- FTSE 6159 -31

- DAX 9917 -34

- CAC 4438 -24

- IBEX 9019 -32

China, oil and Aussie elections

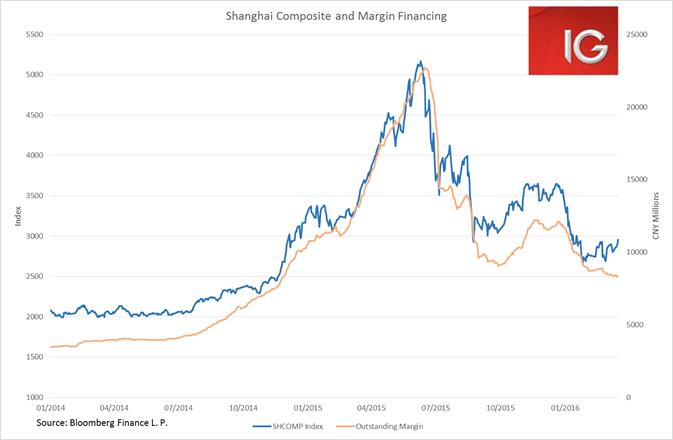

Chinese markets surged today after the government announced they were loosening requirements on margin financing, with the Shanghai Composite breaking above 3000 for the first time since 19 January. However, market performance in the rest of Asia was far more negative after a bounce in the US dollar and pullback in oil prices weighed strongly on the rest of the region. After the biggest two-day fall in the US dollar since 2009, it was not wholly surprising to see some moderation on Friday and the dollar has continued to strengthen, particularly against commodity-currencies, during the Asian session. The Aussie and kiwi dollar both pulled back from their multi-month highs.

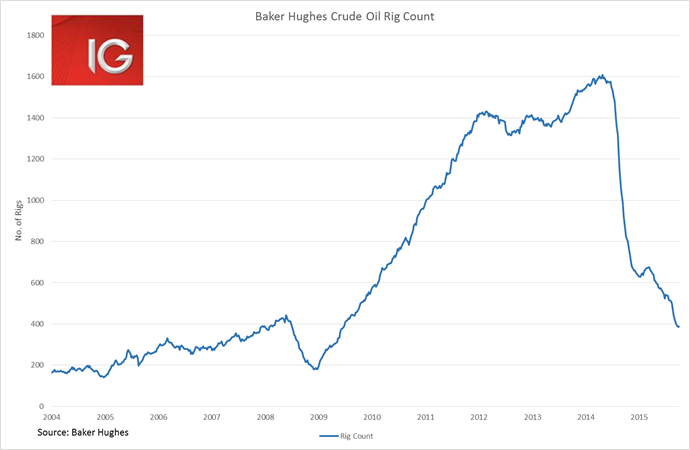

The Baker Hughes crude oil drill rig count on Friday has re-emphasised concerns that the recent rally in oil may upset the slow supply/demand rebalancing of the market. Crude oil drill rigs increased by 1, the first increase since the week ending 13 November. A number of US shale plays are profitable at US$40, and the uptick in the rig count seems to have worried the market that the increase in prices could see a pickup in output adding to already record-high inventories. The API and DOE inventories this week will be very volatile for the oil price in the wake of rig count, and any increase seen on the previous week could fuel the oil price pullback.

China stimulus déjà vu

The Chinese government is clearly pining for the days of yore when domestic stocks and property investment both moved up in tandem. The China Securities Finance Corporation loosened controls on margin lending on Friday and Chinese markets have responded in kind, rallying aggressively as soon as they reopened.

Heavy fiscal spending on the government’s part has helped restart property construction in 2016, while monetary easing and weakening home purchase downpayment requirements have helped spur property sales.

The stimulus taps are clearly being turned back on, despite new government efforts to rein in debt such as the new debt-equity swaps being offered to Chinese banks. The “reflationistas” and heavy spenders of Chinese politics seem to have come out the winners from China’s recent NPC. And one wonders whether part of the reason behind this stimulatory push is due to the fact that top members of the Chinese leadership are positioning themselves for the five out of seven Politburo Standing Committee seats that will become available at 2017’s 19th Party Congress. Nonetheless, this renewed passion for stimulus could continue to provide a lift to China-related assets for the next few months.

Double Dissolution, RBA and the Aussie Dollar

After the Australian government managed to pass the Senate reforms after an all-night session on Friday, the intention of the government is to clearly go for a “double-dissolution” (where both the House of Representatives and the Senate are dissolved) election on 2 July. Prime Minister Malcolm Turnbull confirmed this was his intention today, recalling parliament from 18 April to debate the ABCC Bill, whose subsequent rejection would provide the trigger for the double dissolution election. He also brought the budget forward to 3 May, and announced: “If we do proceed to a double dissolution, the election will be on Saturday, 2 July.”

This is a net positive for the Aussie dollar, holding all things equal, in that it kills the possibility of the RBA cutting rates in Q2 and Q3 as they will not want their rate decision to be viewed as trying to affect the outcome of the election. RBA governor, Glenn Stevens, is also set to retire in September, meaning that the first meeting any newly appointed governor could change monetary policy would be in November.

However, such a scenario depends on whether the eight cross-bench senators choose to vote down the ABCC legislation again, providing the trigger for the double dissolution election. The government already has four votes from its required six from the cross-benchers, so this largely boils down to whether independent Senators Jacqui Lambie and Glenn Lazarus continue to oppose the bill or vote with the government to save themselves from potentially losing their seats in a double dissolution. Although even if they both to changed their minds, Nick Xenophon, who is set to keep his seat and helped vote through the Senate reforms, could potentially vote against the ABCC Bill arguing that a new Senate is more important. At the current juncture, the point appears moot as Glenn Lazarus has categorically denied that he would vote for the ABCC Bill today. This basically guarantees a Double Dissolution trigger, and, by extension, Australian interest rates staying on hold till at least November.