After a heavy selloff yesterday, Asian markets welcomed the upbeat leads from US and European markets overnight. Volumes were down across the region with Japanese markets closed due to Culture Day. With Melbourne Cup holiday in Victoria, Australia, volumes on the S&P/ASX 200 were 20% below their 30-day moving average, while the Hang Seng and Shanghai Composite also saw low volumes.

Despite China’s manufacturing PMIs still lingering in contractionary territory, their slight improvement was welcomed by global markets still weary from Q3 China crash fears. With China hopefully no longer threatening an economic crash in Q4, focus will turn to potential moves from the Fed and the European Central Bank (ECB) as the primary macro drivers of global markets as we head into the end of 2015.

With the slew of US data this week, the primary focus is clearly on the Fed at the moment.

The US ISM PMI was right on the verge of contraction overnight, slowing to 50.1 from the previous month’s 50.2 (a reading below 50 indicates contracting output). There were some bright spots in the sub-components, with production and new orders both seeing a decent increase from the previous month. But this positivity was countered by a big decline in the employment component, which dropped to 47.6 from 50.5 the previous month. The employment measure is now at its lowest level since 2009.

This does not bode well for the all-important Non-Farm Payrolls data on Friday. The weak external demand environment and strong US dollar has clearly been impacting job growth in the manufacturing sector. Indeed many of the US regional PMIs are firmly in contraction territory. Further detail will be added to the employment picture when the ADP employment figures are released on Wednesday night.

Despite the fairly weak ISM PMI, the WIRP implied probability of a Fed December rate hike still held at 50%. The DXY dollar index did drop 0.3% in the wake of the PMI, but had largely recovered ahead of the Asian session. The US factory orders number tonight could take some of the steam out of the December pricing with expectations for a further 0.9% month-on-month decline, from a 1.7% decline the previous month.

Given the rally we’ve seen in global equities over the past 24 hours, some US data tonight that supports low rates for longer in the US will likely be taken as a positive by the markets. The hawkish statement by the Fed last week does seem at odds with much of the data coming out of the States at the moment, and one would expect market pricing of the first rate hike to increasingly reflect this.

The three-day rally in oil on the back of the increase in US refinery capacity utilisation last week was halted overnight. News that Russian oil output reached its highest level in the post-Soviet era saw the European benchmark Brent lose US$0.77, with the US benchmark only losing US$0.45.

This does look more like a temporary pullback, with oil still in a short-term uptrend. The performance of energy-related equities despite the pullback in the price supports this thesis. The energy sector was the best performer on the FTSE overnight, gaining 0.7%, and was also the best performer on the S&P 500, gaining 2.4%. These positive moves have been carrying over into Asia with a strong performance in the energy sectors in the ASX and the Hang Seng today.

WTI oil has traded fairly consistently within a US$43-$50 band over the past 2-3 months. One would expect the current momentum in the oil price to push it closer towards the US$50 region before we see much of a major turnaround.

The API oil inventory report will be released tonight, and then we will receive the much more closely followed EIA inventory report Wednesday evening. If we do see inventories steadying in the wake of increased refinery utilisation as we come to the end of the September-October maintenance season, that could see further rallies in the oil price.

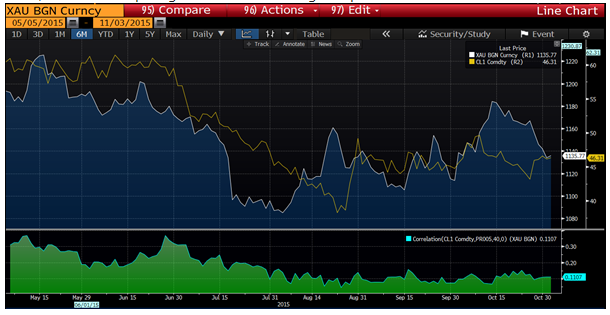

One other question the bounce back in oil prices provokes is whether we will also see a turnaround in the gold price in the short term. There is an imperfect but long-noted correlation between gold and oil. Gold has now dropped to its lowest level since early-October in the wake of the unexpectedly hawkish Fed statement. If US data does dint the chances of a December Fed rate hike this week, one would expect gold to start following oil upwards.

ASX

Unlike outside chance Prince of Penzance winning the Melbourne cup, the Reserve Bank of Australia (RBA) decision was in line with the bookies pricing. The RBA left rates on hold at their meeting today as expected by most in the market. However, there was a noticeable new dovish bias in the statement that will increase speculation for a rate cut at either the December or February meeting.

Clearly last week’s disappointing CPI number has impacted the RBA’s view on the economy, with the RBA noting that inflation is still within their forecast, “but a little lower than earlier expected”. In line with market pricing, the RBA has now left the door open to a cut in December or February as it notes that “the outlook for inflation may afford scope for further easing of policy, should that be appropriate to lend support to demand”.

The Aussie dollar had been rising throughout the day ahead of the RBA meeting and holding fairly steady at the US$0.7165 mark just ahead of the announcement. But there was some major volatility around the release with the Aussie diving to as low as US$0.7111 before spiking over US$0.72 a few seconds later. The Aussie then looked like it may even start to decline a few minutes after the meeting, but ten minutes later it did catch a steady uptrend as it moved pretty close to the US$0.72 mark.

After a big sell off and a worrying close below 5200 for the first time since 14 October yesterday, the ASX has rebounded strongly today. The ASX responded positively to strong leads from US and European equity markets overnight. Expectations for the Reserve Bank of Australia (RBA) to leave rates on hold at their meeting today may also have been feeding through to some positive sentiment on the outlook for the Australian economy.

The index was particularly hurt yesterday by the heavy selling in large-cap stocks, the Big Four banks and Telstra (AX:TLS) all had very poor days. But the high-yielding darlings of self-managed super funds had a strong day with the banks and telcos both gaining on the day.

The big weighting sectors of banking, materials and energy all saw solid gains, which supported a strong rise on the index as whole. A close above 5200 will help sentiment on the ASX, with the hope that yesterday’s disappointing close won’t be revisited soon.