by Eli Wright

The US dollar moved lower and nearly all global equity markets have wilted on low-volume, quiet holiday trading. Sell-offs dominated the exchanges yesterday and into this morning.

In Asia overnight, the Nikkei shed 1.3% on the back of a higher yen, as well as a further 16% loss for Toshiba Corp (T:6502). Over the past three days, the venerable Japanese conglomerate has plunged by 42%, after the company warned it could suffer multi-billion dollar losses stemming from cost overruns at its nuclear power subsidiary.

In China, the Shanghai Composite lost 0.17%. The Hang Seng edged mildly higher, up 0.04%, to 21,764.

In Europe, the FTSE is down 0.14%, to 7,095.10; the DAX is 0.27% lower, to 11,444.25; and the Stoxx 50 has fallen 0.08%, to 3,273.50.

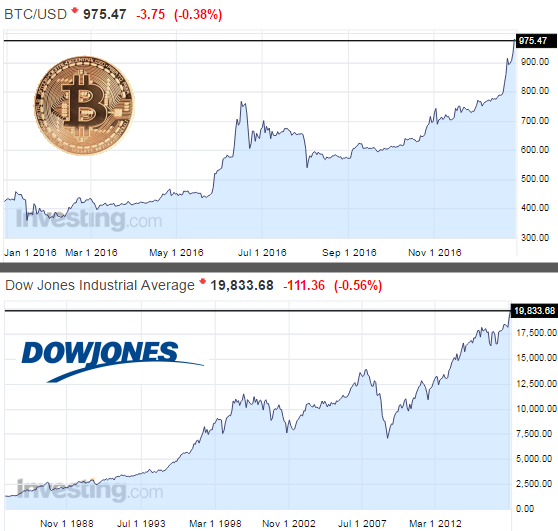

On Wall Street yesterday, volume was low, but volatility was higher—the VIX is up 9% over the past two days, to 13.14—and sell-offs proliferated. The Dow dipped 0.56%, closing at 19,833.68, while the NASDAQ fell 0.89%, to 5,438.56. The S&P 500 had its biggest decline in 54 sessions, dropping 0.84%, to 2,249.92. The S&P’s worst stock yesterday was, ironically, NVIDIA (NASDAQ:NVDA), which lost nearly seven percent on profit taking and a bearish call from Citron Research. The stock dropped to $109.25. NVDA remains the S&P 500's best performing stock of 2016, up 231.46% YTD.

In pre-market trading, the S&P is 0.03% lower. The Dow and NASDAQ are also down, 0.04% and 0.1%, respectively.

US bond yields have fallen. The 2-year yield is 1.246%; the 10-year yield is 2.481%; and the 30-year yield is 3.074%.

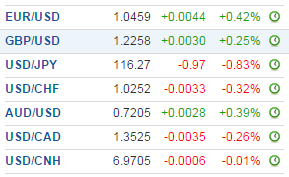

Forex

The US Dollar Index retreated to its lowest level in almost two weeks earlier this morning, as yesterday's US Pending Home Sales figures disappointed. The Dollar Index is down to 102.86.

The Japanese yen rose to ¥116.27 against the dollar, and the euro, which dropped to $1.0384 yesterday, is back to $1.0459.

Short-term price action aside, dollar prospects for 2017 are bullish: the Fed has said it plans to raise interest rates three more times, Treasury yields are up, and US stocks are near all-time highs, making the greenback attractive as well.

Bitcoin, which has been grabbing headlines the past few days due to its meteoric rise, saw a slight 0.08% retracement this morning, as it fell to $978.39. Nevertheless, the crypto-currency is up approximately 15% over the past week. Markets are taking bets on which asset will reach its benchmark first...will the Dow hit 20K before Bitcoin touches $1,000, or vice versa?

Commodities

Oil is on its longest winning streak since 2010, closing higher for ten straight days, as prices are up to levels not seen since July, 2015. Crude is currently trading at $54 while Brent is at $57.13.

