- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Markets Bounce As Trade Tensions Ease

Here are the latest developments in global markets:

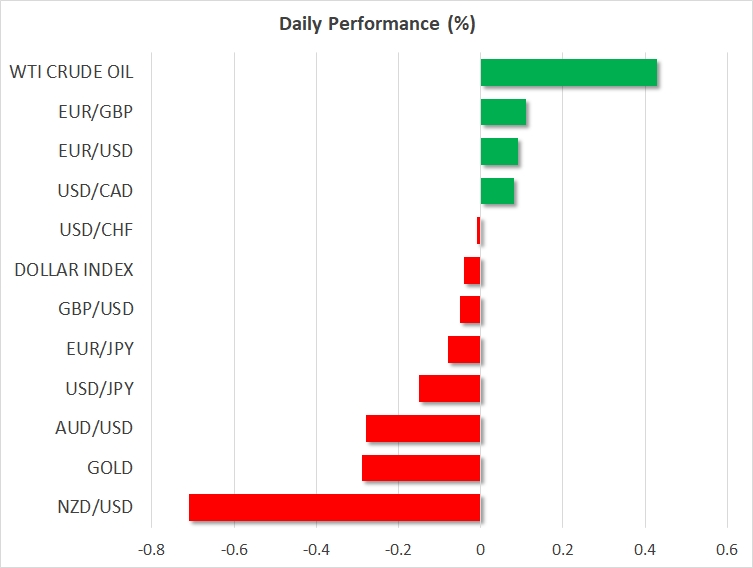

- FOREX: The US dollar index is down on Wednesday, but by less than 0.1%. It managed to rebound yesterday, recovering some losses from the previous three sessions. The euro was on the back foot yesterday, perhaps amid jitters ahead of the EU summit tomorrow, while the pound retreated as well following some dovish-perceived signals from the BoE.

- STOCKS: Concerns around an imminent trade war took a back seat yesterday, after the Trump administration hinted it may opt for less-aggressive measures to curb Chinese investments into US technology firms. The tech-heavy Nasdaq Composite rose by 0.39%, while the S&P 500 and Dow Jones edged higher by 0.22% and 0.12% respectively. However, the rebound may be short-lived, as futures tracking the Nasdaq 100 Futures, S&P, and the Dow are pointing to a notably lower open today. In Asia, most major indices were in the red. In Japan, the Nikkei 225 fell 0.31% but the Topix managed to gain 0.02%, while in Hong Kong, the Hang Seng dropped by 1.07%. Meanwhile, Europe looks undecided, as futures following the major benchmarks are mixed and close to neutral territory.

- COMMODITIES: Oil prices raced higher on Tuesday, amid headlines that the US will press its allies to halt their Iranian oil imports altogether by November, something that would tighten global supply. Some news that militants have taken control of oil ports in Libya, and a larger-than-anticipated drawdown in the private API inventory data released yesterday may have helped as well. WTI and Brent crude are up by 0.4% and 0.6% respectively on Wednesday as well. In precious metals, gold prices are down by 0.3% today, posting a new low for 2018 of $1,253. The dollar-denominated metal continues to be battered by a strong US dollar, and has displayed a very limited response to mounting trade tensions over the past weeks.

- Major movers: Markets take a breather as Trump extends “olive branch”; dollar rebounds, euro and pound tumble

The US dollar index edged higher on Tuesday, recovering some of the losses it posted in the previous three sessions. The move came as concerns around an escalating US-China trade confrontation eased somewhat, following “peace” signals from US President Trump. He said his nation may not restrict all Chinese investments into high-tech US firms, but instead may rely on a committee to scrutinize foreign acquisitions for national security risks, on a case-by-case basis.

The fact that the US administration seems to have extended an “olive branch” to China likely dampened concerns around further escalation, for now at least. As a result, the safe-haven Japanese yen retreated against the dollar, while major stock indices like the S&P 500 rose a little. Risk sentiment remains very fragile, with markets switching from gains to losses almost daily, and any new signals on the trade front will be closely watched.

In the UK, the pound came under renewed selling interest yesterday, after two BoE policymakers struck different chords. BoE MPC member Ian McCafferty – who will leave the Bank at the end of August – and his incoming replacement Jonathan Haskel were both on the wires, and appeared to be at the two extreme ends of the hawk-dove spectrum. McCafferty called for hikes without delay, while Haskel kept the option of further rate cuts on the table. The difference in views was so striking that it likely dampened expectations for rate increases beyond August, amid speculation that one of the most hawkish voices in the BoE would be replaced with a dovish one.

