by Eli Wright

Global equity markets continue to rally and have been remarkably upbeat recently, with U.S markets particularly buoyant since the US election. US markets closed the holiday shortened-week last week on thin volume but at all-time highs.

The S&P 500 Consumer Staples in particular helped boost the market; it gained 0.8% on Black Friday. Bricks-and-mortar sales declined 10.4% from last year. However, online sales boomed, increasing by a whopping 21.6%. It's likely that as Cyber Monday kicks off, e-tail could see another big jump. The National Retail Federation expects total holiday season sales to grow by 3.6% this year, to $655.8 billion.

This coming week also features a variety of market-moving economic announcements that will surely affect US markets: Tuesday's US Q3 GDP update, Wednesday's monthly Pending Home Sales report and Friday's big event, monthly Nonfarm Payrolls.

Perhaps most important, all eyes will be on Vienna this Wednesday in anticipation of OPEC's ability—or lack thereof—to finally come to some consensus on an oil production freeze deal between member and non-OPEC producers.

There might also be an additional, market-moving wild card: will the push for vote recounts in several swing states orchestrated by Jill Stein, but aided by the Clinton campaign team, upset the equilibrium? As of this writing, only Wisconsin has opened recount proceedings, but there have been requests for additional recounts this week in Michigan and Pennsylvania.

In Asia overnight, the Nikkei edged 0.13% lower, closing at 18,356.89. The Shanghai Composite Index gained 0.43%, closing at 3,275.94. It's headed towards a 9.2% gain this quarter, the largest such rally for the beleaguered index this year. The Hang Seng rose 0.45%, to 22,826. Fears that an OPEC output deal might not materialize at this week's Vienna meeting weighed on markets.

In Europe markets opened lower, the DAX is currently down 1.03% to 10,592; the FTSE is down 0.93% to 6,776.90 and the Stoxx 50 is down 0.86% at 3,020.50.

Though trading was thin last Friday in the United States, Wall Street still finished the week at record highs once again. The Dow gained, 0.36%, to close at 19,152.14; the NASDAQ increased 0.34% to 5,398.92; the S&P 500 moved up by 0.39%, to 2,213.35. For the week, all three majors gained approximately 1.5%. Small caps also gained, as the Russell 2000 added 0.37% to hit a new record close of 1,348.47. The VIX is currently at 12.34.

Wall Street is set to open a tad lower today, as the S&P, NASDAQ, and Dow are all down in pre-market trading: 0.42%, 0.34%, and 0.4%, respectively.

The U.S. bond sell-off seems to have paused, with yields down across the board: the 2-year Treasury yield is now 1.111%; the 10-year yield is 2.329%; and the 30-year yield is down to 2.988%.

Additional economic events that could have an impact on markets this week include:

- On Tuesday, CB Consumer Confidence is forecast at 101.2.

- On Wednesday, the ADP National Employment Report is expecting to show 165K new jobs.

- On Thursday, the ISM Manufacturing PMI has an expected reading of 52.2.

Forex

After a three-week rally, the US dollar encountered some resistance on Friday, falling 0.28%, to 101, but it doesn’t look like it's time to sell just yet. If the dollar does drop, the retracement is likely to be brief and shallow, and may provide a good entry point for additional gains.

ECB President Mario Draghi will speak later today and his pro-QE stance, combined with Italy’s uncertainty in the face of the December 4 referendum on the country's Senate reform, could push the EUR/USD yet lower. Eurozone CPI, German Manufacturing PMI and German employment numbers are all scheduled for release this week which could also drive the euro's trajectory.

Sterling, meanwhile, appears to be on course for its strongest month in over seven years. While trading relatively flat against the USD, the Pound Sterling Index has gained more than 5% in the past 30 days. However, if Theresa May triggers Article 50 during March 2017, in order to begin the Brexit, the cable could plummet. Some Deutsche Bank analysts see sterling at just $1.06 by the end of next year.

