May 1: Five things the markets are talking about

The yen has weakened; global yields have rallied, while equities have climbed as a tentative deal by U.S Congress to avert a government shutdown overshadows weaker economic data from China and the U.S.

The U.S House and Senate seems to have reached a bipartisan agreement yesterday on a +$1.1T bill to keep the government open through the end of September, ahead of a busy week for macro-economic events and data.

Tomorrow, the RBA announces its monetary policy decision followed by the FOMC Wednesday – no policy changes are expected.

Global manufacturing and composite PMI’s begin Tuesday, while Canada releases its March merchandise trade data.

On Friday, its the ‘crème de la crème’ of North American economic data, both the U.S and Canada will update their employment data for last month.

Elsewhere, the second round of the French presidential election takes place on May 7 and the market is also weighing the possibility of escalating tension between the U.S and North Korea.

1. Stocks little fussed in holiday trading

In Japan, the Nikkei hit a six-week high (+0.2%) as tech shares jump on earnings. The broader Topix index rose +0.5% to the highest level since March 29, after capping its biggest weekly gain of the year on Friday.

Down-under, Australia’s S&P/ASX 200 Index gained +0.6%, climbing for a seventh consecutive session for the longest winning streak in 10-months. However, volumes were down in thin trading from the 30-day average. In New Zealand, the S&P/NZX 50 Index advanced less than +0.1%.

In Europe, markets are closed for the May Day holiday.

U.S stocks are expected to open little changed (+0.1%).

Note: On Friday, the S&P 500 Index posted a +1.5% advance to close out the final week of April.

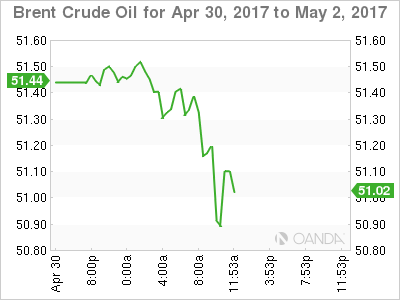

2. Crude oil under pressure from production increases, gold down

Oil prices are starting the week on the back foot as rising crude output and drilling in the U.S offsets OPEC-led production cuts aimed at clearing a global supply glut.

Brent crude for July is down -33c at +$51.72 a barrel, while U.S light crude (WTI) is down -27c at +$49.06 a barrel.

Note: Data on Friday’s from Baker Hughes showed that U.S drillers added more oilrigs in the week to April 28 – 870 vs. 857-w/w, +1.5%.

Prices have also come under pressure after an official survey showed yesterday that growth in Chinese manufacturing (see below) slowed faster than expected this month, potentially weighing on the outlook for oil demand.

OPEC and participating non-OPEC countries meet on May 25 to discuss whether to extend last November’s reduction agreement. Consensus believes that given that inventories remain high, they expect OPEC to support prolonging the curbs in H2.

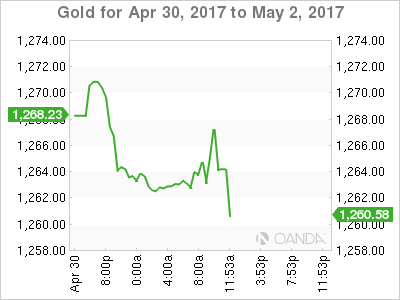

Gold prices fell overnight amid thin trading as the ‘mighty’ dollar firmed. The yellow metal price fell -0.4% to +$1,262.51 per ounce.

3. Fed to dominate proceedings

The FOMC is not expected to change its monetary policy when it concludes its two-day meeting Wednesday, although uncertainty about the prospect of a June rate rise continues to remain. Officials are expected drill down into details about “when and how” to reduce their large holdings of mortgage and Treasury securities.

Note: U.S futures are pricing in a +63% probability on a Fed rate increase by June.

Several Fed officials have indicated they expect to lift rates around two more times this year. Last Friday’s weaker Q1 GDP print (+0.7% vs. +1.1%) may not be enough to prevent the Fed from raising rates in June.

The challenge in their post-meeting policy statement will be to acknowledge the handful of disappointing economic growth indicators since officials last gathered in mid-March without suggesting they are ready to veer from the policy path they have sketched out at recent meetings.

The yield on 10-year Treasuries has backed up +2 bps to +2.30%, after dropping for three consecutive sessions.

4. May Day sees thin trading

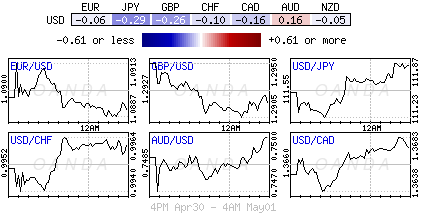

The FX market has started this data laden week relatively quite due to the number of markets closed in both the Far East and Europe for the May Day celebrations.

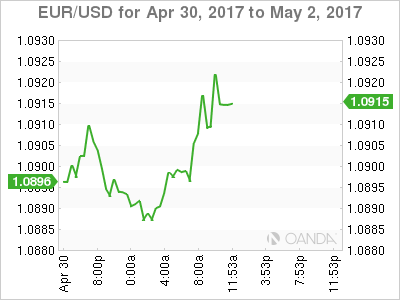

The dollar bulls will be expecting their currency to try and find firmer footing after last week’s disappoint performance. The EUR (€1.0897) starts the week off trading just below the psychological €1.09 handle. Last week, the ‘single’ unit put in a strong shift on the back of the first round election results (Macron and Le Pen square off this weekend, May 7), and on a no-move from the ECB.

Note: Solid Euro inflation data is supporting the currency and could prompt the ECB to take a more ‘hawkish’ tone in its June statement.

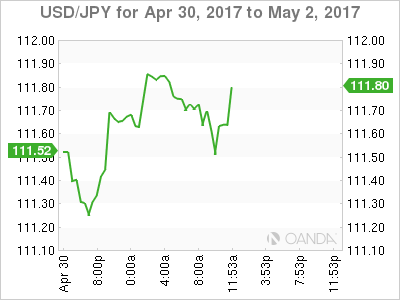

USD/JPY (¥111.80) continues to edge towards the €112 handle. However, expect the market to remain ‘fleet of foot’ on any developments re-North Korea that would bring more safe-haven flows back into the yen.

5. China official PMI’s slow to six-month lows, while Japan’s rise

Following weaker-than-expected U.S growth data for Q1 on Friday, China data over the weekend showed a decline in manufacturing and services sectors.

Last month’s official manufacturing and non-manufacturing PMI’s both hit six-month low on lower prices and lower demand. New export orders and employment components slumped to a three-month low, while input prices are at a ten-month low.

China April Manufacturing PMI Govt. Official: 51.2 (six-month low) vs. 51.6E; non-manufacturing PMI: 54.0 (six-month low) vs. 55.1 prior.

In Japan, April manufacturing PMI (52.7 vs. 52.8 prelim.) was confirmed at an eight-month high, supported by strengthening overall demand across the South East Asia region with exports seen as a key driver of growth.

Down-under, Aussie inflation also trended hotter (+0.5% vs. +0.1% – three-month high), while manufacturing expanded for the eight consecutive month (59.2 vs. 57.5 prior).