Market Brief

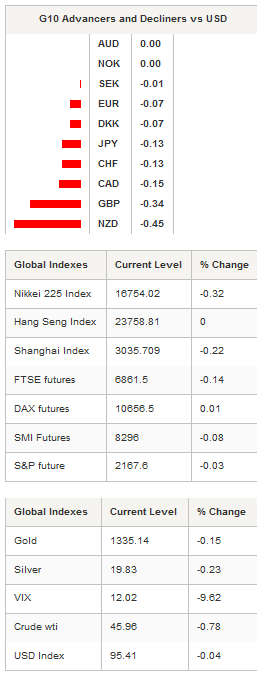

At the end of a busy week, most G10 currencies have somewhat stabilised. After surging 0.80% in the wake of the FOMC rate decision, the single currency eased slightly to 1.12. Overnight, EUR/USD was little changed and traded within a very tight range between 1.1194 and 1.1212. We maintain our bullish view on the pair as the ECB made clear its intention to stay on the sidelines, awaiting further data before adjusting its quantitative easing program, while the Fed will most likely have to delay US rate hikes.

The New Zealand dollar was the worst performer amongst the G10 complex, siding 0.45% against the greenback as investors raise bets on an upcoming RBNZ rate cut. Indeed, even though the Reserve Bank decided to leave the official cash rate unchanged, Governor Wheeler reminded markets that further policy easing will be required to ensure that inflation moves closer to the target. NZD/USD has continued to move toward the next support standing at 0.7235 (low from September 13).

Unfortunately for the RBNZ, it would require more than a 25bps cut to keep investors away from the Kiwi as their chase for higher returns will continue to drive their investment decisions. Therefore, we believe that the downside is quite limited for now.

Norges Bank gave a boost to the krone yesterday as it decided to leave its deposit rate unchanged at 0.50%. USD/NOK fell sharply to 8.08 before stabilising at around 8.12. With mounting inflationary pressure and an encouraging growth outlook, the risk is definitely skewed to the downside. A support can be found at 7.97 (low from May 3), while a resistance lies at around 8.40 (previous highs).

Equity returns were broadly mixed during the Asian session as traders were reluctant to load on risk ahead of the weekend. After a day off, Japanese equities opened lower with the Nikkei and Topix index falling 0.32% and 0.23% respectively. In mainland China, the mood was no better as both the Shanghai Composite and Shenzhen Composites were off 0.19% and 0.38% respectively. Offshore, Hong Kong’s Hang Seng traded flat, while in Taiwan, the Taiex rose 0.53%. In Europe, equity futures are trading slightly lower with the FTSE 250 down 0.14% and the Euro Stoxx 600 falling 0.14%.

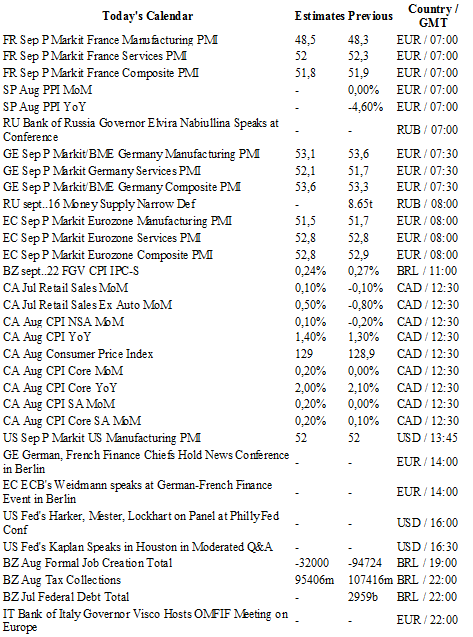

Today, traders will be watching PMI from France, Germany, the Eurozone and the US; PPI from Spain; retail sales and CPI from Canada.

Currency Tech

EUR/USD

R 2: 1.1616

R 1: 1.1428

CURRENT: 1.1216

S 1: 1.1046

S 2: 1.0913

GBP/USD

R 2: 1.3445

R 1: 1.3121

CURRENT: 1.3030

S 1: 1.2851

S 2: 1.2798

USD/JPY

R 2: 107.90

R 1: 104.32

CURRENT: 100.84

S 1: 99.02

S 2: 96.57

USD/CHF

R 2: 0.9956

R 1: 0.9885

CURRENT: 0.9694

S 1: 0.9522

S 2: 0.9444