The Aussie, kiwi, and loonie all moved higher versus the greenback, as investors pulled out of their dollar positions following the recent USD surge.

Commodities

Oil prices haven’t waited for the close of this week's OPEC meeting in Vienna before falling. Two of the largest oil producers, Iran and Iraq, want deal exemptions, while Russia has agreed to freeze production “at current levels” – which is approximately half of what OPEC wants. A production cap at current levels would mean Russia is pumping 200,000-300,000 bpd less than planned in 2017. However, OPEC wants to curb output by 500,000 bpd. Saudi Arabia has cancelled talks with Russia ahead of the Vienna meetings. Predictably, oil prices were dragged down as a result. Crude fell 4.11% on Friday, and is now trading at $46.17. Brent dropped 3.9% to end the week, and is currently at $48.38.

It would not be inconceivable for oil to fall further. There are strong decision points at $43.21 and $43.59 for Crude and Brent, respectively.

Gold continues to slump, falling a further 2.51% last week, to close at $1,183, close to its 10-month low. Sellers may try hard to break even at the $1,200 swap line. However, they are under heavy pressure, and the current downtrend could drag gold down to $1,160 fairly quickly. The precious metal is currently trading at $1,190.

Silver, currently at $16.75, is still hovering near critical $16 support. At the same time, base metal copper jumped almost nine percent last week. It rose 2.5% just on Friday, when it reached a 17-month high of $2.682. Although the upward trend is being boosted by the improving demand outlook, some of Friday’s gains could be attributed to the weaker dollar. Therefore, there could be a small retracement should the dollar reverse. Iron ore also ended the week up 0.83%, at $71.81.

Stocks

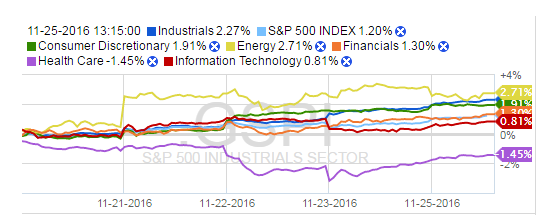

Four sectors have outperformed the overall S&P 500 during the past five days: Energy, Industrials, Financials and Consumer Discretionary.

Energy stocks had the best week, up 2.71%, boosted by higher oil prices. However, with chances for an OPEC production freeze deal rapidly fading, the energy sector might head back down as the week progresses.

Consumer Discretionary stocks rose 1.91%, on the wave of encouraging Thanksgiving and Black Friday online sales. As long as shoppers still have some cash left in their wallets for Cyber Monday, this could potentially be one of the best-performing sectors over the next few days.

Industrials and Financials have been the biggest beneficiaries of the Trump rally. Industrials rose 2.27%, on the continuing belief that Trump will invest heavily in infrastructure. At the same time financial institutions gained 1.3%. They've been boosted by the hope that Trump will repeal Dodd-Frank banking regulations. The nearly 100% chance of a Fed interest rate hike in December is also positive for banks. According to one measure, super low interest rates may have cost banks $250 billion over the past six years, so the prospect of potential change for the better should be pleasing to investors.

IT stocks lagged the overall S&P, gaining just 0.81%. The Health Care sector brought up the rear, losing 1.45%, in part due to a poor earnings report from Medtronic PLC (NYSE:MDT) which tumbled nearly eight percent lower after the call. Patterson Companies (NASDAQ:PDCO) fell 16% on poor earnings results. Disappointment of a another sort pushed Eli Lilly (NYSE:LLY) shares lower as well, when its experimental Alzheimer's Disease drug failed its clinical trial. Shares fell 11% on the news and are now trading lower by 10%.

Overall, it's been a tough year for the Pharma sector, as pricing scandals, the collapse of companies such as Valeant (NYSE:VRX) and Theranos and uncertainty about the future of Obamacare leave markets jittery.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.