Market Brief

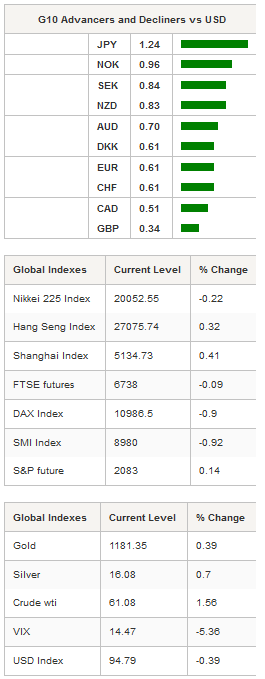

In Asia, equity returns are turning green after a choppy morning. Chinese stocks came under pressure after MSCI (NYSE:MSCI) deferred inclusion of China’s domestic A-shares into its emerging market index. The decision is not definitive, as discussions between MSCI and Chinese authorities continue. MSCI is concerned by international investors’ access to mainland shares, as money will flow massively to Chinese shares as soon as it will be included in the index. The Shanghai Composite edges up +0.41%, while Hong Kong’s Hang Seng is up 0.32%.

In Japan, the Nikkei is about to close into negative territory for a third session, down -0.22%, after BoJ Governor Kuroda said that it is unlikely to see the yen’s effective exchange rate falling further. On the data front, April’s machine orders – used to proxy private capital expenditures – surprised the market on the upside as it jumped 3.8%m/m versus -2.1% median forecast, after a 2.9% expansion the previous month. Producer price index contracted “only” -2.1%y/y in May, while markets expected a lower figure of -2.2%. All in all, with the absence of data from the US yesterday and today, coupled with positive data from Japan and Kuroda’s comment, the dollar depreciated sharply against the yen, retreating 1.70% to 122.60. The next key support can be found at 122 (psychological threshold, while the closest resistance remains at 125.86 (previous high)).

In Australia, consumer’s confidence fell sharply in June, with the Westpac Consumer Confidence Index contracting -6.9%m/m (s.a.), reversing the encouraging 6.4% expansion a month earlier. On the top of it, Governor Stevens reiterated the RBA’s easing bias and his preference for a weaker Aussie. Initially, AUD/USD fell sharply to 0.7636, before reversing the move to 0.7749. On the downside, the 0.76 level will provide a strong support to the Aussie while on the upside, the 0.7814 threshold will be the closest resistance (Fib 38.2% on May-June debasement and previous high).

In Europe, investors are getting tired of the lack of progress in the Greek negotiations. European equity futures are broadly lower with the FTSE down -0.09%m, CAC down -0.14%, DAX down -0.90% and the SMI down -0.92%. European sovereign yields are on rise, again, with the 10-year German yields up 2.3bps, UK up 2.2bps and Spain up 5.4bps.

In Brazil yesterday, the government unveiled infrastructure concession projects in an attempt to bring back growth in the world’s seventh biggest economy. The new concessions intend to increase investments in the transportation sector (railroads, toll roads, airports and ports) as much as BRL 198.4bn over the next 5 years. The infrastructure package has a dual purpose: revitalise the Brazilian economy by investing in outdated infrastructures, but also to sugarcoat the pill of recent fiscal adjustment measures that cut in labour and social expenditures. USD/BRL didn’t react and moved sideways around 3.10.

Today's Calendar Estimates Previous Country / GMT TU 1Q GDP SA/WDA QoQ 0.70% 0.70% TRY / 07:00 TU 1Q GDP WDA YoY 1.70% 2.40% TRY / 07:00 TU 1Q GDP YoY 1.70% 2.60% TRY / 07:00 DE May CPI MoM 0.10% 0.10% DKK / 07:00 DE May CPI YoY 0.70% 0.50% DKK / 07:00 DE May CPI EU Harmonized MoM - 0.20% DKK / 07:00 DE May CPI EU Harmonized YoY - 0.40% DKK / 07:00 SW Apr Industrial Production MoM 0.20% 0.80% SEK / 07:30 SW Apr Industrial Production NSA YoY -2.00% 0.30% SEK / 07:30 SW Apr Industrial Orders MoM - 3.70% SEK / 07:30 SW Apr Industrial Orders NSA YoY - 1.40% SEK / 07:30 NO May CPI MoM 0.20% 0.40% NOK / 08:00 NO May CPI YoY 2.10% 2.00% NOK / 08:00 NO May CPI Underlying MoM 0.30% 0.40% NOK / 08:00 NO May CPI Underlying YoY 2.30% 2.10% NOK / 08:00 NO May PPI including Oil MoM - 0.00% NOK / 08:00 NO May PPI including Oil YoY - -5.60% NOK / 08:00 IT Apr Industrial Production MoM 0.30% 0.40% EUR / 08:00 IT Apr Industrial Production WDA YoY 1.00% 1.50% EUR / 08:00 IT Apr Industrial Production NSA YoY - 4.30% EUR / 08:00 EC Estonian Central Banker Hansson Speaks on Economy, Euro Area - - EUR / 08:00 SW Swedish Labor Board Presents New Forecasts - - SEK / 08:00 UK Apr Industrial Production MoM 0.10% 0.50% GBP / 08:30 UK Apr Industrial Production YoY 0.60% 0.70% GBP / 08:30 UK Apr Manufacturing Production MoM 0.10% 0.40% GBP / 08:30 UK Apr Manufacturing Production YoY 0.40% 1.10% GBP / 08:30 SA 2Q BER Business Confidence 48 49 ZAR / 10:00 US Jun 5 MBA Mortgage Applications - -7.60% USD / 11:00 BZ May IBGE Inflation IPCA MoM 0.59% 0.71% BRL / 12:00 BZ May IBGE Inflation IPCA YoY 8.30% 8.17% BRL / 12:00 UK May NIESR GDP Estimate - 0.40% GBP / 14:00 BZ Currency Flows Weekly - - BRL / 15:30 US May Monthly Budget Statement -$97.0B -$130.0B USD / 18:00 NZ Jun 11 RBNZ Official Cash Rate 3.50% 3.50% NZD / 21:00 CH May Aggregate Financing CNY 1132.5B 1050.0B CNY / 22:00 CH May Money Supply M1 YoY 4.00% 3.70% CNY / 22:00 CH May Money Supply M0 YoY 3.60% 3.70% CNY / 22:00 CH May New Yuan Loans CNY 850.0B 707.9B CNY / 22:00 CH May Money Supply M2 YoY 10.40% 10.10% CNY / 22:00

Currency Tech

EUR/USD

R 2: 1.1534

R 1: 1.1385

CURRENT: 1.1357

S 1: 1.0882

S 2: 1.0521

GBP/USD

R 2: 1.5879

R 1: 1.5800

CURRENT: 1.5445

S 1: 1.5191

S 2: 1.5090

USD/JPY

R 2: 135.15

R 1: 125.64

CURRENT: 122.63

S 1: 122.03

S 2: 118.18

USD/CHF

R 2: 0.9712

R 1: 0.9573

CURRENT: 0.9247

S 1: 0.9072

S 2: 0.8986