As Michael Loewen, a commodities strategist at Scotiabank in Toronto, said by telephone:

“It seems like OPEC and non-OPEC are committed to this [production cut] right now. There’s some hopefulness in the market.”

A committee tasked with monitoring the deal compliance has proposed its first meeting for January 13, 2017.

In the US, Crude Oil Inventories are set for release this morning, with an expected drop of 2.06M.

Gold has been rising for three straight days. It’s up around 0.7% as of this writing, to $1,148.65.

Silver has climbed for four consecutive sessions. It’s up approximately one percent this morning, to $16.197.

Stocks in Focus:The Dogs of the Dow

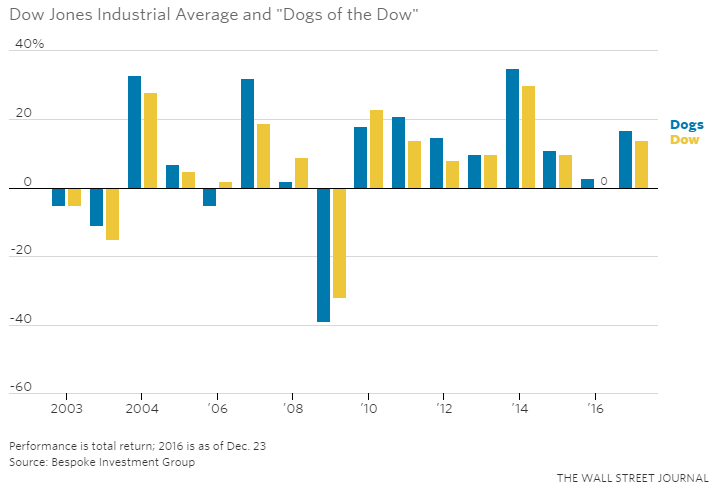

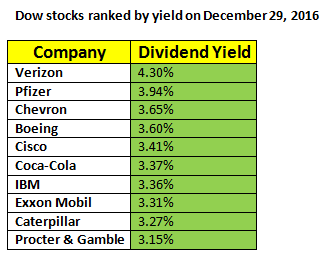

With just one more trading day left in 2016, it’s time to take a look at the Dogs of the Dow – the trading strategy wherein one buys the 10 highest dividend-yielding components of the Dow 30 on the assumption that (excluding dividend increases) yields rise when stock prices falls, making these blue-chip companies potential bargains. Stocks are held from the beginning of the year until the end, at which time, investors reassess performances and react accordingly.

The strategy has outperformed the overall index in ten of the past fifteen years.

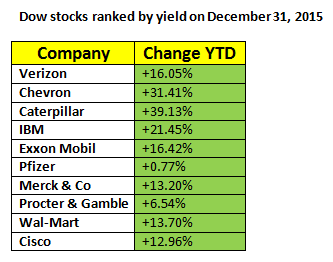

The 2016 dogs were Verizon (NYSE:VZ), Chevron (NYSE:CVX), Caterpillar (NYSE:CAT), IBM (NYSE:IBM), Exxon (NYSE:XOM), Pfizer (NYSE:PFE), Merck (NYSE:MRK), Procter & Gamble (NYSE:PG), Wal-Mart (NYSE:WMT), and Cisco (NASDAQ:CSCO).

Altogether, last year’s dogs are up approximately 17% in 2016, three percentage points higher than the Dow itself. The best performers were Chevron and Caterpillar, with Pfizer bringing up the rear, on gains of just 0.77%.

Heading into 2017, eight of the ten dogs remain unchanged. Only Merck and Wal-Mart will be dropped, replaced by Boeing (NYSE:BA) and Coca-Cola (NYSE:KO).

Of note, Coca-Cola is one of only two companies on the Dow—Nike (NYSE:NKE) being the other—to post a loss on the year. KO's shares are down 3.14%.

Interestingly, all gains occurred prior to the US election. After November 9, the dogs have lagged the DJIA by four percent. That's led analysts to wonder if the classic strategy will have legs in 2017 under Trumpian policies that are expected to be more business friendly.