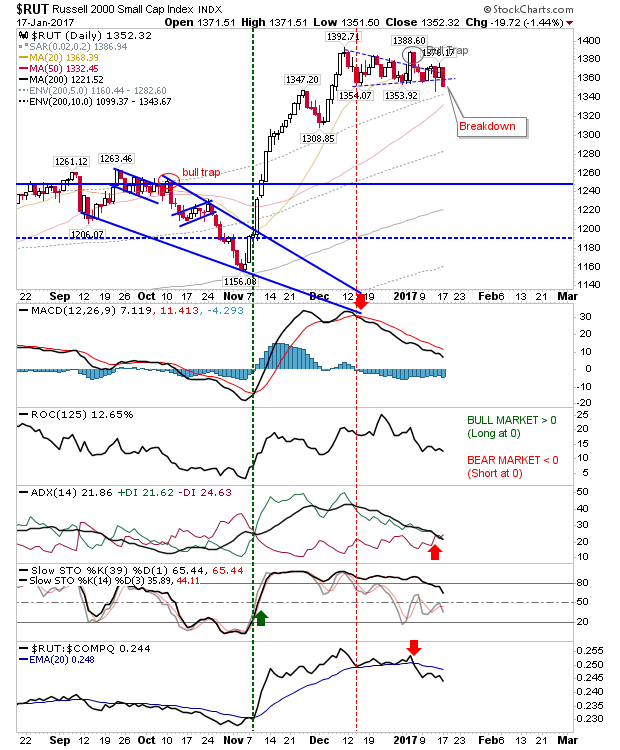

In the end, it was Theresa May rather than Donald Trump who yesterday set the Russell 2000 cutting through support to confirm the earlier 'bull trap'. This change coincided with a 'sell' trigger in +DI/-DI. Only stochastics are hanging on to its 'buy' signal.

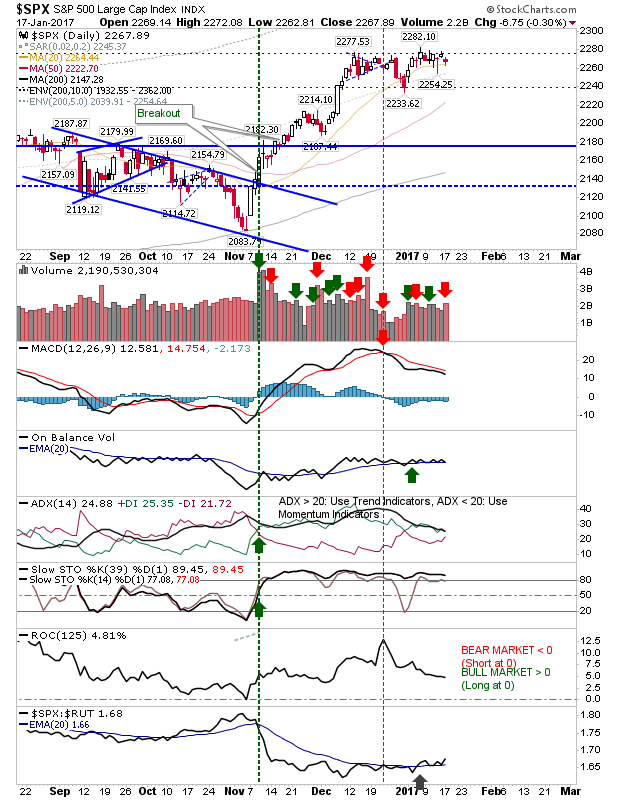

The S&P experienced heavier volume distribution yesterday, but there wasn't a big percentage loss, nor was there a break from the consolidation range.

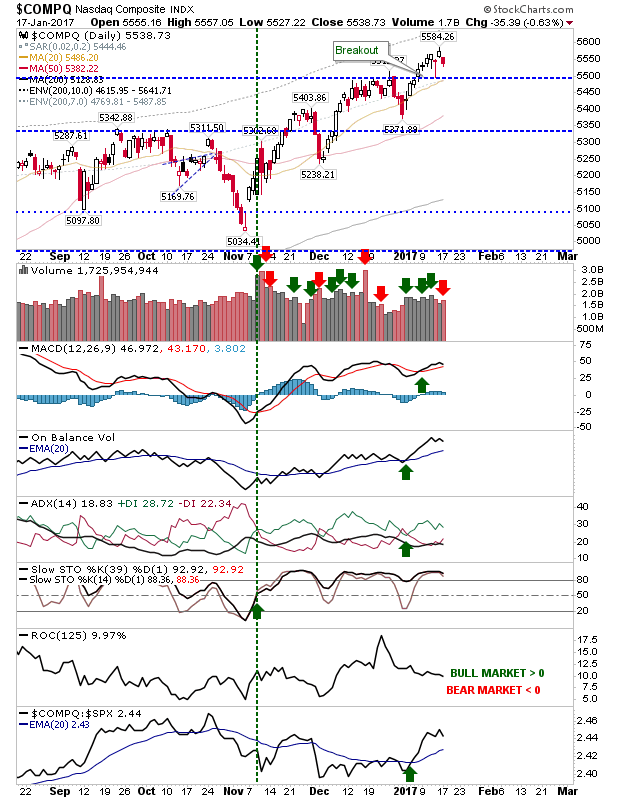

It was a similar story for the NASDAQ. It took a greater relative loss than the S&P, but it didn't challenge support from the breakout. However, look for such a test today. All supporting technicals remain in the green.

With the bank holiday weekend over, traders can again look to push the Trump/May agenda. Shorts can remain tied to the Russell 2000 - shorting rallies as they emerge. Longs should look to Large Cap indices and the short covering which is likely to follow once trading range resistance is breached.