Market Brief

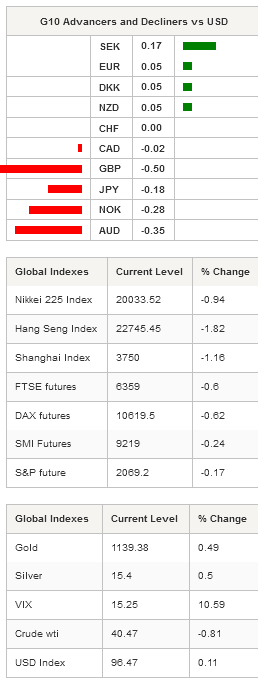

US 2-year Treasury yield dropped 8bps, the 10-year 11bps while the dollar lost almost 1% versus the euro, 0.50% versus the CHF and 0.70% against the NZD. In New York yesterday, the S&P 500 paired losses and retreated -0.83%, while the Nasdaq fell -0.80% and the Dow Jones -0.93%. There is no doubt, September-rate-hike-enthusiasts did not like the minutes of the last FOMC meeting. Fed members “judged that the conditions for policy firming had not yet been achieved, but they noted that conditions were approaching that point,” adding that “the Committee's communications around the time of the first rate increase should emphasize that the expected path for policy, not the initial increase, would be the most important determinant of financial conditions and should acknowledge that policy would continue to be accommodative.” Fed members seem to be pretty comfortable with the labour market, while some are still concerned about low inflation and wage pressure. In our opinion, a September rate hike cannot be ruled out but it’s not a coin flip anymore, December is appearing more and more likely.

In Asia, regional equity markets continue to lose ground as China weighs. Japanese Nikkei is down 0.94%, Hong Kong’s Hang Seng -1.82%, Shanghai Composite -1.16% and Shenzhen Composite -0.71%. The yuan continues to gain strength against the dollar as the PBoC raised its reference rate for fifth straight day to 6.3915. USD/JPY found a strong resistance at 123.78 (Fib 61.8% on June-July debasement) and is bouncing back toward 124.50, as the dollar regains strengthen in post-FOMC minutes trading. In Australia, the S&P/ASX is down -1.70% while AUD/USD erased previous losses, back around $0.7310. The kiwi consolidates gains against the dollar and is currently trading above the 0.66 threshold.

In Europe, equity futures follow Wall Street and Tokyo’s lead as they trade into negative territory. The Footsie is down -0.60%, the DAX -0.62%, the CAC -0.23% while the SMI is down -0.24%. After having reached 1.0960, EUR/CHF is heading toward 1.07 despite disappointing trade data. July trade balance printed at CHF3.74bn compared to a previous figure downwardly revised to CHF3.51bn. Exports contracted -1.7%m/m compared to -0.7% a month earlier while imports fell 2.5%m/m versus +2.5% previous month.

In UK, retail sales are due later today and are expected to have strengthen in July with median forecast of 0.4% versus -0.2%m/m in June. Overall, we remain bullish GBP as monetary policy divergence will remain the main driver. GBP/USD is trying to escape the 1.5450-1.5650 range and is currently trading above 1.5660. EUR/GBP remains our favourite currency pair to play the UK strong economic data and upcoming rate hike.

Today will be a busy day of economic data, with unemployment rate from Sweden; GDP from Norway; retail sales from UK; unemployment rate from Brazil; initial jobless claims, Bloomberg consumer comfort, existing home sales, Philadelphia Fed business outlook and finally, leading index.

Today's Calendar Estimates Previous Country / GMT JN Jul Convenience Store Sales YoY - 0.60% JPY / 07:00 SA Bloomberg Aug. South Africa Economic Survey (Table) - - ZAR / 07:00 DE Jul Retail Sales MoM 0.50% 0.60% DKK / 07:00 DE Jul Retail Sales YoY - 1.50% DKK / 07:00 SW 2Q Total No. of Employees YoY - 1.30% SEK / 07:30 SW Jul Unemployment Rate 6.90% 8.50% SEK / 07:30 SW Jul Unemployment Rate Trend - 7.60% SEK / 07:30 SW Jul Unemployment Rate SA 7.60% 7.40% SEK / 07:30 NO 2Q GDP QoQ -0.10% 0.20% NOK / 08:00 NO 2Q GDP Mainland QoQ 0.20% 0.50% NOK / 08:00 UK Jul Retail Sales Ex Auto Fuel MoM 0.40% -0.20% GBP / 08:30 UK Jul Retail Sales Ex Auto Fuel YoY 4.30% 4.20% GBP / 08:30 UK Jul Retail Sales Inc Auto Fuel MoM 0.40% -0.20% GBP / 08:30 UK Jul Retail Sales Inc Auto Fuel YoY 4.40% 4.00% GBP / 08:30 UK Aug CBI Trends Total Orders -10 -10 GBP / 10:00 UK Aug CBI Trends Selling Prices - 1 GBP / 10:00 AS ECB's Nowotny Speaks in Panel on - - EUR / 11:30 BZ Jul Unemployment Rate 7.00% 6.90% BRL / 12:00 BZ Bloomberg Aug. Brazil Economic Survey - - BRL / 12:00 CA Jun Wholesale Trade Sales MoM 0.90% -1.00% CAD / 12:30 US Aug 15 Initial Jobless Claims 271K 274K USD / 12:30 US Aug 8 Continuing Claims 2265K 2273K USD / 12:30 US Aug 16 Bloomberg Consumer Comfort - 40.7 USD / 13:45 US Aug Bloomberg Economic Expectations - 45.5 USD / 13:45 US Jul Existing Home Sales 5.43M 5.49M USD / 14:00 US Aug Philadelphia Fed Business Outlook 6.5 5.7 USD / 14:00 US Jul Existing Home Sales MoM -1.10% 3.20% USD / 14:00 US Jul Leading Index 0.20% 0.60% USD / 14:00 BZ Jul Formal Job Creation Total -115800 -111199 BRL / 22:00

Currency Tech

EUR/USD

R 2: 1.1436

R 1: 1.1278

CURRENT: 1.1068

S 1: 1.0809

S 2: 1.0660

GBP/USD

R 2: 1.5930

R 1: 1.5803

CURRENT: 1.5682

S 1: 1.5330

S 2: 1.5171

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 124.23

S 1: 120.41

S 2: 118.89

USD/CHF

R 2: 1.0129

R 1: 0.9984

CURRENT: 0.9751

S 1: 0.9571

S 2: 0.9151