by Eli Wright

US markets have been cautious ahead of Donald Trump’s presidential inauguration on Friday. Major Wall Street indices dropped yesterday, and the US dollar—though up slightly this morning—fell one percent following comments by Trump (that were echoed in gentler form by Anthony Scaramucci, the president-elect's representative at Davos), describing the dollar as 'too strong.' Oil is down as well, possibly in part because of increased US shale production.

Overnight in Asia, the Nikkei gained 0.43% to 18,894.37; the Shanghai Composite inched 0.12% higher, to 3,112.49; and the Hang Seng rose 1.13% to 23,098.26.

In Europe this morning, the FTSE is up 0.22%, at 7,237.25; the DAX is 0.17% higher, at 11,560.00; and the Stoxx 50 is flat at 3,288.50.

Yesterday, US markets all closed lower: the Dow and S&P 500 both slid 0.3%, to 19,826.77 and 2,267.89, respectively, while the NASDAQ lost 0.63%, to close at 5,538.73. The small-cap Russell 2000 also broke lower, falling 1.47% to 1,352.82.

In pre-market trading the momentum appears to have reversed. The Dow and S&P are up 0.12% and the NASDAQ is up 0.15%.

US Treasury yields have edged higher today: the 2-year yield is 1.164%; the 10-year yield is 2.345%; and the 30-year yield is 2.944%.

Forex

The dollar has recouped some of yesterday’s losses, with the Dollar Index currently up 0.2% at 100.52.

The greenback took a hit after Trump said in a Wall Street Journal interview on Friday that the dollar was too strong. Anthony Scaramucci, Trump's Director of Public Liaison followed-up at the World Economic Forum by saying,

“We need to be careful about the rising currency, not just because of what is going on internationally but it will have an impact internally to the United States as well.”

CPI data due out this morning could help the dollar move higher, as could Fed Chair Yellen’s speech later this afternoon.

Yesterday's biggest news was Theresa May’s speech outlining her Brexit plans. After earlier remarks intimating the likelihood of a 'hard Brexit' May softened her tone yesterday by committing to a Brexit vote in parliament and repeatedly stating that she wants free trade with the EU as well as new, beneficial, global trade agreements. The pound rocketed higher in response, rallying by three percent versus the USD. However, the pound still has a variety challenges ahead, and its upward trajectory might just be temporary. Though currency markets liked what May had to say, the EU response hasn't yet been forthcoming. Right now sterling is down 0.68% , to $1.2328, and even with today's better-than-expected UK unemployement data, which reported that the claimant count decreased by 10.1K, the beleaguered cable hasn't yet received a boost.

Commodities

Risk-off sentiment has pushed investors toward gold and silver in recent days, and the precious metals are up 4.8% and 7.2% respectively since the New Year. As of this writing, gold is trading at $1,212.75 while silver is at $17.168.

With the value of the US dollar dropping, and real interest rates in the US remaining extremely low, gold has room to move higher. Looking at the technical chart, the yellow metal could reach $1,260 before encountering stronger resistance.

Silver could also climb higher, to $17.50. However, it might fail to break that line of resistance, and drop back below $17.

Oil prices have fallen 1.5% this morning, ahead of the OPEC monthly report, when oil market participants expect to get an idea of how the OPEC agreement to limit production is faring. Even if compliance to the deal is indicated, US oil production could put a dent in prices.

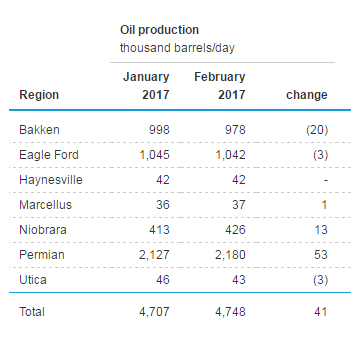

Just yesterday, the EIA reported that production from seven major U.S. shale plays is forecasted to climb by 41,000 bpd.

Source: EIA.gov

Crude is currently trading at $51.71 while Brent is at $54.66.

Stocks

Financial companies will continue rolling out earnings reports. On the docket for today, Goldman Sachs (NYSE:GS) is set to report Q4 2016 EPS of $4.82 on $7.49B in revenue, while Citigroup (NYSE:C) is set to report Q4 2016 EPS of $1.12 on $169.9B in revenue. TD Ameritrade (NASDAQ:AMTD), US Bancorp (NYSE:USB), and Northern Trust (NASDAQ:NTRS) are also set to report.

Big banks—including Bank of America (NYSE:BAC), JPMorgan (NYSE:JPM), Wells Fargo (NYSE:WFC), and Morgan Stanley (NYSE:MS)—have blown past earnings expectations in their most recent reports by an average of 13%. Nevertheless, shares of those companies, as well as many other smaller banks, finished mostly lower yesterday as investors bought into the stronger earnings expectations hype before the reports and sold the news.

It’s possible at this point that the financials have been oversold and today's reports might drive shares higher.

Kinder Morgan (NYSE:KMI), which owns and controls oil and gas pipelines, is expected to report Q4 2016 earnings per share of $0.19, on $50.05B in revenue.

Netflix (NASDAQ:NFLX) is set to report Q4 2016 earnings after the close, with expected EPS of $0.13 on revenue of $57.38 billion. The stock reached an all-time high this past Friday of $133.65 and shares are up 18% this quarter after Q3’s strong subscriber growth numbers. However, with an outsized P/E ratio of 357.04, long-term investors might want to make sure their entry price-point is justified.