by Pinchas Cohen

Key Events

After global stocks turned in a mixed performance yesterday, all four major US indices fell, for the first time in three days.

The Dow Jones Industrial Average declined 0.15 percent; the S&P 500 was off 0.32 percent; the NASDAQ Composite fell 0.42 percent while the Russell 2000 had the hardest landing, dropping 0.8 percent.

These losses are puzzling. Why did this occur yesterday, at the same time that the US Congress was on the verge of finally passing the much anticipated tax reform legislation, after the House easily approved the bill before sending it to the Senate (which approved the overhaul early this morning)? After all the eager anticipation and heated market reaction to the possibility of tax cuts, which buoyed US equities to a streak of new records, this further step brings investors to the very brink of the most sweeping tax overhaul in decades.

With just a final vote remaining in the House, tax reform could be a reality by Christmas. At the risk of stating the obvious, even if the long-term economic outlook might be uncertain, in the near-term, lower corporate and individual tax rates are widely anticipated to increase growth over the next year or two. Therefore, yesterday's selloff is surprising, particularly with investors rotating out of the Russell 2000, whose domestic small caps stand to benefit the most from reduced corporate rates.

So, why the selloff?

- The bill's passage may already have been priced in. With investors just steps from the 'finish line' they may have finally taken a breather and realized they were dealing with an overpriced market, ripe for a sell-off. However, that doesn't completely hold water. Post the Brexit vote of June 2016, equity investors have proven themselves resilient (or foolhardy, depending on who you ask) regarding what many may consider risk. In general investors have held on to their stocks, even buying more at higher prices when the risk was more potent and even tangible. For all intents and purposes, the extra required vote is a minor setback.

- Another view: traders followed the old Wall Street adage, "buy the rumor, sell the news." With market returns thus far this year surpassing expectations and tax reform all but in the bag, many traders may have assumed a correction was imminent anyway, so they might as well take profits early.

- Or perhaps the shape of the final bill isn't living up to expectations. In order to move it through Congress many of the bill's specifics were changed over the last few weeks. While the original version was drafted with a focus on corporate tax reform, it has been reworked to focus more on individual tax cuts. This change has substantial ramifications for growth. It takes money out of corporate coffers and reroutes it into consumers' pockets. However, from an investor/shareholder perspective, the money diverted into consumer pockets by the bill’s refocus has been taken out of their own holdings, making the final bill something of a disappointment from the corporate perspective.

Whatever the actual reason, it was an across-the-board selloff , touching all sectors—Real Estate, a cyclical growth sector and Utilities, a defensive sector, led the declines, with 1.89 percent and 1.82 percent respectively.

Global Financial Affairs

Ironically, when stocks skid, bonds generally receive a boost. However, global bonds including Treasuries have extended their selloff exponentially to a third day, as each day pushes yields up in rising increments.

The US 10-year Treasury yield advanced 0.77 percent on Sunday, 1.04 Monday and leaped 2.72 percent on Tuesday.

So why would Treasuries be sold off now, together with stocks? Consumer spending is responsible for more then 70 percent of economic growth in developed economies. Therefore, more money in consumer pockets increases the odds for inflationary pressure, which improves the outlook for rising rates later, rendering the current rates unattractively low.

As well, Treasury yields extended gains, climbing to session highs, on better-than-expected domestic home construction, reaching a 13-month high, suggesting a booming housing market, a key benchmark for economic growth.

This morning Japanese shares rose, though ironically, construction shares extended a selloff triggered by a suspected bid-rigging scandal. Financial shares —whose firms invest in US Treasuries since yields on Japanese sovereign bonds are negligible—led the gains.

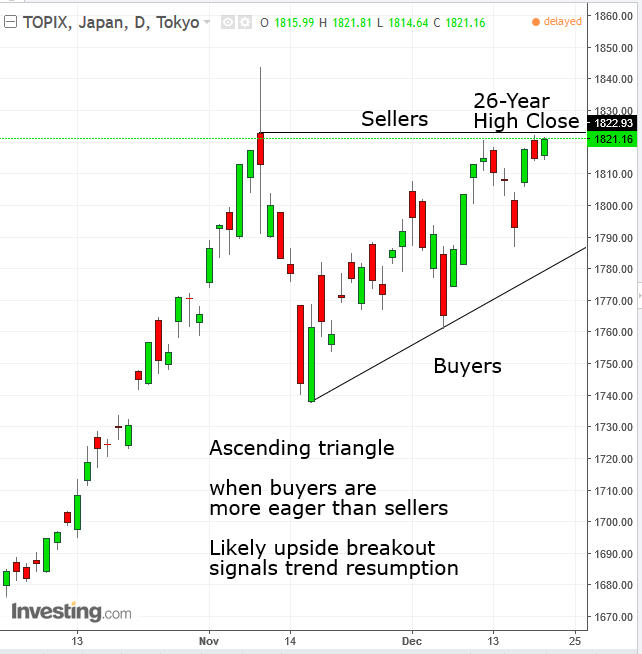

Japan’s TOPIX hit its highest closing price since November 1991.

China’s Shanghai Composite as well as Hong Kong’s Hang Seng fell. South Korea's KOSPI fell too, led by tourism shares which were dragged down by a report that China is banning package tours to the country.

Of interest, investors seeking valuations relative to earnings will find that Asian shares, with 13 times earnings, are currently among the cheapest globally.

The Stoxx Europe 600 drifted this morning amid mixed signals from regional benchmarks. The Real Estate and Technology sectors weighed on most other industry sectors pulling everything lower. Most European bond yields edged lower alongside U.S. Treasury rates after yesterday’s jump which was sparked by hawkish comments from US central bankers.

Miners gained as the Bloomberg Commodity Index advanced for a sixth day. Gold edged higher and industrial metals rose, led by nickel.

Oil gained as industry data showed a larger-than-expected drop in US crude stockpiles.

S&P 500 Futures moved higher after the underlying benchmark index slipped on Tuesday.

Up Ahead

-

- The U.S. and U.K. release updated estimates of third-quarter GDP on Thursday and Friday respectively.

- The Bank of Japan meets on Thursday to set monetary policy.

- Catalonia’s secessionists are at risk of becoming a minority in the Spanish region’s parliament with the main pro-unity party set to add seats in Thursday’s election.

Market Moves

Stocks

- Euro Stoxx 50 futures rose 0.1 percent in early European trading. Futures on the S&P 500 Index rose 0.3 percent after the underlying gauge declined 0.3 percent Tuesday.

- Japan’s Topix index was up 0.3 percent at the close in Tokyo, while the Nikkei 225 Stock Average rose 0.1 percent.

- Hong Kong’s Hang Seng Index fell 0.1 percent while the Shanghai Composite Index declined 0.3 percent.

- Australia’s S&P/ASX 200 was up 0.1 percent.

Currencies

- The Dollar Index was little changed.

- The euro traded at $1.1838 after climbing 0.5 percent Tuesday.

- The Japanese yen was at 112.94 per dollar after slipping 0.3 percent.

Bonds

- The yield on 10-year Treasuries was down one basis point at 2.45 percent after jumping seven basis points on Tuesday.

- German 10-year bund yields were little changed at 0.37 percent.

Commodities

- West Texas Intermediate crude was little changed at $57.71 a barrel after advancing 0.7 percent Tuesday.

- Gold was at $1,263.72 an ounce.