The euro tumbled against its major peers on Tuesday, without any clear catalyst behind the move. Its underperformance may reflect market jitters ahead of tomorrow’s EU summit, where it increasingly appears that unless Angela Merkel can secure a deal on immigration, then her job as German Chancellor may be in jeopardy.

Elsewhere, Kiwi/dollar is down by 0.7% today, touching a fresh seven-month low, after the ANZ business survey for June revealed another notable drop in business sentiment. While typically not a major market mover, the decline may have generated speculation for a more cautious bias by the RBNZ today, which will announce its rate decision at 2100 GMT; rates are expected to be maintained at the historic low of 1.75%.

Day ahead: US durable goods and pending home sales due; global trade developments remain in focus

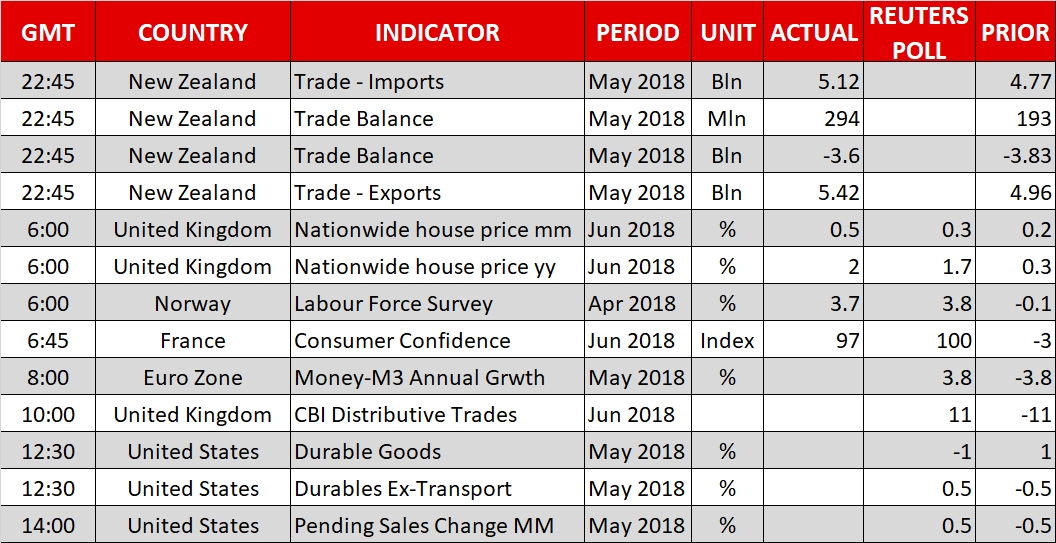

The main release out of Wednesday’s calendar are capital goods orders out of the US. Beyond releases, any updates on the front of global trade will be closely watched.

The European Central Bank will be releasing monthly data on lending and money supply at 0800 GMT, while the Bank of England’s Financial Stability Report for June is due at 0930 GMT.

At 1000 GMT, the Confederation of British Industry’s distributive trades balance relating to retail sales growth is projected to stand at +11 in June, matching May’s reading which was the highest since January.

The attention will next turn to the US which will see the release of durable goods orders data – that give an indication on business spending – for May at 1230 GMT. The headline measure of orders is forecast to record its second straight monthly decline, specifically to fall by 1% m/m after contracting by 1.6% in April. The core measures of capital goods orders will also be watched. Projections for those are mixed, with orders that exclude defense expected to decline by 1.0% m/m, and those that exclude transportation anticipated to increase by 0.5% m/m. It would be interesting to see if the releases offer any clues as regards whether rising trade tensions are starting to weigh on business activity in the world’s largest economy.

US pending home sales data for May are due at 1400 GMT. Sales are expected to increase by 0.5% m/m in May after contracting by 1.3% in April.

Once again, trade developments which have implications not just for FX markets but other asset classes as well, will be closely monitored.

Fed Vice Chair for Supervision Randal Quarles (1500 GMT - permanent FOMC voting member), Boston Fed President Eric Rosengren (1430 GMT - non-voter in 2018) and Bank of Canada Governor Stephen Poloz (1915 GMT) are some of the policymakers making appearances today.

