- Is inflation peaking?

- Gold and the dollar slip

- Bitcoin moves higher

- European stock and bond markets are closed on Friday.

- US stock and bond markets are closed on Friday.

- The MSCI Asia Pacific Index rose 0.8%

- The MSCI Emerging Markets Index rose 0.8%

- The euro rose 0.2% to $1.0908

- The Japanese yen fell 0.3% to 125.35 per dollar

- The British pound rose 0.1% to $1.3129

- Brent crude fell 1.3% to $107.32 a barrel

- Spot gold fell 0.4% to $1,970.08 an ounce

Key Events

European stocks as well as US futures on the Dow Jones, S&P 500, NASDAQ 100 and Russell 2000 were fluctuating on Thursday, seemingly unable to draw any firm conclusions as the US earnings season starts.

Yesterday, JPMorgan Chase (NYSE:JPM) officially kicked off the proceedings by disappointing expectations—pressured by slowing revenue from its investment banking division. Chief executive Jamie Dimon said he sees possible "storm clouds ahead." However, some traders were more focused on Tuesday's lower than expected core CPI reading it as a sign that US inflation may be peaking.

Investors will be closely watching today's earnings releases from other major banks for additional insight.

The price of oil remains under pressure.

Global Financial Affairs

The current behavior of the major US indices is similar to their performance during the first coronavirus wave when the NASDAQ outperformed while shares listed on the Russell 2000 underperformed as the world adjusted to lockdowns and work from home mandates.

Technology contracts are probably benefiting from the slide in the 2-year Treasury yield, signaling traders were paring aggressive bets on US Federal Reserve interest rate hikes. Technology stocks typically sell off during a cycle of rate hikes as their valuations look more expensive.

European stocks edged cautiously higher after the STOXX 600 closed nearly flat yesterday following two down days. The market is focusing on the exact timetable for the end of the European Central Bank's bond buying program as the bank has repeatedly promised it would not raise interest rates before it completely unwinds its asset purchases.

The pan-European gauge may be forming a small rounding top after finding resistance by the 200 DMA. The 100 DMA crossed below the 200 DMA, complementing the Death Cross when the 50 DMA fell below the 200 DMA amid the drop to the March low. The 50 DMA is the last support before the benchmark retests the Mar. 7 trough. Both the MACD and ROC provided sell signals.

Earlier Thursday, Asian stocks tracked Wednesday's US stocks action and closed higher, as Treasuries eased and China's State Council said that monetary policy tools, which include reductions in banks' reserve requirement ratios, should be used in a timely way in an attempt to support the economy as the Chinese government's zero-COVID policy means lockdowns are still in place there. The Shanghai Composite rallied 1.22%.

In Japan, the Nikkei 225 also rose 1.22% as stocks climbed with an increase in overseas investors. The market saw the sharpest rise in weekly inflows since September. Some of the incoming flow came after the Tokyo stock exchange tightened standards on trading liquidity and corporate governance.

On Wednesday, all four major US indices rose at least 1%, with the NASDAQ 100 and Russell 2000 gaining almost 2%. The move seemed to imply that both small caps and large-cap technology shares benefited from the same theme—upcoming US interest rate hikes may not be as aggressive as previously thought. Either way, investors were adding risk to portfolios with defensive Utilities the only S&P 500 sector in the red.

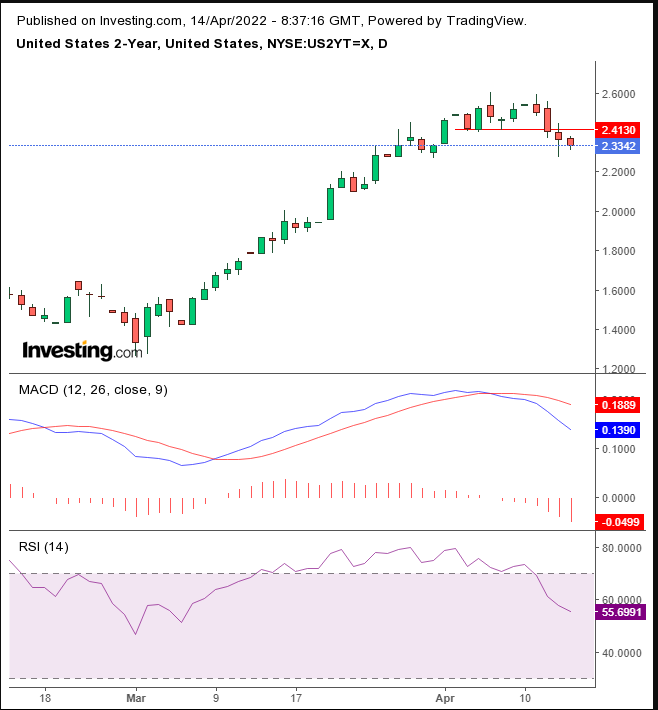

Treasuries at the front end of the curve climbed, including the 2-year note, another indication that the market is reconsidering how fast the Fed will hike rates. This dynamic comes despite recent hawkish comments from some Fed officials.

The reason for the change was the US consumer price data release which suggested inflation might be topping out. The yearly rate was an expected 8.5% but the core rate was lower than forecast. However, when examining the bigger picture, it seems that producer price activity shows the opposite.

While the 10-year yield fell was slightly higher, the 2-year yield declined for the fourth consecutive day.

The 2-year yield topped out in the short term, confirmed with the MACD providing a bearish cross and the RSI topping out.

The dollar opened lower amid the about-face from traders on the interest rate outlook.

Yesterday's trading completed a Bearish Engulfing pattern which occurs when the price opens higher and closes below the last opening price. This move demonstrates a failed bullish attack, which gives ground to bears. We consider this bearish behavior as the start of a Return Move to the continuation structure, which reinforced the H&S Continuation pattern.

Gold also dropped, ending a five-day winning streak. We had been pointing out the anomaly of gold rising while the dollar strengthened. Now, we're seeing the opposite anomaly.

The yellow metal is falling on an expectation of lower rates, which should boost the price. Perhaps rising demand for short-term bonds rerouted capital away from the commodity haven.

Bitcoin eked out a third day of gains.

Can we rely on the cryptocurrency rallying along with the rising channel? Not necessarily, considering the preceding, more oversized H&S top.

After having already well surpassed the $100 mark to reach $104 on Wednesday, oil receded amid dampened demand from China due to coronavirus restrictions.

WTI's trading behavior rendered the Symmetrical Triangle moot, in our opinion, as the price meanders through its apex.