crude inventories and by the ongoing risk of supply disruptions.

Brent crude oil futures are at +$72.07 per barrel, up +49c or +0.7%from Tuesdays close. US West Texas Intermediate (WTI) crude futures are up +49c, or +0.7% at +$67.01 a barrel.

Note: In the US, yesterday’s API crude inventories numbers fell by -1m barrels last week to +428m barrels,

Expect the market to take its cue from today’s weekly EIA report (10:30 am EDT).

Outside the US, oil markets continue to receive support from potential supply disruptions concerns in the Middle East, renewed US sanctions against Iran and falling output as a result of political and economic crisis in Venezuela.

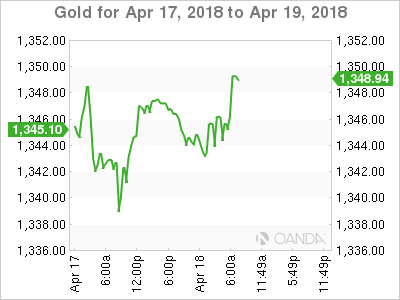

Ahead of the US open, gold prices have slipped after rising for three consecutive sessions as investors opted for riskier assets, with the dollar holding its gains on the back of upbeat domestic economic data. Spot gold is down -0.3% at +$1,343.31 per ounce, while U.S gold futures for June delivery has fallen -0.2% to +$1,346.30 per ounce.

3. US short-term notes extend declines, narrowing 2/10’s yield gap

The gap between short and long-term US Treasury yields continued to shrink, which is reflecting market confidence that the Fed will keep raising interest rates even as investors grow sceptical about the outlook for economic growth and inflation.

Note: US 10-year Treasury note has backed up to +2.840%, while the yield on the two-year note is at +2.398%.

After widening early this year, the 2-10 spread has been shrinking for more than two months, resulting in a flatter yield curve. It’s at +0.442% vs. +0.78% in early February.

Elsewhere, on weaker EU and UK inflation expectations Germany’s 10-year yield has dipped -1 bps to +0.50%, the lowest in a week, while the 10-year Gilt yield sank -4 bps to +1.436% percent, the lowest in a week.

In China, their 10-year bond yield has also plummeted after the PBoC cut the reserve-requirement ratio for banks yesterday.

4. Dollar finds some support

The ‘big’ dollar is slightly better bid against G10 currency pairs, supported mostly by the continued disappointing inflation data out of Europe.

GBP/USD (£1.4191) is trading below the key £1.42 handle, falling -0.77% outright after this morning’s disappointing March inflation data (see below). Market expectations for a May BoE rate hike have moved only marginally lower from +86% to around +78%, however, any additional hikes down the road is very much put in question.

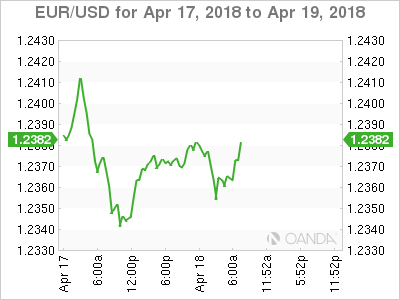

Like wise for the ‘single’ unit, the EUR/USD (€1.2365) is softer by -0.2% as this mornings March Final CPI data was revised lower to +1.3% vs. +1.4%e. The headline print supports the recent patience rhetoric from ECB members on achieving the inflation target.

USD/JPY (¥107.25) is a tad higher, helped by prospects of reduced trade tensions and an easing in geo-political tensions.

Note: US President Donald Trump to meet Japan’s PM Shinzo Abe today and there are reports that CIA Director Pompeo met with North Korean leader Kim during visit to North Korea over Easter.

5. UK inflation cooled in March

Data this morning that inflation in the UK cooled by more than expected in March, but price-growth nevertheless remains well above the BoE’s +2% annual target.

Consumer prices rose an annual +2.5% in March, which is a slower rate of growth than the +2.7% annual pace recorded in February.

Digging deeper, the slowdown was driven by clothing prices and prices for tobacco and alcohol, which increased in March at a much slower rate than they did a year earlier.

Note: The cooling in inflation may suggest that the squeeze on household budgets is coming to an end.

The BoE has telegraphed that it expects to lift its benchmark interest rate two or three times in the next few years to bring inflation back to its +2% annual target.