EIA data on crude oil inventories due at 1430 GMT might offer some short-term direction to oil prices. Crude stocks are forecast to have declined by around 2.6 million barrels during the week ending June 22, after falling by around 5.9m in the previously tracked week.

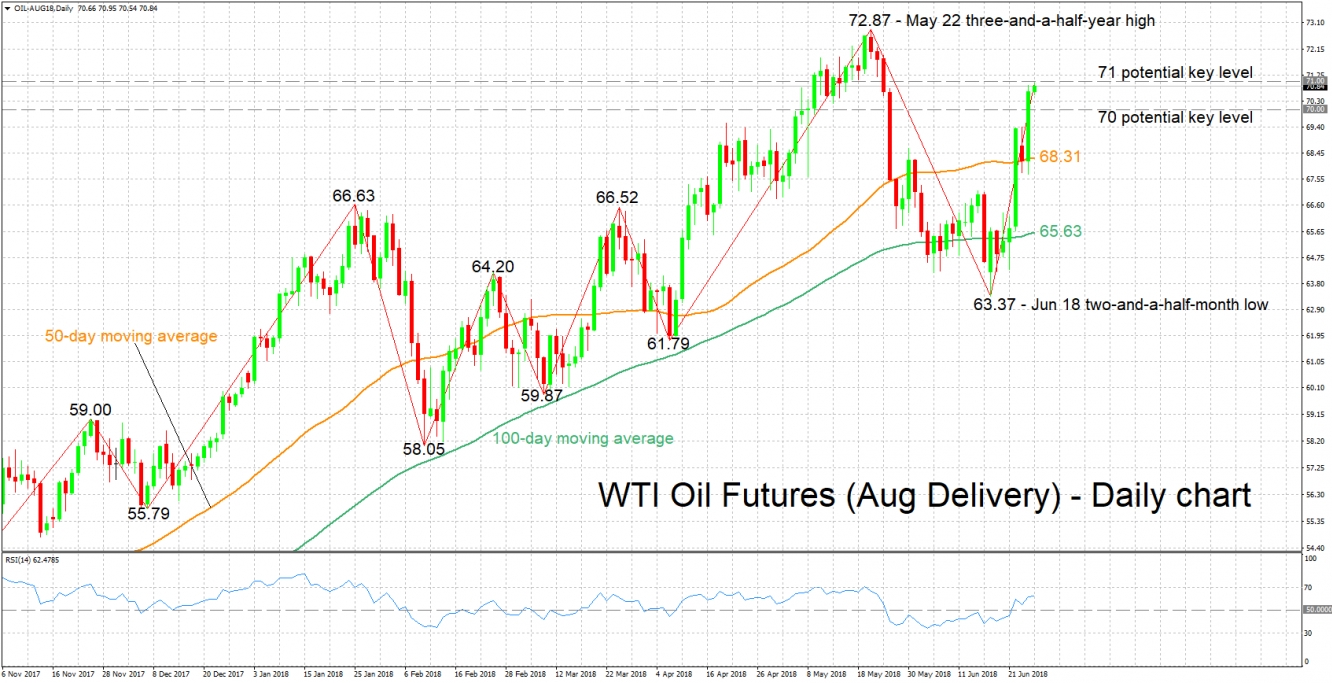

Technical Analysis: WTI oil futures bullish at one-month high

WTI oil futures (August delivery) have risen considerably over roughly the last ten days and they touched a one-month high of 70.95 earlier on Wednesday. The RSI remains on the rise in bullish territory, projecting a positive picture in the short-term. Notice though that the indicator has eased somewhat, indicating a partial loss of positive steam.

If today’s EIA report shows a larger-than-anticipated drawdown in crude inventories, then prices could move higher. Immediate resistance seems to be taking place around the 71 round figure which may carry psychological significance. An upside break would increasingly bring into scope the three-and-a-half-year high of 72.87 from May 22.

On the downside and in case of a smaller-than-expected drawdown in crude stocks (or a buildup) that pushes prices down, support could come around the 70 handle which may also be of psychological importance. Steeper losses would shift the focus to the region around the current level of the 50-day moving average line at 68.31.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Japanese yen is slightly lower on Wednesday. In the North American session, USD/JPY is trading at 148.92, down 0.07% on the day. What is the best performing G-10 currency...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.